Huawei’s Undersea Ventures and Global Internet Security

Many intelligence analysts and agencies around the world are concerned that Chinese tech giant Huawei, as it sells hardware, software, and services around the globe, is working hand-in-glove with the Chinese government to further its geopolitical ambitions. These concerns are not limited to the present U.S. administration; even where the U.S.’ developed-world partners seek to distance themselves from current U.S. foreign policy priorities, they quietly concur in worrying about Huawei’s role and influence. (EU officials, acting against U.S. pressure, just decided not to recommend a ban on Huawei’s participation in the continent’s next-generation broadband buildout. But individual European officials have frequently voiced caution.)

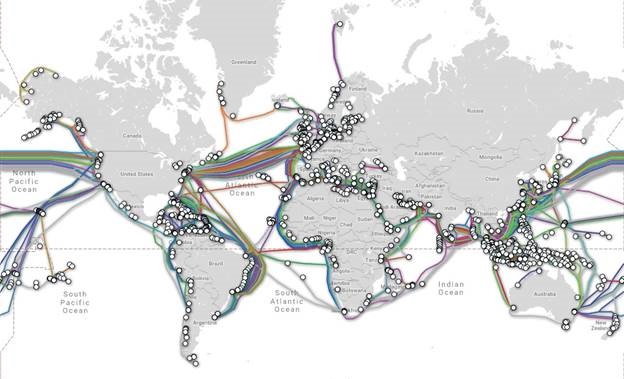

Now that concern is getting a new focus: undersea cables. Huawei Marine Networks, 51% owned by Huawei, is expanding its presence in the global network of undersea cables that carry 95% of the planet’s intercontinental voice and data traffic.

A Map of Global Undersea Data Cables

Source: Huawei Marine Networks

Undersea cables pose several potential security threats. They could permit the company which laid them to install devices which monitor or divert data clandestinely. Readers may recall the case that broke late last year, in which it was alleged that Chinese manufacturers, at government behest, installed nearly undetectable spy chips in servers sold to various U.S. tech leaders, including Apple [NASDAQ: AAPL] and Amazon [NASDAQ: AMZN]. Careful data forensics detected that the hardware was compromised, but the event served to underscore the significance of hardware security (something that can be lost in the public’s attention on software hacks).

Undersea cables are also significant because they are potentially not just vulnerable to spying, but could be weaponized in the case of a conflict — hampering or perhaps even completely shutting down data traffic to an isolated country. Since the vast majority of data move between continents via undersea cables, the presence of satellite links would do little to compensate for the impact of this kind of attack.

The problem is set to become more acute in coming years, as the arrival of 5G technology will fuel ever-greater demand for data transmission that will need a lot of cables to be laid. About a quarter of the cables completed between 2015 and 2020 will be laid by Huawei Marine.

(Of course, part of the reason U.S. intelligence agencies are aware of the possibility of exploiting vulnerabilities in undersea cables is that they themselves have developed the capacity to access and monitor cable data from submarines — or so NSA defector Edward Snowden alleged in 2013.)

The problem is one that highlights the long-term problems that will be associated with China’s global ambitions.

Investment implications: Security analysts are concerned about Huawei’s presence in the internet’s global hardware backbone. However, this does not derail our current bullishness on Chinese equities. As long as the Chinese stock market retains its present character — small, volatile, and driven by local retail investor sentiment — we consistently regard it as unsuitable for long-term investing, but valuable for short and medium-term tactical investing. The current tactical thesis for Chinese equities, which we have outlined in recent letters, has not changed. Still, investors should remain aware of the larger and longer-term context of growing friction between China’s global ambitions and the established developed-world powers. And to be clear, we also do not believe that China will eclipse the west — technologically, geopolitically, or financially — within the next three decades, assuming no major western mistakes.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. Currently, Guild’s clients own AAPL. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.