Executive Summary

1. We’re long-term bulls on India. A recent U.S. action rescinded some tariff exemptions that India had enjoyed as a developing nation. We don’t feel this is a significant event, and anticipate that the friendly relationship between the U.S. and Indian administrations will continue. We see policy continuity as Indian Prime Minister Modi gets back to work following his election victory, pursuing progress in constitutional reforms, foreign investment, and export growth. An economic inflection into the second half of 2019 could be constructive for Indian stocks, and the Reserve Bank of India is set to cut rates supportively as inflation remains low. India remains one of the emerging world’s best growth stories.

2. Self-driving taxis? Not so fast. The legal, social, and technological hurdles for self-driving cars remain high — likely higher than many optimists have assumed. Efforts for totally driverless taxis have backtracked, with Alphabet’s Waymo putting backup drivers back into their test fleet after removing them last year. Autonomy will likely begin with trucks and shuttles on established and controlled routes, and it could be decades before autonomous vehicles can really rival human drivers in safety. Companies that have banked strategically on the rapid deployment of fully autonomous, “go anywhere” vehicles may find themselves in an untenable position.

3. Market summary. Fed Chair Jerome Powell sparked the strongest day for U.S. stocks since January by emphasizing that the U.S. central bank would respond to economic and market weakness occasioned by ongoing trade conflicts. Markets now see better than 50/50 chances for a rate cut in July, and talk has moved from two potential rate cuts this year to three. The Fed is far from alone. The Australian central bank has cut rates in view of the potential fallout of trade conflicts. The Reserve Bank of India is likely to follow suit, as are other central banks facing potential problems and cooperatively low inflation. We believe the stage is set for a rally in the U.S. for the next few weeks or months.

We are long-terms bulls on India, and believe that the Modi administration will be able to use its new mandate to make further progress in its reform efforts, encourage foreign investment, and boost exports. Elsewhere in emerging markets, we would like to see positive news on the trade front. Our base case is still that trade deals get done, including between the U.S. and China, given the interests of all participants in successful outcomes.

Global investor anxiety about trade issues, and the anticipated response of global central banks to provide easier monetary policy, has allowed gold and gold shares to rally, and dovetailed with positive technical signs. A successful move above the February high of $1340 could set the stage for a more significant move higher. Around the world, debt levels are rising, and central banks are accumulating gold.

India’s Elections and Opportunities Ahead

Source: Xinhua

The Trump administration’s most recent trade salvoes included one directed at India. The administration removed about $5 billion of India’s $83 billion in exports to the U.S. from tariff exemptions that had applied as part of a program intended to boost the economies of developing countries. Although the current U.S. and Indian administrations are generally quite friendly and mutually supportive, the U.S. expressed dissatisfaction with the pace at which India is opening up to U.S. companies.

Ultimately this is not a significant event. It does not spell significant trouble for U.S./India relations, or for the reform agenda of India’s Prime Minister, Narendra Modi.

Two weeks ago, we wrote about the opportunities presented by the new mandate won by India’s governing coalition and by Prime Minister Modi. When Modi was first elected in 2014, it prompted a powerful rally for Indian stocks in U.S. dollar terms. The Indian market gave up the gains of that rally by 2016, and has since traded more or less in line with the U.S. market, albeit with more volatility. Modi’s recent victory provided another spike up.

Source: Bloomberg LLP

There are many specific areas where reform could be deepened and accelerated; there are areas where over the past five years, the Modi administration faltered or made arguable missteps in the reform drive. Still, it’s important to remember that there will be a basic continuity in policy direction, including fiscal consolidation; infrastructure spending; a focus on attracting foreign direct investment; and strong cooperative relationships with international partners (one reason we believe that trade issues will be resolved through negotiation).

Another reason that trade issues will likely be resolved is that improving Indian exports has been a key strategic component of Modi’s program, and is likely to gain in importance in his second term. The same is true for constitutional reforms, which may have less immediate, tangible impact on markets, but will help lay the groundwork for a sustainable improvement in economic growth and stock market performance in coming years.

Modi’s second term could mark an inflection point in reforms, as well as in the effects of reforms on the Indian economy and the Indian stock market.

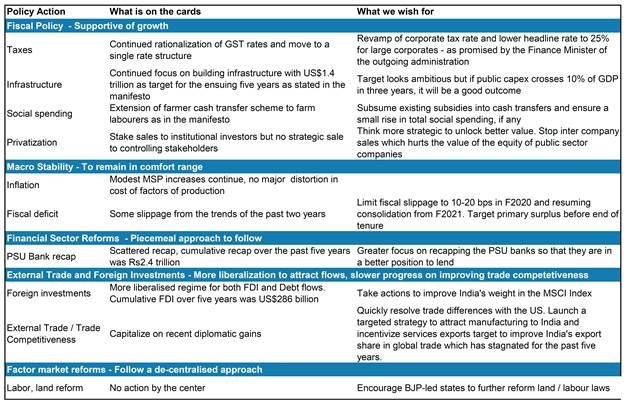

A Strengthening of Reform Efforts Is In the Cards in Modi’s New Administration

Source: Morgan Stanley Research

Soft patches in Indian growth, corporate investment, earnings, and return on equity are all anticipated to resolve as 2019 progresses, according to many analysts, barring unforeseen developments in the global economy as a whole. India presents a favorable picture compared to many other emerging markets, turning a political, legislative, and economic corner, while challenges persist elsewhere. For this reason, India is currently our favored long-term investment destination in emerging markets.

The benign inflation environment in India will also give the Reserve Bank of India (RBI) scope to cut rates and improve liquidity. In addition, the prospect of interest rate cuts by the U.S. Federal Reserve — anticipated by U.S. bond markets — has historically been a positive for emerging markets. And of course, the RBI and the Fed are not alone among global central banks either cutting rates, or contemplating cutting rates as a response to the uncertainty generated by trade conflict.

Investment implications: The renewed and strengthened mandate of the Modi administration in India is a cause for long-term optimism about India’s economic and stock-market outlook. We believe that recent weakness may be concluding and that barring negative developments elsewhere in the world, India may see positive inflections in the second half of 2019. As always, for U.S. based investors, a central concern is that the Indian rupee not decline to an extent that outweighs Indian stock-market outperformance.

Self-Driving Cars: Further Away Than You Thought

After the public debut of Uber [NASDAQ: UBER], investors were able to sink their teeth into the company’s first quarterly report as a public company. It became more obvious that the company’s strategic path to profitability hinged on the development of driverless technology. Buried in the quarter’s fine print (which we like to read, even for significant stocks in which we are not presently invested), we read:

“While we aim to provide an earnings opportunity comparable to that available in retail, wholesale, or restaurant services or other similar work, we continue to experience dissatisfaction with our platform from a significant number of Drivers. In particular, as we aim to reduce Driver incentives to improve our financial performance, we expect Driver dissatisfaction will generally increase.”

Further — and we believe, related, we read:

“We believe that autonomous vehicles will be an important part of our offerings over the long term, and in 2018, we incurred $457 million of research and development expenses for our ATG and Other Technology Programs initiatives. We expect to increase our investments in these new initiatives in the near term.”

The problem is that self-driving cars and taxis are probably further away than people think.

The tone about self-driving cars from developers and cheerleaders shifting notably between 2017 and 2018. Many companies now are stressing that full autonomy is some distance away. Alphabet’s [NASDAQ: GOOG] Waymo, which removed “companion drivers” (i.e., human backup) from its fleet of autonomous taxis, put them back in again. As the R&D spending on autonomy ramped from $6 billion in 2015 to $60 billion last year, some challenges began to become more evident.

It May Be Further From Tesla’s Autopilot to Full Autonomy Than You Think

Source: Tesla

The basic reality is that in spite of great strides in performance, self-driving cars still face formidable technical problems and limitations. Put simply, they are nowhere near as good as human drivers, in spite of exponential improvements. May Mobility is a company focused on autonomous shuttles rather than taxis, operating on fixed routes. The company’s CEO wrote in a recent post on Medium:

“Between human performance (10⁸ miles per fatality) and the best-reported self-driving car performance (10⁴ miles per disengagement) is a gap of 10,000x. Put another way, self-driving cars are 0.01% as good as humans.”

He shows that self-driving technology is improving at a similar pace to Moore’s Law — with performance doubling every 16 months, as measured by the average distance a self-driving car can go before its human “helper” has to intervene to stop an accident. At that rate of exponential improvement, simple parity with human drivers is almost two decades away. It is a back-of-the envelope calculation, but it is worth pondering — especially for large public companies that may be staking their survival and success on this technology.

These technical hurdles are significant enough — but there remain significant hurdles in public perception (70% of Americans surveyed are afraid to ride in a self-driving car, and only 20% would put their child in one) and insurance concerns, where it is still not clear whether the programmer, manufacturer, or operator will be liable for accidents.

Autonomous vehicles will show up first in logistics, with autonomous trucks driving established, relatively simple routes, and human backup ready to take over when trucks get off the highway and need to navigate the complex environment of surface streets. But self-driving taxis on demand? That’s probably many years away.

Investment implications: If a company’s strategic plan involves imminent deployment of autonomous vehicle technology, ask yourself some tough questions about the implications for the bottom line if that technology proves further away than hoped.

The U.S.

“We are closely monitoring the implications of [trade conflicts] for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion.” With those words, Fed Chair Jerome Powell sparked the strongest day for U.S. stocks since January. Markets now see better than 50/50 chances for a rate cut in July, and talk has moved from two potential rate cuts this year to three.

The Fed is far from alone. The Australian central bank has cut rates in view of the potential fallout of trade conflicts. The Reserve Bank of India is likely to follow suit, as are other central banks facing potential problems and cooperatively low inflation.

We believe the stage is set for a rally in the U.S. for the next few weeks or months, and note that rallies under these circumstances can be significant. We like the stocks of large growth companies, which have recently suffered and may experience a good bounce.

China, India, and Elsewhere in EM

We are long-terms bulls on India, and believe that the Modi administration will be able to use its new mandate to make further progress in its reform efforts, encourage foreign investment, and boost exports.

Elsewhere in emerging markets, we would like to see positive news on the trade front. Our base case is still that trade deals get done, including between the U.S. and China, given the interests of all participants in successful outcomes. But obviously the timeline has become more uncertain. China will need to see a trade deal for domestic investor sentiment to improve — and as our regular readers know, this domestic sentiment, rather than economic and financial fundamentals, is the key variable for domestic Chinese stocks.

Gold

The global investor anxiety about trade issues, and the anticipated response of global central banks to provide easier monetary policy, has allowed gold and gold shares to rally, and dovetailed with positive technical signs. A successful move above the February high of $1340 could set the stage for a more significant move higher. Around the world, debt levels are rising, and central banks are accumulating gold. Those investors wanting exposure to gold shares should concentrate their attention on miners whose reserves are located in countries where the rule of law is respected. Thanks for listening; we welcome your calls and questions.