Over the past year, three U.S. tech giants have been jostling for position atop the list of largest companies by market capitalization: Amazon [NASDAQ: AMZN], Apple [NASDAQ: AAPL], and Microsoft [NASDAQ: MSFT]. All are valued above $900 billion, with MSFT recently taking the top spot — at $1.07 trillion as of this writing.

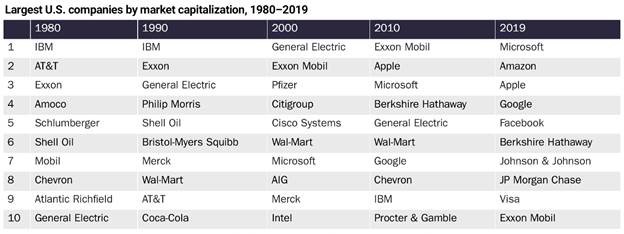

The true outlier among this triumvirate is MSFT. (Non-investors could almost be forgiven if they forgot that MSFT even existed, given the extent to which AAPL, AMZN, and Alphabet [NASDAQ: GOOG] dominate the news and the cultural conversation about tech.) The list of the top ten U.S. companies by market cap is as dynamic and adaptive as American capitalism itself; over the decades it has shown significant change, reflecting big social, economic, and technological shifts. But MSFT found a spot in the top 10 in 2000, in 2010, and will in 2020 as well. MSFT’s ability to maintain a leading position during an epoch of deep and far-reaching technological change makes us ask what has been at work in this company’s strategy and execution.

Source: Cato Institute

MSFT is a study in how new leadership can transform a company. Satya Nadella had been a MSFT employee for two decades at the time he was tapped to take over from Bill Gates’ right-hand man Steve Ballmer in 2014. Many observers had expected an external candidate to take the top spot — a heavy hitter from the upper echelons of corporate America. Instead, MSFT opted for a mild-mannered engineer. It turned out to be the right choice, as became apparent almost immediately. Nadella’s first appearance as MSFT CEO was a low-key event announcing the release of Microsoft Office for iPad.

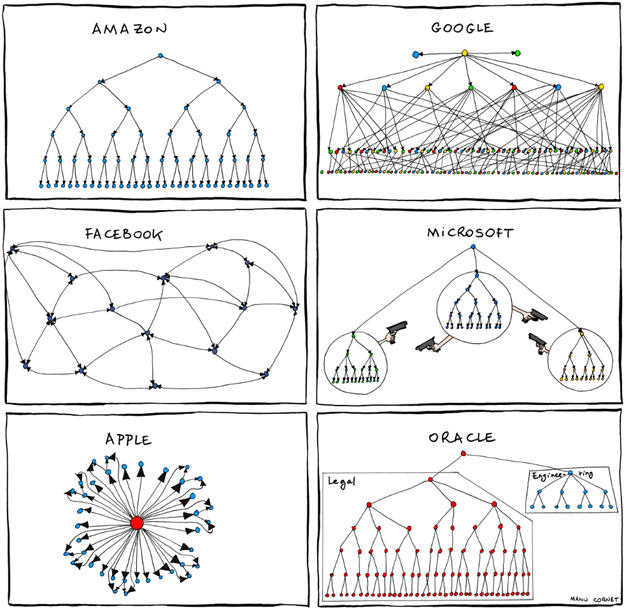

This event effectively symbolized the basic shift that Nadella was inaugurating: from combative exclusivity, towards cooperation and openness. MSFT’s approach to competitors throughout the Gates and Ballmer years had been infamously aggressive, courting both public controversy and regulatory interventions that led to a near-death antitrust experience. In 2011, engineer and cartoonist Manu Cornet published a viral cartoon on his blog, depicting satirical “org charts” for tech companies. MSFT’s combative culture did not just extend to regulators and outside competitors, hindering the company from embracing the cooperative, networked open-source ethos of the internet age. It also operated within the company itself, with internal departments behaving like warring gangs.

Source: Wikipedia

This was what Nadella set out to change. At the core, he needed to change a culture of rigidity. That rigidity had caused MSFT to miss out on the internet, on mobile technology, on search, and on social media because of its inflexible focus on the dominance of the Windows operating system. Rigidity led MSFT to view competitors as enemies, rather than as participants in building networks that would allow many participants to expand together and thrive. Rigidity led to hubris towards regulators who were seen to be thwarting the company’s goals.

Nadella is a wide reader whose video blog entries for MSFT employees often discuss his current reading (which includes many non-tech related books; Nadella is a reader of poetry who has quoted T.S. Eliot in corporate presentations). The book he credits most for his turnaround of MSFT was Carol Dweck’s Mindset: The New Psychology of Success. At the core of Dweck’s thesis is the idea that it is not some set of fixed traits that matters most for success (such as IQ or educational accomplishments), but the ability and willingness to learn. Above all, what Nadella did was to inculcate a culture at MSFT where existing Gospel could be challenged, where new ideas were welcome, and where employees felt that their curiosity and questioning were valued. One manifestation is MSFT’s annual “One Week” gathering, in which the company’s Washington campus is filled with tents occupied by employees from different parts of the organization cooperating on projects outside their workaday responsibilities. Nadella walks around the project spaces like a tourist in a bazaar, with evident delight.

This shift has allowed MSFT to shift from its rigid focus on Windows, to being a cloud leader welcoming the open-source Linux operating system that Nadella’s predecessor excoriated as “intellectual property cancer.” That shift has, arguably, saved the company. MSFT is also noticeably absent from the fracas of public displeasure and regulatory wrath that shrouds AMZN, GOOG, and Facebook [NASDAQ: FB].

The other big tech leaders would do well to emulate this approach. Thus far, most have not. Their public relations efforts — for example, in the face of privacy issues or censorship concerns — often still come across as paternalistic and dismissive, rather than humble and genuinely engaging. In their interactions with regulators, there is still an almost archetypal Silicon Valley hubris, barely deigning to address a group of politicians whom they obviously believe to be incapable of understanding the real issues or the excellence of tech’s solutions to all the world’s problems. And their determination to dominate or eliminate their rivals, rather than work together to create tech ecosystems in which many companies can thrive, is frequently evident. Sometimes they seem driven almost solely by their founders’ ambitions; we have often noted a similarity in style between FB’s Mark Zuckerberg and the unreformed Bill Gates of MSFT’s pugnacious past. If the other tech giants want to find themselves in the U.S. top ten when 2030 rolls around, they would do well to study Satya Nadella’s stewardship of MSFT.

Investment implications: Under current market conditions, we continue to like the big U.S. tech leaders; they are focuses of investor attention due to rising earnings and perceived long-term growth tailwinds. They are likely to continue to outperform. In the long run, we would be more favorable to companies that follow MSFT’s lead in taking a less combative attitude towards competitors, regulators, and the public. We feel that of the others, AAPL and GOOG have done the best job so far in this area, and that AMZN and FB are lagging. This is an example of how attentive investors must be to leadership changes at companies they own — doing their due diligence to learn about the background, track record, plans, and style of new management.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. Currently, Guild’s clients own AAPL, AMZN, FB, GOOG, and MSFT. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.