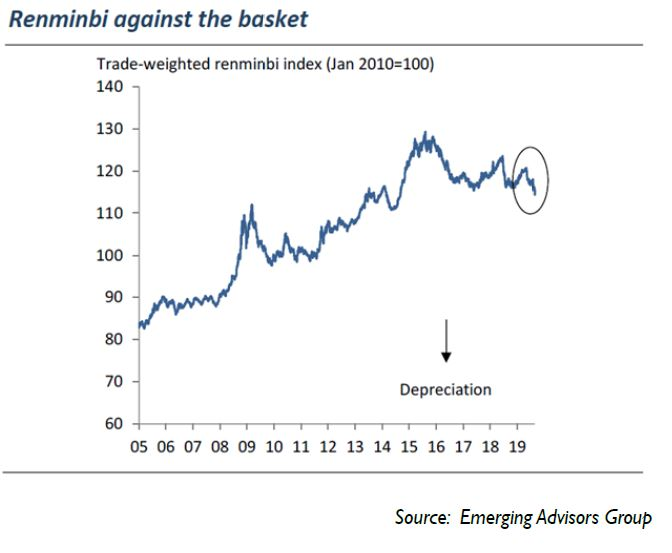

At the beginning of August, when the U.S. administration announced that

it would levy tariffs on all remaining Chinese imports, the Chinese responded by allowing the Chinese yuan to depreciate against its target

basket of other currencies — but only by 1%. And in the wake of last

week’s tweets further ratcheting up pressure on China and on U.S.

companies that do business there, the Chinese again let the yuan fall

— by another 1%. The reaction to the news was big, but objectively, China’s actions were not big. Below is a chart that puts the recent moves in longer perspective.

Why such a minor depreciation?

Why couldn’t the Chinese government simply allow the yuan

to depreciate to compensate for all the loss in demand that comes from

higher tariffs? Back in May, we wrote a little about the longer-term pressures that are at work here.

Trouble For the Yuan

We wrote:

“The real trouble for China… is a race against time for its currency. “Our favorite China analyst, Jonathan Anderson of Emerging Advisors Group, wrote in a piece last fall that in the long term, the writing is

on the wall for China’s currency — that is, in the long term, it very likely must fall, and must fall dramatically, as domestic broad monetary

growth outstrips the country’s accumulation of foreign reserves. He notes that inevitably, that decoupling is what causes emerging-market

currency pegs or quasi-pegs such as China’s to collapse.

“Much of China’s growth in U.S. dollar terms over the past decades has in fact come from currency appreciation, as China has stored

away foreign reserves.

“But for many reasons, that huge foreign exchange war chest is not going to grow further… It will shrink.

“First, however closed the Chinese financial system tries to be, it ‘leaks’ — with about 2% of the banking system’s assets finding their way out

of the country through various kinds of theft and fraud each year. As the yuan weakens in coming years, that flight will only accelerate. (This is

one reason why the Chinese government does not want its people trading cryptocurrencies.)

“And second, China’s era of massive trade surpluses is ending — both because of dissatisfaction on the part of trading partners such as the U.S., and because Chinese wages have risen and low-cost manufacturing has been moving to other, cheaper countries. It is a matter both of geopolitics and trade, and simple economics.

“The Chinese authorities know that both of these things are true… But in the long term, [China seems] stuck on using fiscal stimulus to encourage the growth that they must create in order to keep their people content with their style of rule.

“That means that broad money in China, in the long term, will keep outstripping foreign exchange reserves; and that in turn means that

something must give — and that something will very likely be the yuan.”

Capital Controls… and Saving Face This is why we emphasize that China truly is between a rock and a hard place, with no apparent long-term solution that isn’t disruptive and risky for the country’s economic and

political stability.

China is dealing with the classic “trilemma” o monetary policy. Of these three things — full control of monetary policy (e.g., interest rates), free movement of capital, and a fixed exchange rate — a country can pick two. Having all three at once is fundamentally impossible. Most developed nations have chosen policy contro and free movement of capital. China has chose full control of monetary policy, and a fixed (or managed) exchange rate. China wants to have all three, but it will not be able to.

Full control of monetary policy allows a country to adjust that policy in response to domestic economic conditions (think of the U.S. Fed’s supportive response to recessions). Free movement of capital allows a country to benefit from foreign investment in its economy, and from its own investments abroad, and to benefit from the advantages of unhindered global trade.

A fixed exchange rate allows predictability for domestic export producers and import consumers, which undergirds willingness to consume and invest, and supports a stable financial system.

China would like to have its cake and eat it too. It would like the benefits and geopolitical clout of having a world reserve currency, for which free movement of capital is necessary. But it also wants the domestic economic leverage of fixed exchange rates and monetary policy control. But, like all other countries, it can’t have all three.

Now connect these desires and ambitions with the forces driving yuan depreciation. To maintain the exchange rate will become increasingly

difficult and will require increasingly draconian capital controls. These controls are already, theoretically in place; a Chinese citizen cannot

move more than $50,000 out of the country each year. But for a long time, for various reasons, the government turned a blind eye to the covert

ways in which Chinese businesspeople and corrupt politicians were able to get money out of the country. For example, an exporter could over-invoice for goods sold and fraudulently get more money out of the country.

“Capital flight” is the sudden outflow of capital due to some spike in economic and political uncertainty. It’s a destabilizing scourge of

emerging market economies that can undermine the stability of their financial systems and spike domestic inflation, leading to a spiral of

economic and political turmoil. When the yuan was sharply devalued in August 2015, capital flight accelerated. Chinese citizens who can get money out obviously have a big incentive to do so if they think further devaluation is in the works. But critically, the Chinese government does not want to be seen heading towards more stringent capital controls. That would contradict their preferred narrative of China as a rising world power whose currency might soon challenge the dollar, euro, and yen in global reserves. In short, they are highly motivated by “saving face” on the global stage. In the years since the 2015 devaluation, an especially this year, though, China has indeed quietly tightened capital controls. The regulator is the State Administration of Foreign Exchange. In addition to other measures since 2015, it has now been placing increasing responsibility on banks themselves to monitor and police foreign exchange transactions by Chinese firms and citizens. It remains to be seen how seriously these efforts will be enforced as the downward pressure on the yuan continues to mount. Eventually, China will have to choose between its managed exchange rate, and its geopolitical ambitions. When this choice needs to be made, it will be highly disruptive whichever way it goes — both

for domestic Chinese politics, and for the global economy.

Investment implications: Investors should remain aware of the asymmetry between the U.S. and China as they continue to

engage in the trade war back-and-forth. Politically and economically, China is facing multiple dilemmas. U.S. pressure will gradually bring some of those to a head. Overarchingly, it is a good thing to correct

some of China’s trade practices that have exploited the goodwill of the developed world and had negative consequences for the developed-world economies. However, we note that if that pressure causes cracks in the Chinese financial system and the Chinese economy, the resultant political

and economic fallout could reverberate globally. In spite of the current pushback against globalization, the world’s economies and financial systems remain closely linked by both direct and indirect channels. We have often noted a Chinese or European financial “event” as a possible

spark for the next global downturn.

We do not believe such an event is imminent, but we are alert.

Market Summary

The U.S. With the two-to-ten-year U.S. Treasury yield curve having decisively inverted, financial media are getting jittery. We note the

research we have done, confirmed by data from Canaccord Genuity’s Tony Dwyer, that the initial inversion is, on average, followed

by a significant period of stock market outperformance before a bull market peak.

(In the past seven recessions, after the 2/10 inversion, stocks gained a median 21.1% over a median 18 months before the final market top.) When we restrict the analysis to the last several credit-driven cycles, that

pattern becomes even more marked. Of course there are many reasons why this time may not follow the pattern closely — which would be a case of history rhyming, rather than repeating. Still, with Dwyer, we see the

likelihood of further gains in U.S. stocks as the current credit-driven cycle approaches its peak.

In the context of falling rates, we continue to believe that a “barbell” approach is constructive. On the one hand, we believe the market will continue to demand secular growth stories — companies with longterm

social, technological, and demographic tailwinds and the prospect of robust earnings growth that can continue “through thick and thin.” This certainly means U.S. technology leaders. On the other hand, particularly for investors who are in need of income from their portfolios, we like an approach that seeks solid dividend yielders who also have growth characteristics. This combination — a solid high yield, and robust earnings growth — has performed well historically during both Fed cutting cycles and yield curve inversion periods.

Europe and Emerging Markets

As for some time, we continue to see the best equity opportunities in the United States. A no-deal Brexit has become more likely as UK Prime Minister Boris Johnson has prorogued Parliament — that is, Parliament

will be suspended from September until October 14. This tactic will give Parliament less time to engineer any efforts to derail a no-deal Brexit if that is what seems to be on the table. While Brexit will be disruptive,

particularly if it is on WTO terms (i.e., “no deal”), we continue to regard the UK’s future as brighter outside the EU, and we would be buyers of weakness in the pound and possibly in UK stocks, depending on broader global market conditions.

Gold and Bitcoin

Central bank buying has been one of our key theses for gold in 2019, and it is ongoing. Other theses include buying by residents of countries whose currencies are falling versus the dollar, as well as those who are

frightened by negative interest rates and wise speculators. We believe these trends will continue. In addition to growers and dividend payers, we want investors to own some gold-related shares.

Bitcoin continues in its trading range. We are most interested to see how it behaves if volatility spikes or there is seasonal or event driven volatility in global stock markets. We believe that intelligent crypto speculators

at this point should be focused on bitcoin itself rather than other coin projects or on blockchain-related themes.

Thanks for listening; we welcome your calls and questions.