Let’s start with a review of U.S. and global economic, trade, finance, and banking outlooks.

• The U.S.: Bullish economics, very strong. Trade negotiations not a lasting problem.

• Europe: Neutral. Avoid.

• Asia: Growth companies are attractive. The U.S. dollar is strong; this is neutral for Asian commodity exporters. If and when the U.S. dollar stops rising and moves sideways or down, we will become bullish on commodity exporters.

• Latin America: On a case-by-case basis, speculators can make money buying when crises occur.

The U.S.

First, trade is making slow progress in spite of scary headlines. For example, there has not been much media coverage, but China has lowered tariffs on U.S. goods three times in the last few months. Also, although it is not well understood, today the U.S. has substantially lower trade tariffs than those of our trading partners.

U.S. trade policy will produce results; over the summer there will be volatility, and eventually, progress. Why? Because a real trade war would be negative for everyone, and the world — which runs an $800 billion annual trade surplus with the U.S. — will be more than happy to maintain a $500 billion trade surplus. Such a reduction in the U.S. trade deficit will add to U.S. GDP growth, U.S. employment, and U.S. prosperity. Trading partners who run big surpluses with the U.S. will complain loudly and make false accusations against the U.S. for our imagined misdeeds, but they will settle in the end and be grateful to maintain a still-positive trade position with the U.S.

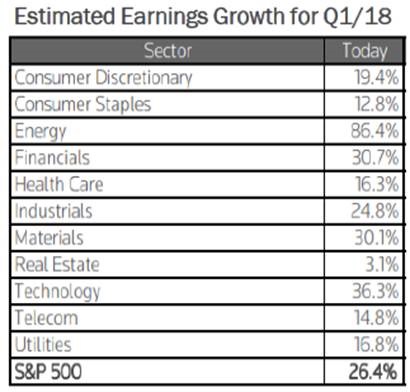

Second, economic growth is much stronger than pessimists have expected. The major reason that we are bullish on the U.S. is good economic growth, very strong earnings growth, and market valuations that are slightly below historical averages. (When inflation has been between 1–3%, the market has averaged 19 times earnings.)

Source: Canaccord Genuity

The U.S. economy is moving ahead much more rapidly than establishment economists have predicted. The pessimist case for slow growth in the U.S. has been substantially wrong so far, and we believe it will continue to be wrong.

Establishment economists have predicted and continue to predict a “new normal” that would result in lower trend GDP growth of about 1.5% due to lower population growth, lower productivity growth, high debt, and Chinese growth exceeding that of the U.S.

The “actual current normal” is much more positive than the establishment economists have predicted. It is 3% or more real growth driven by lower taxes, repatriation, increased net exports, deregulation, and increased rule of law.

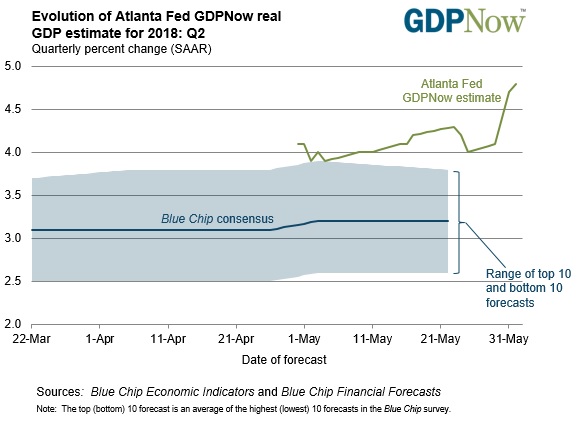

The GDPNow estimate is frequently inaccurate, but it is noteworthy how far it currently diverges from economists’ consensys

Source: Federal Reserve Bank of Atlanta

As is often the case, widely heralded trends are wrong, and this time substantially wrong so far. According to an analyst greatly respected by the Guild team, John Hook of Hook Analytics:

“The 20th century’s real growth was about 50% more than the 19th century because of accelerating technological advance. Technological advance is still accelerating and probably accelerates more ahead. Technological advance is the chief driver of increased productivity.”

He goes on to say: “Tax cuts and repatriation are one-time [events]. But deregulation, increased net exports, increased rule of law, and accelerating technological advance — though uneven — are capable of continuing. Probably these positive forces will increase and increase productivity, and thus real growth.”

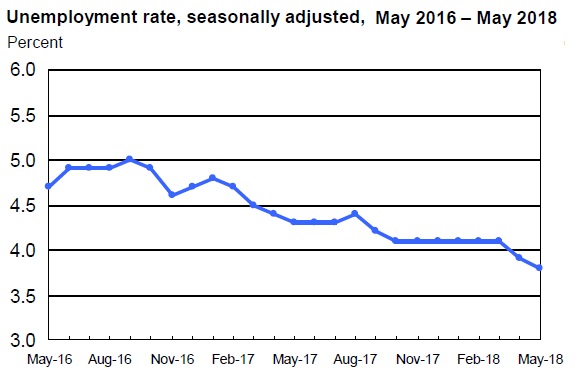

The U.S. employment report of last Friday can be described in one word: impressive.

Source: Bureau of Labor Statistics

The unemployment rate fell to 3.8% — a multi-decade low. Construction and manufacturing employment surprised by increasing faster than expected. Wages grew by 0.3% month-on-month, adding up to about a 3% annual wage increase this year, with expected 2018 inflation of about 2%. This is a very positive combination for the public’s well-being and rising consumer spending. Inflation remains constrained, and a strong dollar has kept it constrained.

Europe

We are neutral on Europe and believe that investors should avoid it.

As has been the case for months, we are not bullish on Europe. Europe has banking problems that have not been addressed. Italy’s political and banking woes are destabilizing, and Europe is being faced with increasing expenses for their defense. NATO members have been notified that they must increase their support for NATO, and that the US will not continue unilaterally underwriting Europe’s defense costs. They must repay billons that the U.S. has subsidized in excess of agreed-upon amounts. Europe is our least favorite regional investment destination.

Asia

We believe Asian growth companies are attractive, and commodity companies are neutral. Asia is growing, and does not suffer from the political and banking problems of Europe.

We see Asia as divided between two camps. First, there are countries that are growth-oriented due to manufacturing or technological expertise; second, there are those that produce and export commodities. We are bullish on Asian growth economies and neutral on Asian countries that produce raw materials. If the U.S. dollar were to stop rising versus world currencies, we could become more bullish on commodity-producing countries, but with the current strong U.S. dollar, we are avoiding commodity-producing countries like Malaysia and Indonesia.

We are more bullish on China, Vietnam, and India. Within China, we prefer technology companies and major internet-related gaming, retail, and growth stocks. Within India, we prefer growth sectors that benefit from a rapidly expanding middle class. We especially favor automotive and transportation finance subsidiaries of major automobile, motorcycle and farm equipment manufacturers.

Latin America

We’re back to the same old crisis management in the major countries in Latin America.

Brazil, Argentina, Venezuela and others have mismanaged their economies through corruption or economic programs run amok. Of the three, the one that seems most salvageable and positive for speculation is Argentina. Argentina is rebuilding after the devastating damage inflicted on the economy by the two Kirchner presidents and their Peronist allies.

In Venezuela, it appears that the country will have to continue with its collapse cycle, and the government will have to change before they come to their senses.

Brazil is early in a long cycle of corruption revelations — showing that many politicians of most parties have been on the take, and have taken advantage of the voters through corrupt practices.

Gold

Gold remains in a trading range and has been held down by the strong U.S. dollar. We believe that gold will rise modestly in 2018, but we do not see a major bull market brewing.

Cryptos

2018 continues to be shaping up as a transformative year for digital currencies, with significant new platform launches addressing key weaknesses that have proven problematic for existing cryptos. We will be watching to see how these new platforms perform, whether they attract users, and what unforeseen problems may emerge. In 2017 the crypto fruit was low-hanging; crypto speculators now need to have a real grasp of technical fundamentals and the regulatory landscape, and that often involves monitoring communication channels different from mainstream news sources, including Twitter, Telegram, and Reddit.

Major actors in the crypto ecosystem are vigorously pursuing integration into the established financial system and accommodation to regulatory demands. This bodes well for the entire space, in our view.

Thanks for listening; we welcome your calls and questions.