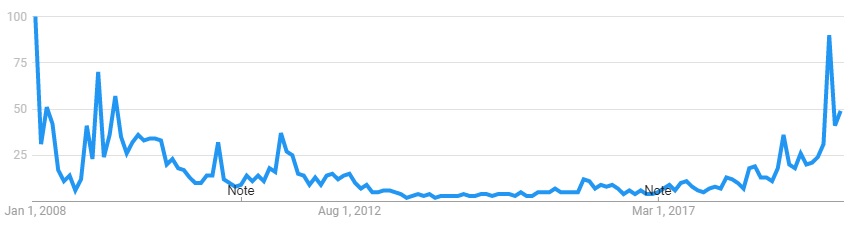

Recession fears have been on the rise in the U.S., and here’s one way to quantify that trend. Below is a chart showing Google News search trends for the topic of “recession.” On a 1-to-100 scale, it hit its peak in early January, 2008, just after the Great Recession had gotten underway. In the intervening years, interest in the topic dwindled, but then began to trend up again in 2018 — spiking to a level of 90 in August, 2019, nearly as high as when an actual and severe recession was underway.

Occurrence of Google News Searches for the Topic of “Recession”

In the age of the internet, news can go past a tipping point to become viral, and viral news can actually change the zeitgeist. The question is whether that change of public consciousness can have actual economic ramifications. Aren’t the realms of opinion and economic fact totally separate and watertight? Investors just need to look at the data — opinion doesn’t matter. Or does it?

The Effects of “Soft Data”

Nobel Prize-winning Yale economist Robert Shiller published a book this year (Narrative Economics: How Stories Go Viral and Drive Major Economic Events) which makes a reasoned case for what those in the market trenches have always known instinctively — sometimes, negative sentiment can become a self-fulfilling prophecy. He notes:

“New crises that shake up the economy often surprise economists because no [external] cause appears to be a sufficient explanation for a downturn. People begin to suddenly frame current events in the context of stories they had heard many times before. This may seem puzzling until we realize that an old narrative has renewed itself in an epidemic, and people have begun to respond reflexively in their day to day decisions. If enough people begin to act fearfully, their anxiety can become self-fulfilling, and a recession, sometimes a big one, may follow.”

We are not suggesting that current trends suggest this process is currently going on and will result in the arrival of a recession. We’re just pointing out that public opinion can have a real, and sometimes decisive, effect on actual economic data, when it causes businesses and consumers to retrench, spend less, and take fewer risks because they fear that economic turmoil is ahead.

How “Soft Data” Can Affect the Real Economy

Therefore it is worth paying attention to so-called “soft data” — data derived from polls asking consumers and businesspeople about their impressions of current economic conditions, and their anticipation about future conditions. These “soft data” include, for example, the manufacturing and services purchasing managers’ indices (PMIs) which caused markets to stumble last week, and have shown even more dramatic deceleration recently in Europe than they have in the U.S. It is important to watch these not just because they may provide accurate hints about the near-term economic future, but because they provide a barometer of opinion about that future.

All of the businesspeople who are responding to the PMI polls are, after all, human beings: they also consume media, and however focused on their businesses they may be, their opinions will reflect their exposure to trending media themes. Ultimately, as those opinions are compiled and recycled in the form of news stories about recession risks and weakening PMIs, businesses can change future plans in response. Opinion, as Shiller observes, can sometimes become self-fulfilling, even if the objective, “hard data” don’t confirm it.

Current Hard and Soft Data

Many analysts continue to see the hard data diverging from increasingly negative soft data. On the employment front, for example, the labor market continues to show strength, with upward revisions to previous months’ job gains, and a headline unemployment rate at a half-century low. Close scrutiny allowed some observers to cavil at the wage gain numbers, but overall, those remain healthy and on-trend for the expansion. U.S. economic growth, as measured by a variety of current activity indicators, continues to be healthy, as do overall U.S. financial conditions (which, as our readers know, we consider to be extremely significant in assessing the health of a credit-driven market cycle).

The hard and soft data will eventually converge. The question is how they will converge. We believe the most likely outcome is that, as the U.S. economy emerges from the third shallow deceleration of the post-2009 expansion, the soft data will improve to match.

News and Partisan Bias

We are in an era in which many news sources have become more politicized and partisan. As tech critic Jaron Lanier has observed, this has something to do with the political economy of the internet, whose lifeblood is advertising and a consequent relentless hunger for your attention (sparked, if necessary, by your anger and your fear). Whatever the source of the media’s polarized character, we are sure that political interests on both sides are aware of the self-fulfilling character of public exuberance or despair about economic conditions. In short, there are likely partisan interests at work on both sides, trying to shape the public’s views about the state of the economy — especially ahead of the 2020 U.S. Presidential elections.

Investment implications: Investors should give some attention to “soft,” survey-based sentiment data, although not because they are necessarily useful in predicting real economic performance. Some attention on these data will warn investors if negative consumer and business sentiment are becoming self-fulfilling prophecies of economic trouble. Investors should give more careful attention to “hard” economic data, and we believe that the balance of hard data suggests that the expansion remains intact and is recovering from its third mini-slowdown after 2012 and 2016. Until we see an indication that negative soft data are manifesting in the hard data, or are metastasizing in public consciousness, we will continue to give more weight to the hard data in our strategic allocation decisions.