It has long been obvious to every professional investor, pension administrator or member of a corporate or union pension committee. Now it’s even in The Wall Street Journal: an article on the increasing risks that pension funds are having to take on as they struggle to earn adequate returns in an environment of persistently and extraordinarily low interest rates. With all their traditional safe-haven assets yielding much too little (such as developed-world government bonds and blue-chip corporate bonds), they are reaching ever further beyond their traditional remit, into areas as diverse as real estate, infrastructure, direct lending, developing-world bonds, mortgage-backed securities, and other “alternative assets” from which pensions usually shy away because of the risk.

We covered this topic back in 2017, and due to its importance, we are reprinting some of our analysis here – particularly about pension fund participation in the leveraged loan market. Although this is unlikely to be a source of trouble imminently, it is an area that we have been watching for several years, and continue to watch. At some point, difficulties in this area could emerge and be a component of a period of tightening credit conditions that helps precipitate the next recession.

We also explain why, even though it is increasing eventual risks, this phenomenon is bullish for further advancement of the bull market in stocks. Read on.

Leveraged Loans Are a Secret Sauce For Banks, U.S. Corporates, and Pension Funds

Modern bull markets are fundamentally credit-driven. They are also credit-ended, when the spread between long-term and short-term rates goes negative and chokes off the supply of credit. This is why watching that spread — the “yield curve” — is one element of an effective strategy to protect investment capital from bear markets. The current bull market is no different. It has been driven by a credit boom that originated in and was sustained by extraordinary monetary policy in the wake of the 2008 financial crisis and subsequent recession.

As credit cycles mature — and this one is quite long by historical standards — they tend to create excessive leverage, and the unraveling of that leverage is usually what kicks off a recession and its attendant bear market. So besides monitoring the yield curve, we also watch conditions of financial stress, as well as potential signs of emerging frothy leverage levels in new corners of financial markets.

The saying goes that history doesn’t repeat, but rhymes. Usually, after a credit cycle collapses as it did in the 2008 financial crisis, legislators and regulators get to work to tighten rules and address the points of regulatory weakness where overly risky behavior was allowed to go unchecked and cause more widespread chaos. Although the most recent round of post-crisis regulation was occasionally misguided or excessive, or ineffective, in the U.S. at least, it was in broad strokes a laudable and effective effort.

Financial History Doesn’t Repeat, But It Rhymes

Still, the basic reality — that long credit booms generate excessive leverage — is inescapable. The creativity and ingenuity of financial engineers is always a step ahead of the regulators — for one thing, the incentives for financial engineers are always a lot greater than the incentives for regulators.

For some actors in the financial system, the forces driving them to creativity and ingenuity in devising new forms of leverage are existential — do or die. Their success and viability is under threat, so they innovate to create returns from new activities when the old activities have been curtailed or rendered insufficiently profitable by regulators.

Over the past year we have been watching a rise in leveraged lending to corporates. One aspect of this rise is being driven by big banks who have found their profitability extremely challenged in a long, low-interest-rate, low-growth environment. That environment is beginning to shift, but it is still very challenging for them compared to a long-term benchmark of normality. So they have generated fees by financing leveraged corporate loans.

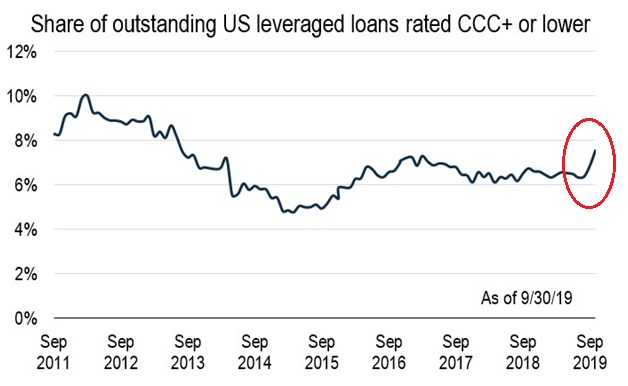

Both banks and non-bank institutions have also packaged those leveraged loans into collateralized loan obligations, or CLOs (an acronym familiar to those who remember the 2008 financial crisis), generating further fees. Over the past few years, the quality of these loans has been gradually deteriorating, as demand for these products has risen. A reckoning may come as the lower-quality tranches exceed the limits set by CLO creators, but that reckoning is still some ways off. After a CLO selloff in late 2018, issuance in 2019 has nearly matched 2018’s robust pace.

CLOs have also received negative political attention, with Democratic presidential hopeful Senator Elizabeth Warren sending a letter late last year to regulators citing her “concerns that the broad leveraged lending market continues growing rapidly with increased leverage, degradation in the loan terms, and weaker covenants to protect lenders.” The Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the Securities and Exchange Commission (SEC) all responded to Senator Warren, saying essentially that they were monitoring the risk.

The Elephant in the Room: Pensions

However, besides banks and non-bank financial institutions seeking to boost profits in a low-interest-rate, low-volatility environment, there is another actor driving the creation of these CLOs — an actor big enough to dwarf other financial system participants: pension funds.

U.S. pension funds have enormous liabilities — liabilities which have grown inexorably relative to GDP.

On balance, these pension funds require an annual return of 7.5% on their assets to meet their obligations — a figure that is relatively high due to rising obligations from accelerating retirements and low interest rates over the past two decades. Pension funds must typically operate according to a prudent and diversified model. Bonds comprise the largest portion of their assets, at 50% or more; followed by stocks at about 30%; with the remainder in real estate and alternative investments. Bonds and stocks together would now generate returns below what pension funds require, and real estate returns are highly variable. So to make up the difference between what bonds, stocks, and real estate can provide, and the return they need to meet their obligations, they must turn to complex and leveraged synthetic instruments such as CLOs. The financial engineers who construct these instruments do so in a manner that attempts to mitigate risk — but as we have seen in many episodes of financial history, a crisis often reveals that such complex risk mitigation has fallen short.

Thus, U.S. pension funds are availing themselves of the newest and shiniest CLO products in order to boost the overall performance of their stock and bond portfolios and generate the returns they need.

Will those needs be reduced, by allowing big public pension funds to cut the benefits they pay out to their retirees? Perhaps eventually, but that will be a politically ugly and unpalatable fight, given the extent to which recipients of public pensions rank above taxpayers in the pecking order, and politicians do not want to cross public employees’ unions. (It is a form of political suicide to talk about reducing pension benefits for police or firefighters, for example.)

For now, it is very likely that tax dollars will continue to flow into public pension funds, and those funds will buy leveraged loans as they seek to reach their needed return benchmarks. While this is not a crisis in the immediate making, we are observing it as a potential focus point of the inevitable future unraveling of the current credit cycle.

Bullish For Stocks

In the meantime, however, it is a bullish phenomenon for stocks. The hunger of pension funds for yield is leading them to buy not only CLOs, but also synthetic, leveraged corporate bond packages. According to fixed income analyst Brian Reynolds, much of the post-crisis stock market rally has been driven by corporate stock buybacks. That is, in the big picture, U.S. corporates have borrowed money cheaply and used the proceeds to buy back stock, boosting stock prices (and, not coincidentally, the compensation of corporate executives, which is comprised heavily of stock options).

Therefore we have two sets of existential demands: (1) of banks, to generate profits by creating leveraged corporate loan and bond instruments, and (2) of pension funds, to meet the near-impossible actuarial assumptions that keep them solvent.

These twin demands will keep the credit cycle ramping for some time — and will eventually contribute to a final blow-off in the equity markets. But that time is not yet here — so when it comes, our advice is still to buy the dip.

Investment implications: The credit-led bull market is ongoing. The first signs of excess and froth are beginning to become visible as big banks chase elusive profits by packaging leveraged loans into synthetic instruments and sell these to pension funds, who are in turn chasing elusive yield so that they can meet their very ambitious actuarial assumptions. It may be that this excess will be a critical element in the ultimate turn in the credit cycle. However, in the meantime, the process will continue to undergird stock prices.