If you’re in lockdown, working from home, or otherwise practicing social distancing, we hope this letter at least offers the chance to think with us about the implications of current events for the economic, financial, and investing landscape. Perhaps it will even be able to briefly take your mind away from the anxieties that are arising in these new and unexpected circumstances. Our prayers go out to everyone who has suffered directly from the illness or who is serving on the frontline in any capacity — or who is keeping the home fires burning for someone who is.

We are focused on two distinct but related areas. First, we are watching the public health impact and monitoring the dynamics of the pandemicand the public health policy response. We are not epidemiologists, and there are a lot of conflicting data and sources. This pandemic is occurring at a cultural moment of skepticism towards all kinds of authorities and experts, and that skepticism is sometimes justified. Still, we do our best to discern what information is trustworthy.

Second, we are closely watching the gargantuan fiscal and monetary stimuli that are being implemented around the world, and gauging their likely impact on markets and investment portfolios. In the very near term, likely for the month of April, grim news about the pandemic’s spread and very bad economic data are likely to monopolize the headlines. However, that news and those worrisome headlines will eventually pass. We want to prepare now for the investment landscape that will emerge when they have passed, and when the massive stimuli still being enacted by global governments and central banks begin to make their way into the economy and into markets.

On the public health front, we see promising signs that countries further along the curve than the U.S., particularly some hard-hit European countries, may be getting past the peak. That’s encouraging, as it suggests that determined efforts in the U.S. over the month of April could achieve similar results. While some reports of promising treatments are merely anecdotal, we see that these treatment strategies are already being taken up in hard-hit U.S. hospitals. Sometimes it is a good thing when physicians on the ground take matters into their own hands and do not wait for officialdom’s stamp of approval.

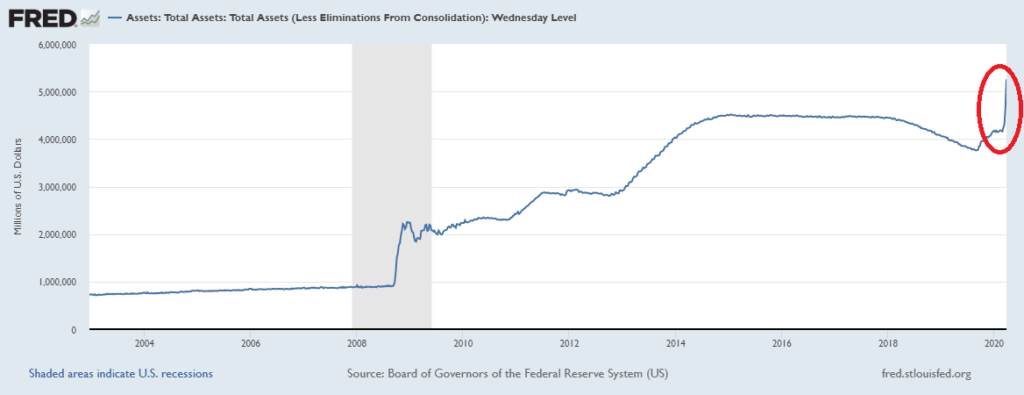

On the stimulus front, the Federal Reserve’s balance sheet is expanding quickly enough to make this report obsolete before it reaches your inbox, whatever number we mention. Analysts see the Fed’s balance sheet doubling, to $9 trillion, from year-end 2019 to year-end 2020 – an incredible move from 20% of GDP to 40% of GDP.

The Fed will effectively monetize the entire upcoming issuance of the U.S. Treasury, which will expand at a pace that is impossible to predict. The recently passed CARES Act, the $2.2 trillion stimulus bill, may soon be followed by a national infrastructure bill of similar size. The crisis will likely galvanize lawmakers to finally act on this long-stated priority of the current administration. This is not a moment when deficit hawks will get much of a hearing.

We have already noted in previous letters the “alphabet soup” of new and revived facilities launched by the Federal Reserve to support businesses and capital markets. Significant since last week’s letter is a new facility designed to help ease the crushing demand for U.S. dollars that has caused the dollar to soar in value in recent weeks. This extraordinary development will extend repo facilities to other global central banks, which can then pass dollar liquidity to banks within their own jurisdiction:

“The Federal Reserve on Tuesday announced the establishment of a temporary repurchase agreement facility for foreign and international monetary authorities (FIMA Repo Facility) to help support the smooth functioning of financial markets, including the U.S. Treasury market, and thus maintain the supply of credit to U.S. households and businesses. The FIMA Repo Facility will allow FIMA account holders, which consist of central banks and other international monetary authorities with accounts at the Federal Reserve Bank of New York, to enter into repurchase agreements with the Federal Reserve. In these transactions, FIMA account holders temporarily exchange their U.S. Treasury securities held with the Federal Reserve for U.S. dollars, which can then be made available to institutions in their jurisdictions. This facility should help support the smooth functioning of the U.S. Treasury market by providing an alternative temporary source of U.S. dollars other than sales of securities in the open market. It should also serve, along with the U.S. dollar liquidity swap lines the Federal Reserve has established with other central banks, to help ease strains in global U.S. dollar funding markets” [emphasis ours].

This is part of the ongoing Fed effort to ensure that the stresses created by the global economic stoppage do not result in unforeseen dislocations that would produce a global financial crisis. Credit Suisse noted that this new facility “effectively backstops foreign central banks from forced liquidation of their Treasury holdings into dysfunctional markets.” Such forced liquidation could of course have disruptive effects on the entire global financial system, given the systemic importance of U.S. Treasurys.

Brean Capital’s senior economic advisor summarized the fiscal and monetary efforts in this way:

“The CARES Act should not be thought of as fiscal stimulus but as an economic stabilization package. The collapse of economic activity in March 2020 is not a normal cyclical recession but the result of a mandated ‘time out’ of individuals and businesses by the government. Many of the provisions of the Act are designed to prevent the private sector from unraveling so that when the containment of the virus permits shutdowns to be lifted, activity can bounce back…

“There is no avoiding recession because the output of airlines, hotels, restaurants, movie theaters, etc., is lost. However, [the stimulus programs] will support businesses so that when the virus permits the resumption of activity, we can see a sharp rebound in activity. Skilled labor was a scarce resource just one month ago and the key is to keep that labor and businesses connected. The support for businesses is really support for labor because it companies cannot pay workers from cash flows, the layoff figures will dwarf the numbers suggested by the latest jobless claims data.

“How effective will the measures be? In the latest quarter, labor compensation was $2.9 trillion (actual, non-annualized) and, to consider a purely illustrative number, a 20% (actual) drop in labor incomes amounts to $577 billion, which is about the magnitude of direct income support to households with consider the impact of support for businesses, which will head off a steeper decline in labor incomes. The fiscal package will unlock upward of $4 trillion of capital market support programs from the Fed. In addition there are the funds to help combat the spread of the virus and the sooner the virus can be contained, the more lives will be saved and the sooner America can get back to work. After a few months of being housebound, we suspect there will plenty of pent-up demand…”

These are cogent remarks. Indeed, the current slowdown was not a typical cyclical event; it was an exogenous shock. The economy, the labor markets, and the capital markets were robust before the shock struck. If the pandemic’s curve permits, it is quite possible that the fiscal and monetary support now being rolled out by authorities around the world will be able to bridge to the other side of the crisis.

On that “other side,” many attractive companies with robust and enduring growth profiles, with products that will remain in high demand, will have endured a loss in valuation out of all proportion to the virus’ long-term effects. We are working now to identify these companies, and can foresee the opportunity to buy many stocks at a discount which we have been patiently watching for years while their valuations have been stretched, in our view.

A word on gold: while the crisis unfolds, the world will be in the grip of an intense deflationary impulse that is normally not constructive for gold, but in our view, the disappearance of monetary and fiscal conservatism should be very constructive for the price of the yellow metal over the longer term. The extensive post-crisis toolkit of central banks is likely to forestall a global financial crisis and the rush for safety that it would create. Therefore in the near term, we see only modest potential for gold. However, the ultimate consequences of unprecedented monetary easing and deficit-fueled stimulus measures are difficult to foresee. There are plausible scenarios out several years in the future in which today’s rescue activities will create substantial inflation. In that context, gold seems to us as always, but particularly now, a wise allocation in any portfolio.

Stay safe, stay healthy, stay sane, and take good care of yourself and your loved ones.

Thanks for listening; as always, we welcome your calls and questions.