Over the past several weeks, we have kept you informed about the monetary and fiscal stimulus being enacted in the United States in response to the coronavirus pandemic and the economic dislocation associated with it. The nature and extent of the economic slowdown caused by measures to combat the virus have yet to be seen. A fuller picture will begin to emerge as companies start to report their first-quarter earnings later this month.

Still, even as more concrete data become available, the second- and third-order effects will not become clear for some time. Speculation on such potential ramifications of the slowdown itself, and of the stimulus measures, is tempting, but premature.

Therefore we are focusing on what we can know and reasonably anticipate about the nearer term, rather than on such speculation. The most important focus of attention for investors, we believe, should still be the stimuli being applied via monetary and fiscal intervention.

Monetary Stimulus

The Federal Reserve has been concentrated on doing everything in its power to avert a financial crisis, by ensuring sufficient liquidity and stepping in to act as a “lender of last resort,” supporting almost any capital market threatened by dislocations. As we’ve mentioned in past weeks, that has included extraordinary measures, such as the extension of FX swaps and repo facilities to many foreign central banks in an effort to ensure the availability of U.S. dollars to foreign banking systems and prevent a damaging surge in the U.S. dollar, or disruptive fire sales of U.S. Treasurys by dollar-strapped foreign entities.

This morning (Thursday, April 9), the Fed announced several expansions of existing facilities, as well as more details about its Main Street Lending Program (which it says will be finalized by April 16), totaling an additional $2.3 trillion in support of the U.S. economy:

“The actions the Federal Reserve is taking today to support employers of all sizes and communities across the country will:

- Bolster the effectiveness of the Small Business Administration’s Paycheck Protection Program (PPP) by supplying liquidity to participating financial institutions through term financing backed by PPP loans to small businesses. The PPP provides loans to small businesses so that they can keep their workers on the payroll. The Paycheck Protection Program Liquidity Facility (PPPLF) will extend credit to eligible financial institutions that originate PPP loans, taking the loans as collateral at face value;

- Ensure credit flows to small and mid-sized businesses with the purchase of up to $600 billion in loans through the Main Street Lending Program. The Department of the Treasury, using funding from the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) will provide $75 billion in equity to the facility;

- Increase the flow of credit to households and businesses through capital markets, by expanding the size and scope of the Primary and Secondary Market Corporate Credit Facilities (PMCCF and SMCCF) as well as the Term Asset-Backed Securities Loan Facility (TALF). These three programs will now support up to $850 billion in credit backed by $85 billion in credit protection provided by the Treasury; and

- Help state and local governments manage cash flow stresses caused by the coronavirus pandemic by establishing a Municipal Liquidity Facility that will offer up to $500 billion in lending to states and municipalities. The Treasury will provide $35 billion of credit protection to the Federal Reserve for the Municipal Liquidity Facility using funds appropriated by the CARES Act.

“The Main Street Lending Program will enhance support for small and mid-sized businesses that were in good financial standing before the crisis by offering 4-year loans to companies employing up to 10,000 workers or with revenues of less than $2.5 billion. Principal and interest payments will be deferred for one year. Eligible banks may originate new Main Street loans or use Main Street loans to increase the size of existing loans to businesses. Banks will retain a 5 percent share, selling the remaining 95 percent to the Main Street facility, which will purchase up to $600 billion of loans. Firms seeking Main Street loans must commit to make reasonable efforts to maintain payroll and retain workers. Borrowers must also follow compensation, stock repurchase, and dividend restrictions that apply to direct loan programs under the CARES Act. Firms that have taken advantage of the PPP may also take out Main Street loans.”

In addition, the fine print of securities eligible for purchase through the SMCCF facility now includes junk bonds and the junk bond ETF, JNK.

“The Facility also may purchase U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. corporate bonds. The preponderance of ETF holdings will be of ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds.”

Fiscal Stimulus

That’s the monetary side. On the fiscal side, so far, Congress has passed three measures in response to the pandemic: two relatively small and tightly targeted, and the third package, the CARES act, worth more than $2.2 trillion.

That’s a huge number, and will almost certainly be followed by more. Why is this almost certain? It’s difficult to gauge the ultimate economic effects of the current economic “coma” induced by social distancing and shutdowns, simply because it is not clear how long these measures will continue or how quickly they will be rolled back when the time comes. Estimates by analysts suggest a major output drop in 2020, and a smaller drop in 2021. If Congress wants a fiscal stimulus to bridge that gap, it simply has to be larger, and partisans on all sides seem to know that.

The fourth coronavirus stimulus is already being wrangled. It is likely to include a number of items. It will have to include major relief for state governments because of the huge revenue shortfalls they will experience from the shutdown. States got a little aid in the second and third stimulus bills, increasing the matching rate for Medicaid payments, and some block grants for education and transportation expenses, but nothing to address looming losses of tax revenue.

The next stimulus bill will also likely need to include further relief for small businesses, more unemployment benefits, and perhaps more “helicopter cash” for individuals. Of course there is ample horse trading going on, but in an election year, we can safely say that neither side wants to appear stingy in dispensing support to the American economy and American businesses and workers in their time of gravest need.

There is also the potential for the long-desired and long-delayed infrastructure bill; so far, irresolvable political disagreements about its funding have stood in the way, and may still. We will see if that could become a fifth stimulus bill; it will likely depend on the evolving severity of the pandemic’s economic fallout.

However, we note that the uncertainty surrounding that level of severity could well create a political bias towards doing “more than we think we need.”

The CARES Act was enacted quickly; it’s hard to say that it was too quick, under the circumstances — but many of its measures were admittedly blunt instruments. For example, if unemployment stands at 15% in the third quarter, that will mean that some $250 billion went to people who were not unemployed. On the other hand, $350 billion represents about half the eligible costs of businesses with fewer than 500 employees. Lawmakers are aware, having fired the first big gun, that it was a scattershot affair. That’s why they’re already reloading.

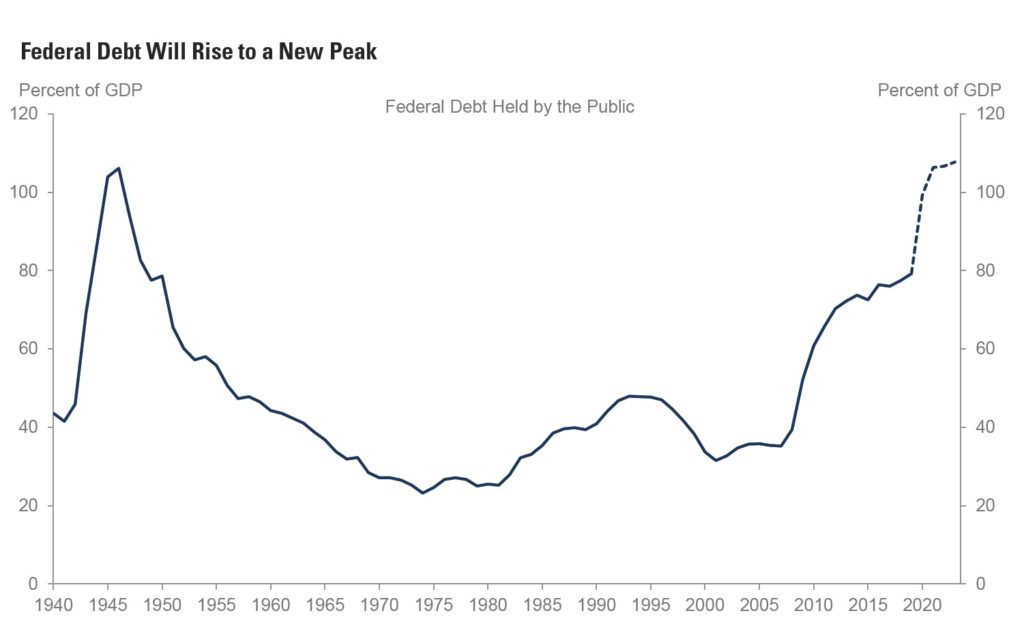

The message, as before, is simply that the stimulus is almost unprecedented. We say “almost,” because the necessary Treasury issuance will likely bring U.S. government debt back to the levels it reached at the end of the Second World War:

Again, the basic message of all this is straightforward. We don’t know the duration or severity of the economic slowdown caused by the pandemic. We don’t know and can’t yet speculate with any confidence about more distant second and third-order effects of the pandemic and the responses to it.

We are confident that the public health crisis will be resolved; and when it is, the magnitude of the stimulus that has been enacted will become apparent and will act powerfully to boost economic activity and capital markets.

Medical Progress

A word on the public health dimension of the crisis: we have noted that the conversation around the U.S. biopharmaceutical industry has radically changed as a result of the pandemic. Not long ago, the industry was a political punching bag; now, its innovation powerhouse is a source of pride and gratitude. The hot-button political issue of drug prices has been forgotten. We would be very surprised if it played any significant role in the upcoming U.S. elections. No one will want to be seen hamstringing the industry that has mobilized such resources and ingenuity in combating the pandemic.

Without running through all the players, we will note that there are multiple vaccine candidates; multiple therapies and treatment regimes; and multiple diagnostic tools all advancing towards near-term catalysts. The speed with which some therapeutic candidates have entered clinical testing is extraordinary. Even if an approved vaccine for the general population is still 18 months off, it is likely that there will be a vaccine available for frontline medical workers considerably sooner than that. As effective treatments are tested and become available, that will hasten the world’s return to normal economic activity.

Market Summary

We believe that the Federal Reserve has done enough to backstop almost all of the U.S. debt market. We also believe that the Fed has created massive liquidity for foreign governments to handle their U.S. dollar denominated debt. We think it’s likely that further volatility will play out in markets in coming weeks and months. It is very rare that a decline as severe as the one experienced in the first quarter of this year should not be followed by a re-test of the initial lows for some industries.

Other industries, including financial services, the issuers of debt that have been so badly ravaged by the market decline, will probably be protected from a re-test by the massive Fed action undertaken over the last several weeks. In essence we believe that the battering taken by income stocks, which was worse than the battering taken by the market as a whole, is being corrected by Federal Reserve action and we do not believe income stocks will suffer through another major decline.

Other industries, however, that are very dependent on global supply chains and economic earnings news, could suffer a re-test.

The catalysts for such a re-test are obvious: dismal economic news, quarterly earnings, and forecasts are likely to emerge in coming weeks. Still, during the volatility, opportunities are being created, and we are actively bargain-hunting.

This is a major economic disruption that will change the competitive landscape of many industries. There will be winners and losers. We believe that focusing our research on finding the long-term winners that emerge from this episode will be rewarding for our investors.

Gold

After the financial crisis of 2008, gold rallied in 2010 and 2011 because of low yields for two and ten-year U.S. Treasurys that were below the current inflation rate, and the anticipation of inflation. By 2011, investors realized that interest rates would remain low for an extended period of time — indeed, disinflation was the real concern on a global basis.

Today, gold is rallying on the massive Fed actions, and this rally can continue if investors believe that these actions will create inflation in coming years. On the other hand, gold investors must balance the fact that the impulse of the current crisis is deflationary. We continue to believe that gold will rally in 2020, and possibly vigorously. But it will likely be volatile, since there will be a tug-of-war between opposing viewpoints in the short term. But please make no mistake: we have no doubt that gold will move ahead decisively in the long term.

We hope you’re staying safe and healthy, and taking good care of yourself and your loved ones.

Thanks for listening; as always, we welcome your calls and questions.