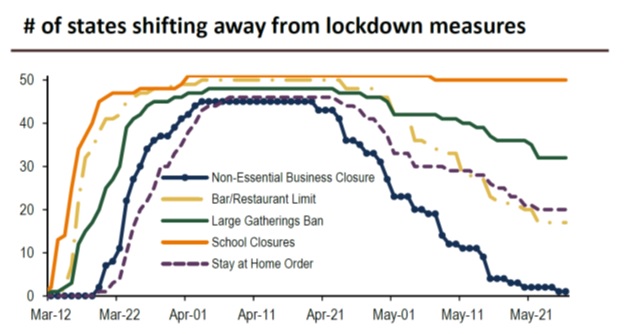

The U.S. economy is reopening across many states:

While after the sharp snapback rally, a 5 or 10% market correction in June or July remains a distinct possibility, we believe that monetary and fiscal support have taken many “worst case” scenarios off the table.

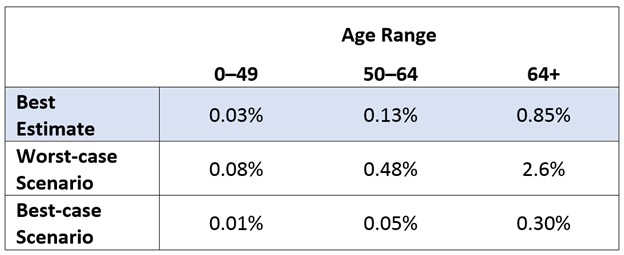

Last week we mentioned data from the Centers for Disease Control and Prevention (CDC) outlining their various scenarios for COVID-19 mortality. Their “best estimate” shows an overall infection fatality rate (IFR) of 0.26% for all ages; their worst-case scenario is about 0.80%, and their best-case scenario is about 0.10% — with mortality in all cases skewed heavily to older demographics.

Scenarios for COVID-19 Mortality (IFR) By Age Range

These increasingly well-founded data suggest that not only has the worst-case market scenario been taken off the table, but the worst-case public health scenario has as well. We believe these data will encourage continued economic reopening, even in the states which have been hesitant thus far. Good news is beginning to replace bad news.

As the trend of better news continues, there will be greater demand for beaten-down industries such as travel, restaurants, entertainment, shipping, trucking, railroads, airlines, and industrials. These will all pick up, as will other basic parts of the economy that we take for granted such as energy, basic materials, utilities, banking, and real estate. The next big opportunity is in these forgotten and ignored sectors as the economy gradually returns to growth.

Growth industries in technology, biopharma, and healthcare may underperform in the short-term, but should perform very well longer-term.

Thanks for listening; as always, we welcome your calls and questions.