What Are Digital Currencies — And What Do They Mean For Gold?

Bitcoin is in the news, once again driven by a price spike that makes speculators and would-be speculators start counting their unhatched chickens. This time, the granddaddy digital currency has competitors — “altcoins” — which are also attracting attention. Ripple, ether, dash, monero, and hundreds of other currencies have sprung up (as of this writing, a total of 888, with a combined market capitalization of about $115 billion). Some promise technical refinements and improvements to the bitcoin system; others offer institutionally friendly features that leverage bitcoin-derived technologies for broader application in contracts and transfers.

All the competitors have their proponents. While some are clearly more serious contenders than others, at the end of the day, disagreement is heated even among technical experts and non-experts who chase windfalls in digital currencies. While the excitement lasts, there will be enough stories of overnight digital currency millionaires to keep the process going, but eventually the music will stop. (Of course, speculation can be fun — as long as you recognize it for what it is.)

Digital Currencies Are Here To Stay

While picking winners and losers in the rapidly growing field of digital currencies is very complex, digital currencies as a whole are doing something for which there is demand. While they share some characteristics with other assets, they combine those with unique characteristics of their own, and therefore they will appeal to users and speculators who want those characteristics. That means that they will continue to exist (even if some governments decide they shouldn’t), so at some point after the dust settles, intelligent speculators, and even investors, will need to decide whether digital currency is an asset class in which they want to hold some of their wealth.

Bitcoin was the model for competing digital currencies for good reason. It came up with elegant solutions to fundamental problems of exchange, which we’ll describe below. Other digital currencies, while differing in technical details, share bitcoin’s solutions in broad strokes. Understanding the technical details is not as important as understanding the basic nature of what digital currencies are trying to achieve, and how they achieve it. With that clear view, speculators and investors can make the essential decision of whether participation in this new asset class aligns with their personal goals and risk appetite — or whether they should ignore it entirely.

Bitcoin’s Goals

The first thing to realize about bitcoin is that the entire system is rooted in a desire to remove financial intermediaries, and allow people transacting business to make their exchange directly with one another. Bitcoin is anarchist money. It isn’t created by a central authority, it isn’t backed by a central authority, and transactions are not confirmed by a central authority. Indeed, the bitcoin system sets out to remove the need for any “central authority” — whether that’s a government, a bank, or any “trusted intermediary.”

Some readers may immediately think, “There’s an asset like that already — it’s gold.” In the contemporary economy, gold is the asset whose ownership is at bottom a vote of “no confidence” in central authorities and the stability that they create — or at least a hedge against their failure.

What bitcoin sought to do (and what its anonymous inventor largely succeeded in doing) was to create an asset that would, like gold, be independent of governments and banking systems — but that existed only digitally, and thus had a host of other characteristics that are desirable in a digitally connected world.

Gold has mass. It takes up space. It’s difficult to divide so that it can be used in exchange. It requires physical-world vigilance and security to prevent theft. It has to be carried and physically exchanged in order to conduct transactions, which could be inconvenient and dangerous. Using third parties to perform any of these functions exposes the owner of gold to the risk of theft and fraud.

Bitcoin, on the other hand, takes up no space, and can be exchanged instantly over any distance. While it can be stolen, that theft can only occur on the edges of the bitcoin system, where it interacts with the established financial world. As it is constructed, within itself, the bitcoin system is impervious to theft and fraud (with one important caveat, which we’ll mention below). A bitcoin wallet — really nothing more than a set of cryptographic keys giving you the power to allocate bitcoins from your address to some other address — in cold storage, unconnected to the internet, is completely secure.

In short, bitcoin set out to be digital gold for the digital age. Will it succeed?

The Top 20 Digital Currencies By Market Capitalization

Source: coinmarketcap.com

How Bitcoin Works

The mechanics of digital currencies are complex in their actual implementation, but the broad structure is not difficult to understand.

In order to remove the need for financial intermediaries, any digital currency system has to solve two problems: the problem of identity and the problem of ownership.

The current global financial system also solves these problems. Central authorities — banks, governments, and courts — keep exhaustive accounts of financial assets and of the ownership of those assets, tying those accounts to identity records maintained by other authorities. When you withdraw money from your bank, the bank has a system to confirm your identity — relying on many other expansive and intrusive identity-confirmation systems within government. Then the bank has to verify your ownership of the money you’re withdrawing — using a complex system of proprietary ledgers and record-keeping as well as the proprietary communications systems connecting all these records. The system functions smoothly, and that smoothness hides the complexity of intermediary structures, not to mention hiding the costs these intermediary systems impose on users.

Bitcoin, on the other hand, solves the identity and ownership problems with math and algorithms. It secures ownership through cryptography. Only the possessor of the correct cryptographic key can spend the bitcoins associated with a certain address, and while the possession of that key can be verified by anyone, the key itself is never revealed to anyone. (If readers want to delve into the mechanics of public/private key cryptography, it’s an interesting and challenging subject area.) The central role of cryptography in almost all digital currencies has led to them being dubbed “cryptocurrencies.” For now, these cryptographic keys are so robust that no existing computer technology is even theoretically capable of compromising them.

These cryptographic technologies existed long before bitcoin. Bitcoin’s real innovation was this: it created an elegant system for the maintenance of a public, universally agreed-upon ledger of bitcoin ownership, that is maintained by a distributed network of computing nodes rather than by any single, proprietary institution.

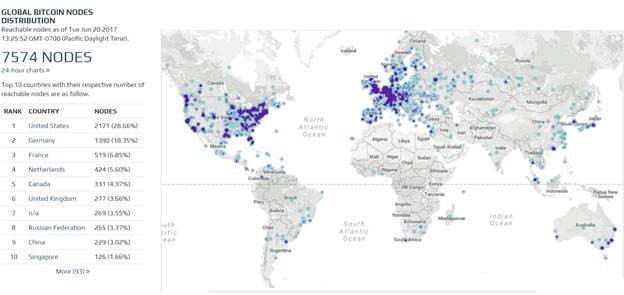

Again, the technical details of how bitcoin accomplishes this goal are abstruse. The bottom line is that every bitcoin transaction that has ever occurred is included in a ledger called the “blockchain,” and the blockchain itself is not held by any central institution, but exists in thousands of independent “nodes” around the world. These nodes compete with one another to verify new transactions being added to the blockchain, and winners are rewarded with newly created bitcoins. The competition involves a race to solve extraordinarily difficult mathematical puzzles. When a new, valid block is added to the blockchain, it propagates among all nodes from peer to peer and is adopted as the basis for work starting on the next block. (To fraudulently rewrite or alter the blockchain, or introduce bogus transactions, would require an amount of computing power that’s far beyond anything currently available.) Thus the system maintains a universally agreed-upon ledger describing the ownership of every bitcoin in existence — without the need for any central authorities or intermediaries.

Source: Bitnodes

Source: Bitnodes

Every digital currency solves these problems with an approach similar to that used by bitcoin. They use cryptography to solve the identity problem, and a distributed ledger (some form of blockchain) to solve the ownership problem.

Digital Currencies: Are They What They Seem?

Digital currency creators set out to make digital gold — an asset that, like gold, needs no central authorities to back it, or to its certify ownership; but unlike gold, takes up no space, can’t be stolen, and can be instantly transmitted anywhere in the world. Did they succeed?

Yes and no. Here are some skeptical thoughts on potential cryptocurrency weaknesses — questions we think speculators and investors should ask themselves as they decide whether they eventually want to hold some of their wealth in the form of digital currency.

First, digital currencies claim to do away with intermediaries. But do they? Although we’ve sketched an extremely high-level view of how digital currencies operate, a real understanding of these systems requires a lot of intellectual sweat — and possibly, for deep comprehension, a decent grasp of several fields of mathematics and computer science. Therefore, a real-world user has two options: acquire the detailed, precise knowledge of how the systems operate — or trust the understanding of a third party, whether a friend or an advisor acting in some formal capacity.

Personally, we would not want to hold assets about which we or a trusted advisor don’t have deep understanding. So any normal person who doesn’t have the time or inclination to become an amateur computer scientist is relying not on the bitcoin system’s supposedly robust independence, but on some trusted authority who facilitates their interaction with the bitcoin system. Despite bitcoin’s theoretical security, for almost all investors its real security will be tied to intermediaries whose trustworthiness they must judge. Sounds rather like we’re back to square one.

Even in a bitcoin world, real-life users will depend on the trustworthiness of other actors in the financial system. So trustworthy intermediaries create value, and will continue to create value. And as unforeseen troubles occur for cryptocurrencies, that truth will, we believe, become more apparent. Of course, while physical gold in one’s personal possession may present risks, those risks are much more easily comprehended and mitigated than the risks associated with complex and novel computer networks.

A second trouble with digital currencies is privacy. Astute readers may have reflected on the public nature of the bitcoin blockchain. This is noteworthy: every bitcoin transaction that has ever occurred is preserved in the blockchain, publicly available and held in its entirety in every node. Those transactions are identified with bitcoin addresses, which are simply long alphanumeric strings — not names. Still, data mining — especially using artificial intelligence and machine learning — may well be able to find patterns in the blockchain and marry those discoveries with external data to tie transactions to real-world identities. (Intelligence agencies are undoubtedly already working on this. This is not idle speculation; worries about privacy have led to the creation of several bitcoin alternatives. Those alternatives, though, end up creating problems and weaknesses of their own.)

This privacy issue is something that gives us pause when we contemplate the proposed expansion of the blockchain technology beyond cryptocurrencies.

Several successful platforms are bringing blockchain to the world of business transactions and contracts, promising to reap the benefits of decentralization and digitization in reduced costs and increased efficiency. We think that privacy concerns here, too, may eventually provoke a backlash as consumers realize that blockchain technology permanently memorializes their activities in a public data base that is pseudonymous, but not necessarily impervious to attempts to extract personal data. And of course, the risk of exposure of personal data doesn’t just concern those who are fearful of government prying, or those who are engaged in illegal activities. Countless commercial transactions must remain private to safeguard businesses against the unfair advantage their competitors would have if, for example, they had detailed information about who their suppliers were. All of that is the kind of information that could be revealed through a public blockchain. Potential use of blockchain technology for financial and medical records also creates privacy issues. (Next week, we’ll explore the promises and potential problems of blockchain technology as a way to smooth exchanges and reduce transaction costs entirely outside the world of cryptocurrencies.)

A third potential weakness is technological. We noted above that both of the central pillars of digital currencies — cryptographic identity and blockchain construction — rely on mathematical problems. Those problems need to be either impossible (in the case of cryptographic identity) or extremely difficult, time-consuming, and costly (in the case of blockchain construction). With current computer technology, all is well: the unsolvable is unsolvable, and the extremely difficult is extremely difficult.

But there’s a new technology coming: quantum computing. The inflection in computing power that quantum computing inaugurates could quite possibly break all existing cryptocurrencies. Indeed, it could break all existing cryptography. We don’t know when that moment will arrive. Perhaps it’ll be like fusion power — always 30 years in the future. But the consensus of computer scientists is shifting, and many now believe that functional quantum computers are only five to ten years away. With such an impending potential destruction of the foundations of digital currencies within long-term view, the question is, can digital currencies be more than a gamble?

All of these considerations could be summed up in one observation: it is essential for investors, as well as for intelligent speculators, to be ruthless in realistically assessing their own ignorance. The saying that “pride goeth before a fall” is nowhere more applicable than here. The apparent simplicity and straightforwardness of digital currencies masks complexities which create risks that are not trivial to understand and quantify. If we ourselves lack the technical expertise to understand and quantify these risks, we have to rely on others whom we trust. Does that reliance cut completely against the cryptocurrency grain?

Gold, Bitcoin, and Artificial Intelligence

Last week we offered some thoughts about the imminent arrival of artificial intelligence (AI) and machine learning, and commented on the “black box” nature of this revolution. With machine learning, we’ll have extremely functional automated systems that can offer no account of their behavior — there will be no real answer to the question, “Why did it do that?” This is simply what happens when artificial neural networks pass the threshold of complexity that they’re passing, and begin to program themselves rather than being programmed by humans.

For most people, bitcoin and other cryptocurrencies will always be black boxes. We noted a few potential weaknesses — but we are not experts, and other weaknesses may well exist in these systems that will not manifest until a major failure occurs. This is part of the problem with complex systems that function as black boxes: the only way to find out when they’ll break, if they’re intractably complex, is to use them until they do break. And then it’s too late – for those who make that mistake, if not for the people who learn from your mistake. Most investors, when they reflect, are not eager to become everyone else’s cautionary tale.

So while cryptocurrencies are technologically, culturally, and politically fascinating, in our view they are at this stage only vehicles for speculation, not investment. We realize, however, that the tempting prospect of outsized gains and the mythic accounts of bitcoin billionaires will inexorably pull in many speculators.

Still, we don’t believe that cryptocurrencies have yet demonstrated success in their quest to be the new “digital gold.” For all its drawbacks, and even though we can’t store it on a flash drive, we still prefer analog gold as a hedge against the malfeasance and irresponsibility of government.

Investment implications: Digital currencies are not investments. In our view, unless you have significant technical expertise, they are rank speculation. Since they marry some desirable characteristics of gold and of virtual assets, they will probably continue to exist — but we believe that it is impossible to determine which of the nearly 1,000 currently existing digital currencies will survive in the medium term. Longer term, there are significant questions around privacy, public comprehensibility, and the potential for quantum computing to defeat the difficult mathematical problems on which cryptocurrencies are based. For all these reasons, we think cryptocurrencies are interesting to study, and may be fun to trade — but are not investments, and in the long run will not supersede the need for trusted intermediaries in the financial system. We believe that most investors who want to hedge against the malfeasance of government and the vicissitudes of monetary policy should keep doing it the way they’ve been doing it for 5,000 years — with gold. Cryptocurrencies have an inherent potential to unseat gold. At their current stage of development, they have not achieved that goal. Time will tell if they can ever gain that status.