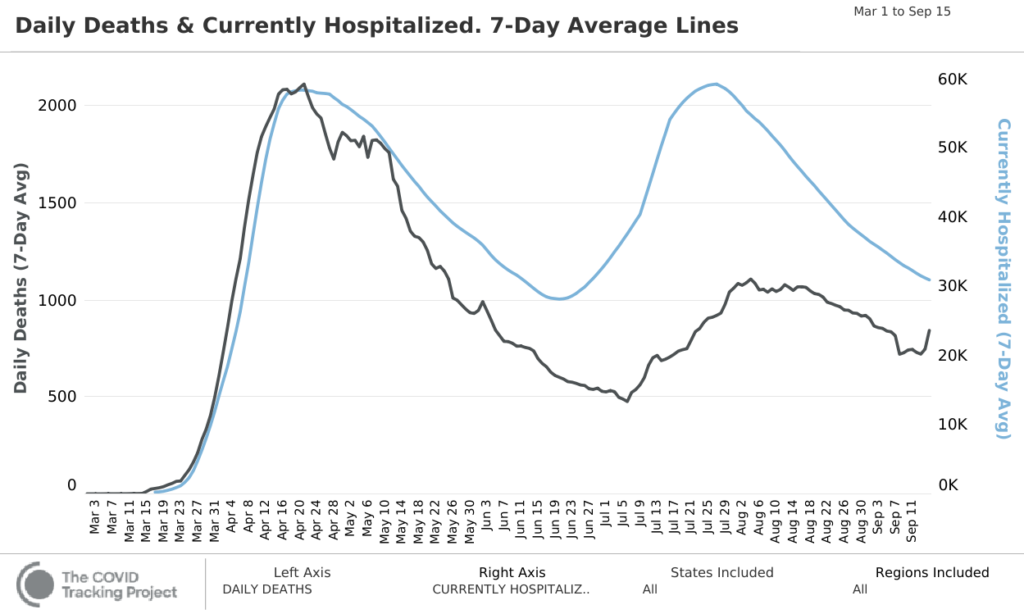

COVID in the U.S. remains under control, and tracking down, despite an uptick in fatalities perhaps related to delayed reporting from the recent holiday weekend:

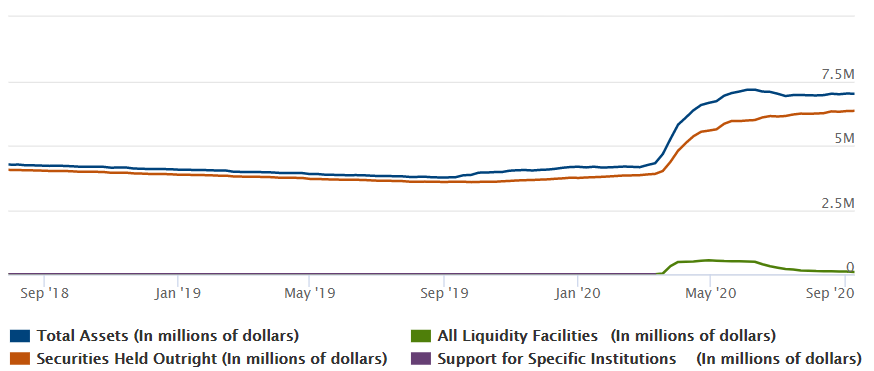

The buoyant recovery of U.S. stock markets after March’s lockdown lows has been driven by abundant liquidity from the financial authorities, and robust spending support from the fiscal authorities. Starting in June, the Fed’s balance sheet began contracting slightly as true emergency liquidity measures began to roll off — such as swap lines extended to foreign central banks. You can see this in the chart below by comparing the orange and green lines:

Asset purchases are continuing, however, and the Fed’s recently revised policy framework has reassured market participants that the low interest rate environment will persist for the foreseeable future.

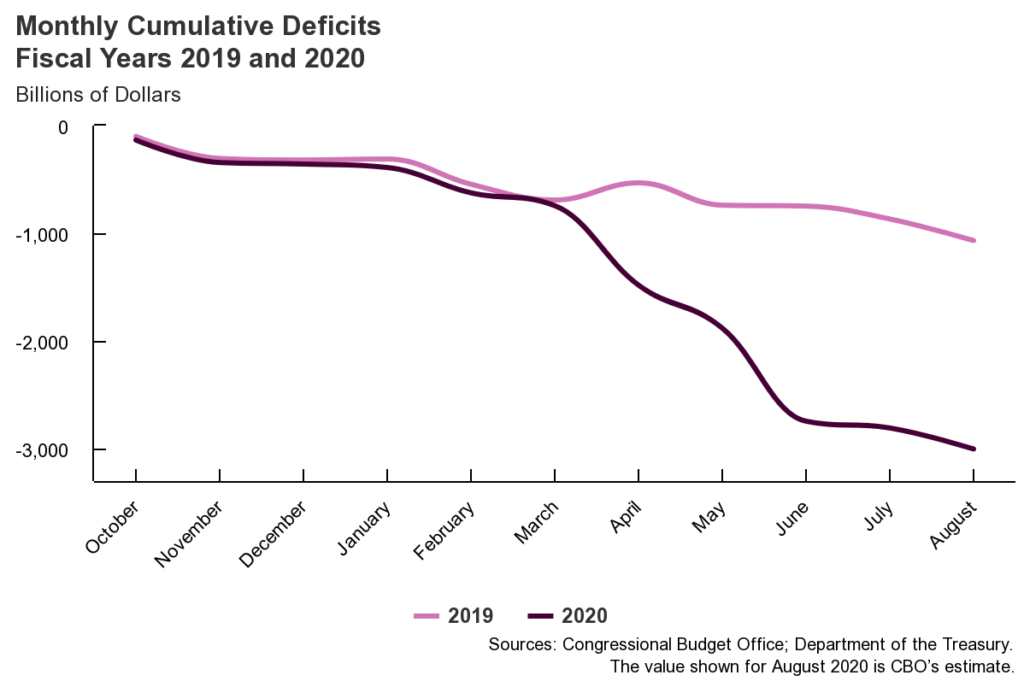

In addition, of course, governments have radically increased their fiscal stimuli to their economies. By August, the U.S. Federal government had clocked a $3 trillion deficit for the year, about 15% of GDP and counting.

Note that this total does not include the spending that will eventually materialize from a further stimulus bill — even if political discord means that it has to wait until after the November elections to materialize.

Mergers and IPOs

All these stimuli coming together have created record-breaking free liquidity in the system — money that is looking for a home where it can generate a return in accordance with the risk tolerance of its holders.

The pandemic lockdowns and recession put the kibosh on both mergers and acquisitions, and on new public offerings, during the first half of the year, when such activity tracked down significantly from 2019 (IPOs were down 67% in April and May from the year-earlier period). Uncertainty was too high. But the unleashed support for asset valuations has helped to turn the tide, and the rest of 2020 is looking very different from the first half.

New companies coming public into the post-lockdown markets have generally performed extremely well. On average, the one-week return for a new offering this year has been 25.4%, compared to 15.2% in 2019 and 11.8% in 2018. These new offerings have been driven especially by technology and biotechnology companies. Health care companies account for about 16% of new issuance and tech about 15%.

Is it shades of 1999, when bubbly tech markets allowed now-infamous companies to come public at high valuations with no business plan, revenue, or path to profitability? Valuations may be historically elevated, but the landscape is very different than it was during the dot com bubble. Companies such as Snowflake [NYSE: SNOW], JFrog [NASDAQ: FROG], Asana, Palantir, and AirBnB — which have either gone public or recently filed to go public — are very real businesses, addressing critical areas in the digital economy, and unlocking real value for their customers. These trends all pre-existed the pandemic and the lockdowns, and have simply been accelerated by the extraordinary events of 2020. American companies are not the only ones. While European offerings have been slow, the simultaneous Shanghai and Hong Kong offering of Ant Financial, the fintech arm of Chinese tech and e-commerce giant Alibaba [NYSE: BABA], may clock in at $200 billion, the largest IPO in history.

Another aspect of 2020’s new offerings has garnered attention: more than 40% of 2020 IPOs by volume have been SPACs, “special purpose acquisition companies.” This method of bringing a company public involves an IPO to raise money for a company whose sole business will be to use those funds to make an acquisition — with the future target either wholly unknown or merely rumored. That makes it easier for the target company to go public without the costly and intrusive rigmarole that accompanies traditional IPOs.

These so-called “blank check” companies have raised over $30 billion so far this year, up from about $12 billion in 2019. One industry veteran commented, “We’re in silly season in SPAC land.” There are currently 120 SPACs with $40 billion to spend on acquisitions. While the trend may be part of the market’s over-exuberance, that doesn’t mean that it can’t continue.

Mergers and acquisitions are seeing similar dynamism after a lockdown-induced coma. The second half of 2020 has started with the strongest corporate deal-making in history. Deals announced so far for the second half of 2020 have reached $256 billion. Some of these deals are new; some had been shelved during the pandemic crisis. At $69.3 billion, tech sector deals were 27% of announced M&A globally during August; healthcare followed with $38.5 billion. Headliners for each group include Nvidia’s [NASDAQ: NVDA] $40 billion acquisition of chipmaker Arm from Japanese conglomerate SoftBank [OTC: SFTBY], and Gilead’s [NYSE: GILD] $21 billion acquisition of Immunomedics [NASDAQ: IMMU].

Even so, for the year as a whole, M&A activity is down 31%. But the acceleration seen in the second half may continue: buyout groups are sitting on a hoard of $1.5 trillion in unspent capital, and industry commentators are expecting activity to accelerate into the fall. Typically, periods immediately after recessions see an acceleration in deals, with the catch-up helped along by cheap capital, just as we are seeing now.

Investment implications: Abundant free liquidity, a buoyant stock market, and the prospect of a more-rapid-than-expected global economic recovery are helping propel both initial public offerings and mergers and acquisitions. During the pandemic crisis, deal volumes collapsed, but even after the sharp acceleration so far in the year’s second half, huge capital remains on the sidelines, seeking an opportunity to profit from the technological and economic trends which the crisis helped to sharply accelerate. It is unlikely that this will prove to be a flash in the pan; it is likely to continue strong into the fall.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.