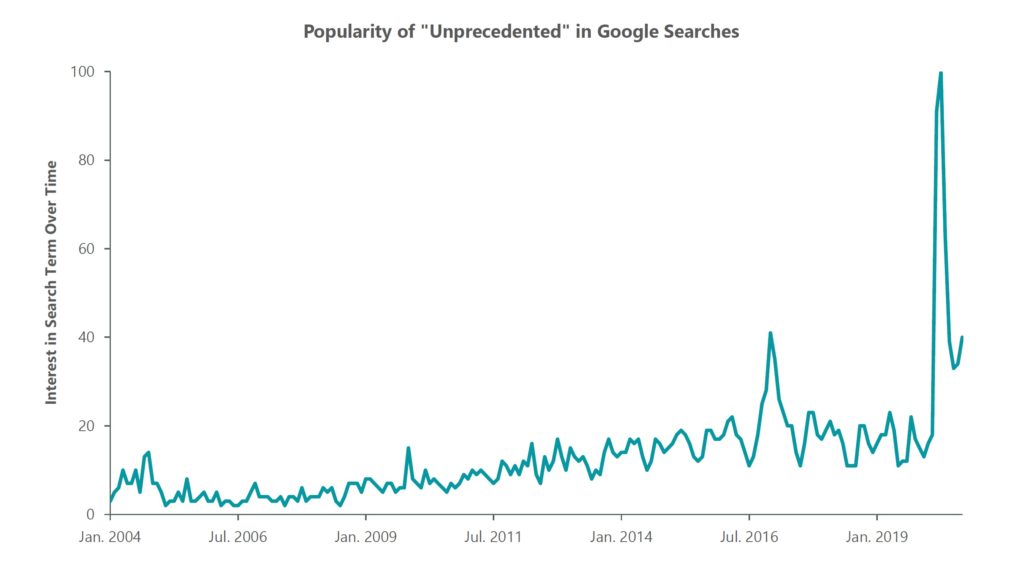

2020 has been the year of the “unprecedented.” Even the word “unprecedented” is receiving unprecedented use in Google searches.

The coronacrisis resulted in a recession so short, and so deep, that even though all its consequences have yet to play out, it seems likely to be very different from any recession in living memory. Analysts at Applied Global Macro Research are applying a model of “80% general strike, 20% recession.” (A “general strike” refers to a seldom-seen broad-based labor action which suddenly brings an entire economy to a halt. Examples have not been seen since the turmoil of the years between the two World Wars.) They note:

“The ‘general strike’ model implies an unprecedented decline AND recovery in terms of both magnitude and speed, dominating economic data through August/September with a fast ‘mechanical’ recovery, followed by a more endogenous recovery… Expect manufacturing PMIs peaking at about 60 in Fall. U.S. fiscal support is big, fast and well targeted whereas fiscal support in Europe is smaller, slower and more indirect. The stalling of another package in the U.S. is not going to pull the rug out from under the recovery. The economy will face headwinds from the pandemic but also economic tailwinds after mechanical reopening… Significantly above-trend growth in 2021 across all demand components… Global equity and credit markets should continue to perform as the global manufacturing cycle remains strong…”

Unlike a recession instigated by a financial crisis, for example, the sudden stoppage and restart that have characterized the coronacession haven’t so far created deep financial wounds that would need a long time to heal. To a large degree, the sharp nature of the shock, and the “unprecedented” flood of fiscal and monetary stimulus that were unleashed, have together made a faster recovery feasible and likely.

Indeed, there are two emerging trends in particular that we think point out how the coronacrisis will see a faster economic recovery, and will produce positive economic benefits in the medium term. Both of them are manifestations of “creative destruction” at work.

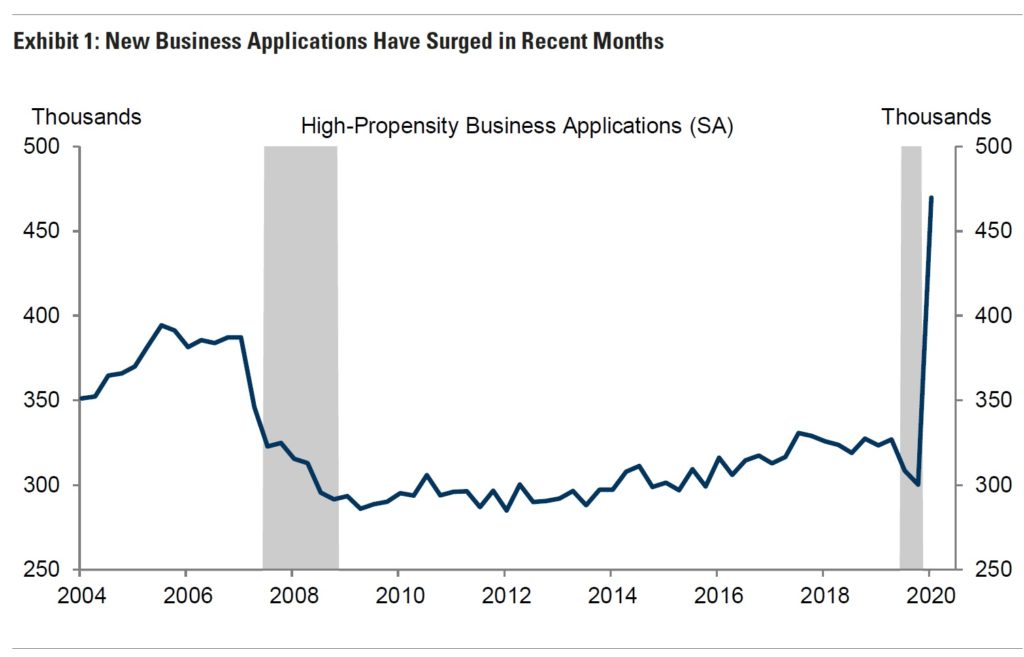

New Business Formation Sees Powerful Impetus

The first is a strong acceleration in new business formation. The Department of Commerce produces a data series of applications from new businesses that for a variety of fundamental reasons are deemed as having a “high propensity” to succeed. Here’s the chart:

Granted that many of these new businesses will be sole proprietorships — not initially employing anyone but the founder. Still, as we have told you probably ad nauseam, small businesses are the biggest engines of any economy’s employment and productivity growth. There will be economic dividends paid in coming years from this bolus of new businesses. Investors should not forget that many of today’s indispensable, transformative disruptor firms rose from the ashes of the Great Recession, including AirBnB, Groupon, WhatsApp, Uber, Slack, Venmo, and Square.

Many small businesses have perished, but the opportunity, coupled with strong fiscal support, are enabling millions of eager entrepreneurs to step in to begin planting in the cleared field.

The Wall Street Journal recently covered the same phenomenon. As one newly minted recession entrepreneur commented, “I may as well just do something crazy and follow my dream… And if it doesn’t work now, when will it?” This is a manifestation of the power of creative destruction. It is one big reason why the labor market is likely to recover much faster than in recent recessions.

Productivity Boost

The second force at work that makes us bullish on a much faster, much stronger recovery is the boost to productivity growth that typically follows recessions — and that may be even more powerful than usual in the wake of this recession, thanks to the pre-existing technological tailwinds.

How do recessions boost productivity?

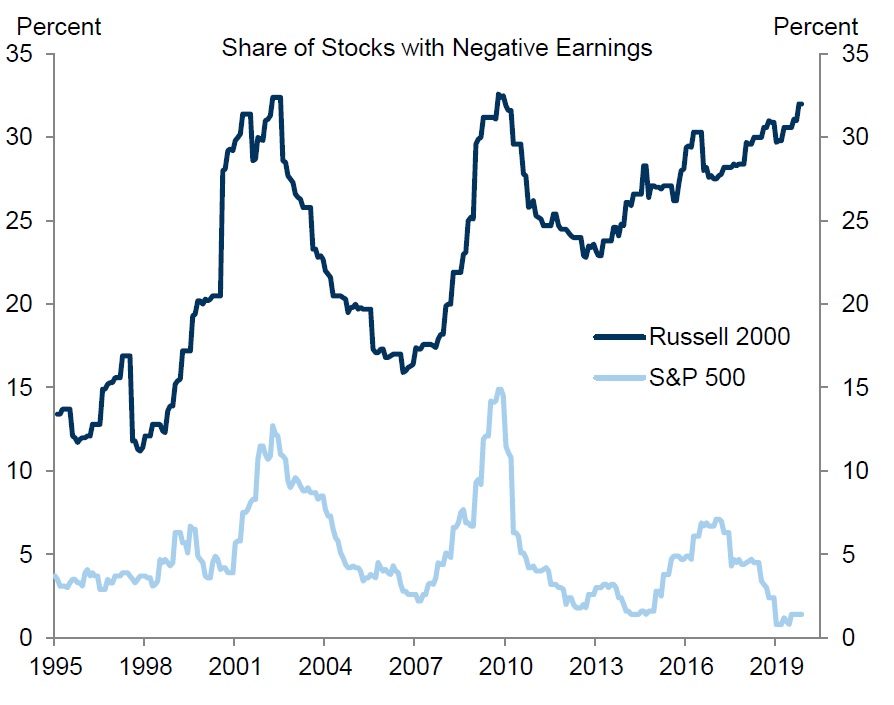

First, they clear out dead wood. For a variety of reasons, there has been a secular uptrend in the proportion of “zombie,” low-growth, low-margin, low-productivity, profitless businesses — with the proportion of them in the U.S. business population nearly doubling over the past ten years.

While fiscal support will protect some of these businesses, there will still be a purge as many economically marginal enterprises succumb to the intense pressure of the economic contraction. These zombie incumbents will be replaced by a healthier population of newer, leaner, more productive and more profitable competitors. That will increase the economy’s overall productivity growth… which is a key driver of overall GDP growth.

A second coronacession boost to productivity growth will come from sectoral changes to the U.S. economy. The employment share of less-productive sectors, such as restaurants, hotels, and recreation, will decline. Some of this will reverse as normalization occurs, but some will not.

And third, productivity is likely to improve as companies are prompted by economic duress to undertake restructuring and cost-saving measures that they didn’t bother to implement during the long expansion. That expansion, in fact, has been long enough that economists expect a lot of “fat” to be present that firms will be able to cut in order to save costs. To some extent these efforts will work against the recovery of the employment market — but not, we believe, in a significant way. Notably, many of these restructuring efforts will be technology-focused, taking advantage of the pre-existing technological trends that the coronacrisis has kicked into high gear — mostly revolving around digital communications, e-commerce, business digitization, telepresencing, etc.

Investment implications: The economic effect of the coronacrisis will likely be quite different from that of any other recession in living memory. Investors who expect a more typical post-recession economic trajectory will probably be surprised by the vigor of the recovery that unfolds in coming months. With all the “unprecedented” events occurring, investors should not be pushed into undue pessimism, and should continue to focus on the broad theme of economic recovery, and within it the continued momentum of tech and healthcare themes.