Source: Bloomberg

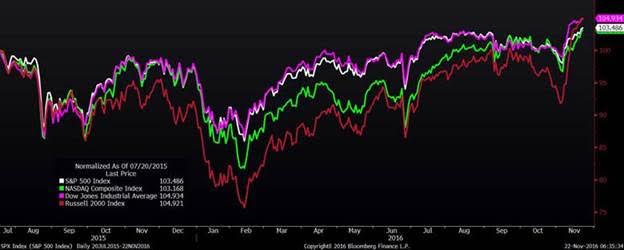

The post-election rally has now taken all four major U.S. indices — the Dow Jones, the NASDAQ Composite, the S&P 500, and the Russell 2000 — to new highs.

The strongest rally has been in the Russell 2000, which consists of the smallest 2,000 stocks in the Russell 3000 index (which itself is a capitalization-weighted index of the 3,000 largest publicly traded companies in the U.S.). The median market capitalization of a company in the Russell 2000 is $1.7 billion, compared to slightly over $18 billion for the S&P 500.

The reason that the rally has been strongest in smaller-capitalization companies is obvious: they are less susceptible to the negative effects of the stronger U.S. dollar, which makes exports more expensive for foreign buyers.

Mr. Trump brings an eclectic and unconventional mix of policy proposals — which some would identify as simply pragmatic. While orthodox Republican doctrine has focused on deregulation and fiscal restraint, Mr. Trump thus far seems set on combining deregulation with fiscal stimulus — both in the form of tax cuts and in the form of ramped-up infrastructure and military spending, while avoiding deep foreign military entanglements.

Taken together, markets — which act as discounting mechanisms — are anticipating that a growth inflection may occur. That is, that the era of sluggish growth in the post-crisis world, an era during which central banks used monetary policy to try to make up for the unwillingness of legislators to loosen purse strings and stimulate economic growth, is coming to an end in the United States.

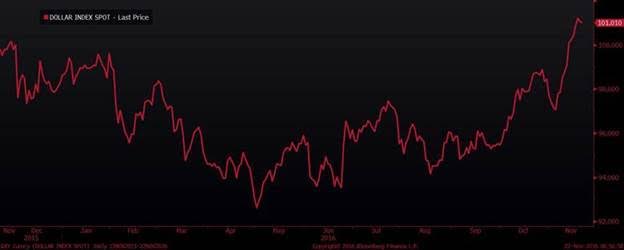

In turn, that view of a coming reversion of growth towards historical norms and away from the anemic pace of the last ten years, has markets anticipating rising interest rates — and that is drawing money from around the world, where interest rates are negative in many places, into U.S. dollars. The U.S. dollar has thus put on a very strong rally after the election, and has risen more than 9% from its recent lows in May.

U.S. Dollar Index Rallies Strongly Post-Election

Source: Bloomberg

After such a strong run, we would anticipate a near-term correction in the price of the U.S. dollar, but after such a correction, the trend could resume.

The rise in the U.S. dollar and the market anticipation of a U.S. growth inflection suggests several things to us:

- First, the market will be anticipating inflation, which we believe will begin to manifest more strongly next year. In such an environment, growth stocks should outperform value stocks.

- Second, the market should continue to prefer smaller-capitalization to larger-capitalization stocks — because smaller-cap companies are more domestic focused and less exposed to the problems that a strong dollar can pose to profits made overseas. Many small-caps are highly priced, especially after the recent rally, and investors will need to wait for pullbacks and search for value.

- Third, the continued rally of the U.S. dollar will draw money out of foreign stocks whose currencies are falling — whether or not those markets are experiencing low or negative interest rates — and into the U.S. Those markets will on balance be less attractive to U.S. and foreign investors.

- And fourth, many companies will be searching for growth through opportunities for mergers and acquisitions — particularly large companies with overseas cash that could be repatriated when the new administration succeeds in implementing tax reforms.

Investment implications: As the post-election rally continues, carrying the major U.S. indices to new highs, and propelling a very strong rally in the U.S. dollar, we see markets acting as they should: as discounting mechanisms, in this case for an inflection in U.S. growth. The prospect of a unified U.S. government pursuing a pro-growth agenda through deregulation, tax reform, and fiscal stimulus seems to be driving current trends. Such an environment should be relatively favorable to growth stocks and to smaller-capitalization stocks with less exposure to the negative effects of a strong U.S. dollar. It should also continue to draw funds to the U.S., where interest rates are likely to be rising and where the currency is not weakening.