With further analysis of trial data, Pfizer [NYSE: PFE] has joined Moderna [NASDAQ: MRNA] in the 95% stratosphere of first-blush Covid vaccine efficacy. MRNA’s prospective vaccine, on the face of it, will be easier to roll out, since its storage requirements are not as onerous as those of PFE’s entry, and it can ship and be stored under normal refrigeration and freezer conditions. PFE’s vaccine requires extremely low temperatures that will be challenging for existing distribution systems, but it may be slightly ahead in securing an emergency use authorization that would permit certain populations to begin receiving it immediately.

Many questions remain about these vaccines, which both employ a novel and unproven technology, messenger RNA. Although there have been few adverse events during the trials, only a few months of safety data have been generated. Typically, vaccines take many years to evaluate and approve. The public, especially in the United States, has become ever more polarized, and pandemic-related issues are now flashpoints for that polarization. The policy and media responses to the pandemic have not pacified, but rather have exacerbated this problem. Even if the commanding heights of media and politically approved science convey a unanimous message that the vaccines are safe, much of the public will be leery of accepting them, and may be wooed to embrace them only with the passage of time. So there may well be many bumps on the road to the vaccine rollout that markets have not yet consistently priced in.

With all that said, the vaccine news does tell us something important about 2021, and markets are correct to take it into account. That is that there is an “other side” to the pandemic — even with the currently ominous tone of media reporting about case numbers and the arrival of more lockdowns and restrictions across many developed markets.

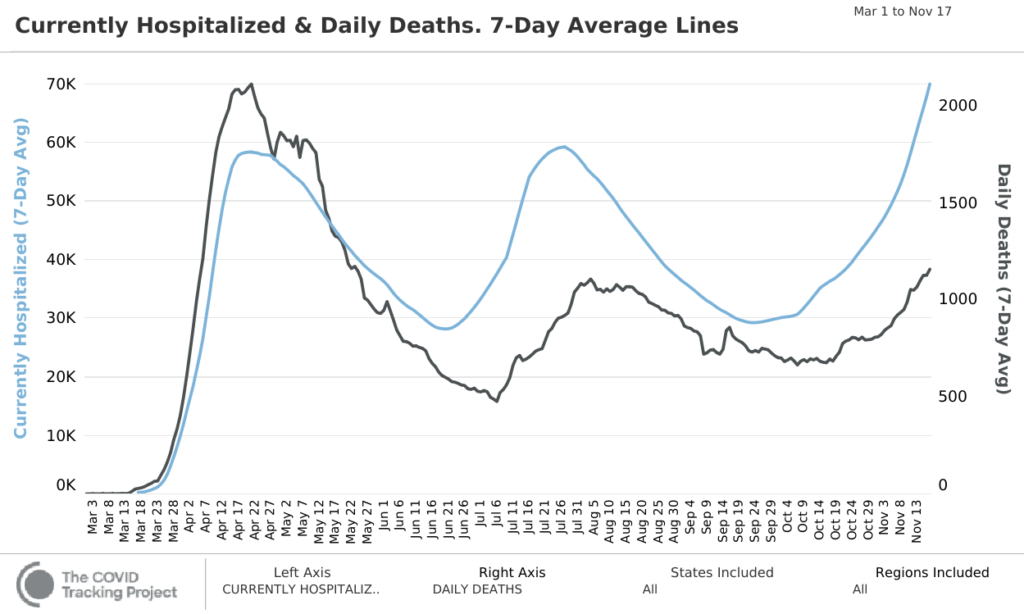

The fact remains that, even with case numbers spiking, and hospitalizations increasing, the lethality of covid has been manifestly stabilized by the development of best practices and the arrival of more and more effective non-vaccine therapeutics, as well as interventions to protect the most vulnerable populations (though sadly, these are still not as robust as they should be).

Vaccine optimism is part and parcel of the growing confidence that the public health response will gradually remove the pandemic’s economic overhang through the course of 2021.

What is most significant is the context surrounding the recovery from the pandemic — accelerating growth and abundant free liquidity in the global financial system, and the absence of painful “scarring” from some internal financial collapse.

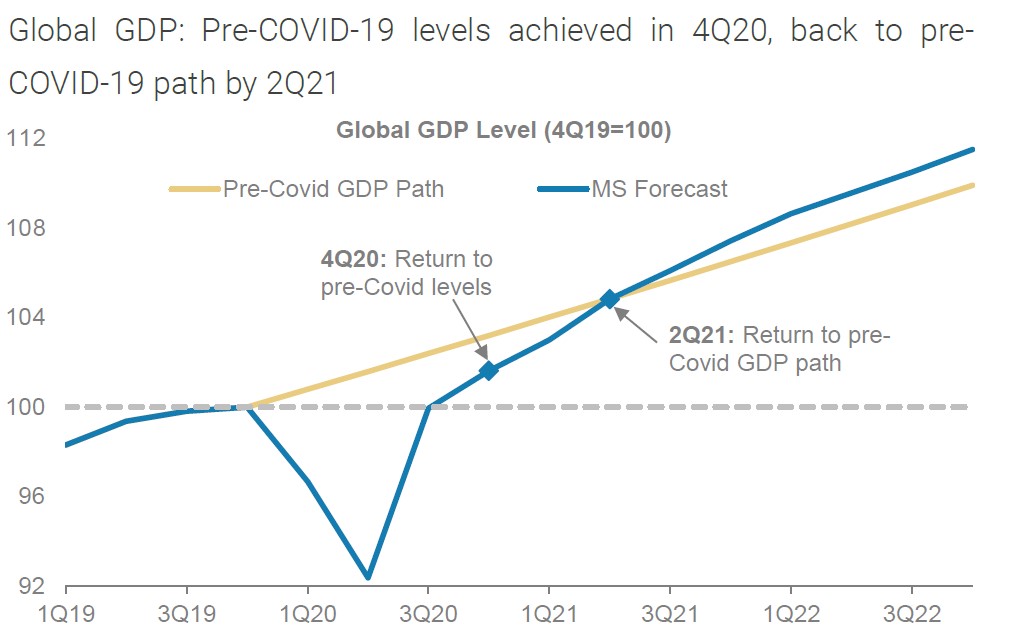

The removal of the pandemic overhang, both psychological and economic, will, we believe, free the twin forces of growth and liquidity with robust effects on many global stock markets. It is important to remember that the pandemic recession was exogenous — caused by a shock external to the global economy, rather than driven by internal financial or economic dislocations. The scope, size, and speed of the policy response have essentially allowed that unprecedented shock to rebound into an unprecedented recovery, without the need for a prolonged “healing” process to cope with some underlying systemic issue.

The private sector as a whole came into the crisis in good financial health, and one major sign of long-term health — the willingness of big corporates to make capital expenditures — is much stronger than initially feared. A strong new capex cycle may be in the offing a few quarters into 2021. Further, the consumer is not beset by the same deleveraging pressures than accompanied the Great Recession.

The global economy has already recovered to pre-covid GDP levels, though it is not yet where it would have been if the pandemic had not occurred. Some analysis suggests that it will reach and then exceed its pre-covid trajectory by the second quarter of next year:

Indeed, China has probably already returned to its pre-pandemic trajectory. The U.S. may reach it by the last quarter of 2021. Through 2021, then, much of the “heavy lifting” in the return of global economic growth will be occurring in global emerging markets other than China — particularly India and northern Asian economies such as South Korea.

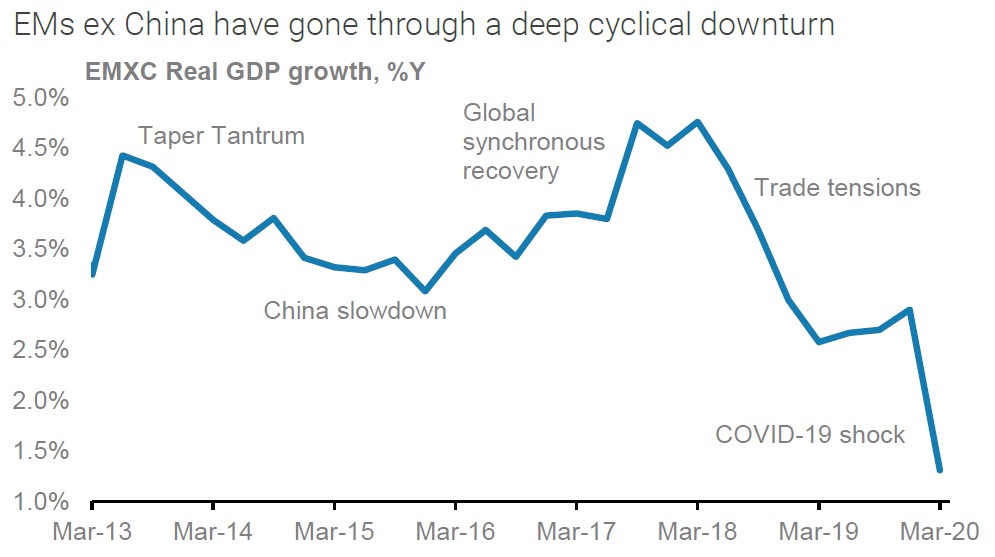

Emerging markets have faced cyclical challenges for years. Just as that seemed to be turning in 2017, trade tensions hit with full force in the latter half of 2018 only to be followed by the pandemic early this year.

The global pandemic response may finally push manufacturing emerging markets out of their doldrums. The export-oriented emerging economies have rebounded the fastest; those with larger domestic demand have been somewhat slower, but are joining their peers.

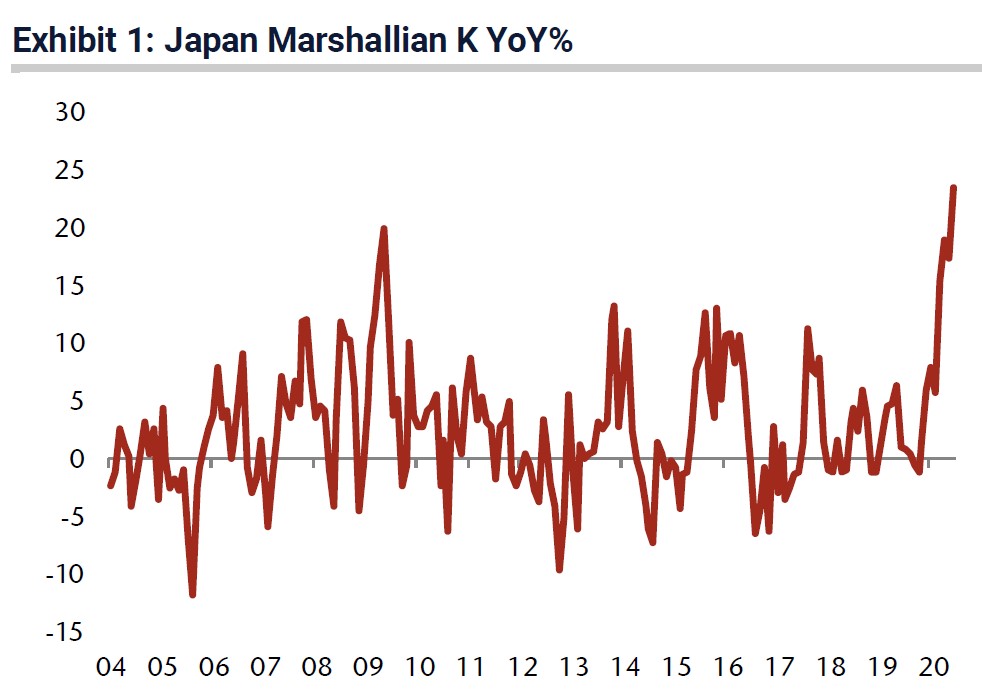

Among developed markets, Japan, in our view, warrants particular attention. After decades of deflation, and extreme monetary efforts to escape its deflationary trap, liquidity relative to GDP (known by the arcane term “Marshallian K”) is now increasing in Japan at the fastest pace since the 1990s:

It is not surprising under these circumstances to see Japanese stocks reaching multi-decade highs and Japanese corporate earnings revisions rising as global demand recovers to its pre-pandemic trajectory. We are more enthusiastic about Japanese stocks than we have been for years.

Investment implications: We remain bullish on the U.S., but we believe that a number of global stock markets have become more attractive in the wake of the fiscal and monetary support unleashed to combat the pandemic. In our view the best candidates for the attention of U.S. investors are manufacturing and consumer focused economies experiencing rapid technological development, for example, India and South Korea. Among developed markets Japan warrants attention if the results of the ongoing coordinated global recovery from the pandemic succeed in boosting the country out of its decades-long deflation. With certain policy risks appearing on the horizon in the U.S., such as the reversal of recent corporate tax reforms, we believe that investors should give attention to opportunities outside the U.S.