As we write, major U.S. indices are just off recent all-time highs; for some, such as the Russell 2000 index of small-capitalization companies, November was the best month in history. Some evidence suggests that the outperformance of certain pandemic-crushed sectors and industries was not really a rotation from growth to value; the overriding characteristic of outperforming stocks was not value, but short interest. Perhaps what we saw was more a massive short squeeze than anything else, as part of the lopsided pandemic trade unwound. Further, flow data suggest that November’s price action was driven not so much by investors reducing their holdings of tech stocks, as by investors reducing their cash holdings.

Central Bank Liquidity, Fiscal Stimulus

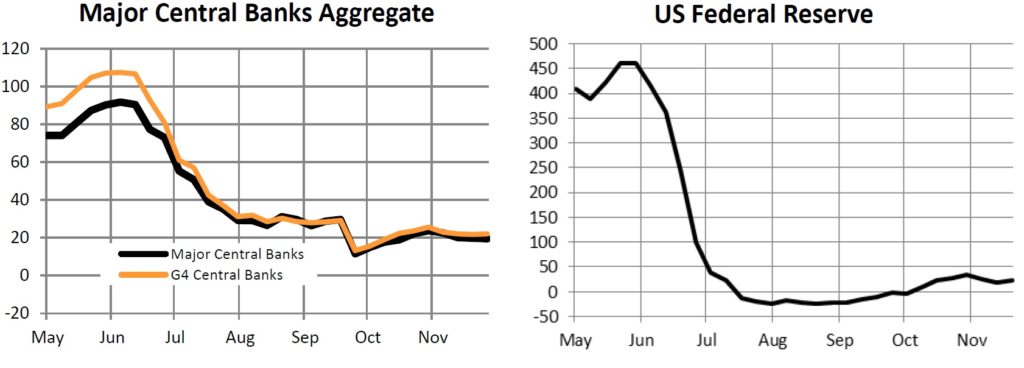

While total global central bank liquidity is still increasing, the pace at which this is occurring has gradually moderated, with the annualized growth of the global monetary base edging down to 19.4% over the last three months. The U.S. Federal Reserve is the primary heavy lifter in global liquidity expansion, with the Bank of Japan trending down, and the European Central Bank and the Bank of England flat.

Source: CrossBorderCapital

Some potentially productive bipartisan conversations have been happening in the U.S. Congress ahead of the January 20 inauguration, with a new pandemic relief stimulus bill of just over $900 billion under discussion. Globally, some $6 trillion in stimulus measures remain in the pipeline.

In short, while “policy panic” may not be anywhere near the heights of the pandemic fear in the first quarter of 2020, both monetary and fiscal support remain robust. This is the larger context within which investors should consider the outlook for the coming year: a gradual resolution to the pandemic from a public health perspective, deepening and accelerating economic recovery, very loose monetary policy (especially from the Fed), and strong fiscal expansion from governments worldwide.

The U.S.

The political situation in the U.S. is becoming clearer: a divided government, within which the far-left wing of the party that has captured the White House is being partially placated and partially sidelined. This scenario is a good one for stocks, since it will hinder precipitous changes to the last four years of decreasing taxes and trade renegotiations. Already the Biden administration has indicated near-term continuity with the Trump administration’s China policy — which we expected based on the broad grassroots support in much of middle America for a tougher approach to China’s trade malfeasance, foreign policy ambition, and poor domestic civil rights record (especially in Xinjiang and Hong Kong).

The U.S. Dollar

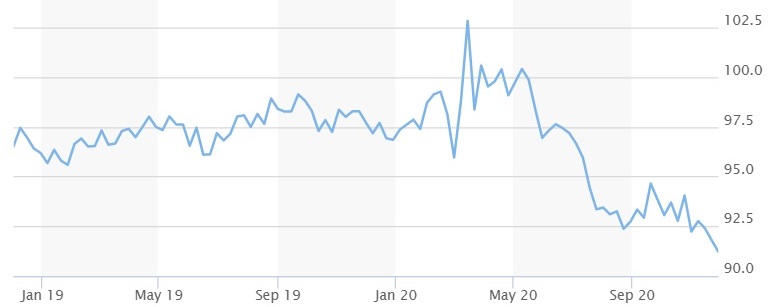

The U.S. dollar, meanwhile, continued its decline, nearing the lowest levels of the past two years against a basket of other currencies:

Many analysts believe the dollar will continue to fall in the coming year, with the basket seeing further declines of 5–10% or more as global investors move out of dollar holdings into assets denominated in other currencies. Although near-term price movements reflect many conflicting influences, the trend of a weakening dollar will be beneficial for gold in the long term, as well as for cryptocurrencies. (In the latter case, the cross-currents can be especially confounding, so we encourage would-be crypto speculators to be well-educated and take high-conviction positions. We believe that accumulating bitcoin on declines is an intelligent speculation, as institutional capital and mainstream financial tech infrastructure increasingly warm to digital assets.) In a world of determined central bank debasement, non-fiat alternatives, as always, make sense as a portfolio allocation. Of course, holding cash, whether as fiat currencies, gold, or cryptocurrencies, is not the great wealth-generator of a portfolio; that place falls to stocks.

Equity Themes: U.S.

Many of our favorite themes for equity investing remain technological: business process digitization, cloud computing, artificial intelligence, big data and the internet of things, cybersecurity, electronic payments, financial technology and services, electronic entertainment, and telepresencing. The familiar suspects here include Facebook [FB], Apple [AAPL], Amazon [AMZN], Alphabet [GOOG], and Microsoft [MSFT], as well as others which experienced strong growth in 2020. We do not believe that growth is over. We also like industries that support physical technology infrastructure buildout, including 5G and AI processing.

We also like many industries within the healthcare sector, including specialty pharma, biotechnology, medical technology, and companies rationalizing point-of-care healthcare delivery, such as CVS. Many of these companies will find ways to prosper in the immediate political environment, and we do not see reason to believe that this environment will be catastrophic for them in the near future. Demographic tailwinds will continue to benefit these industries.

We commented recently on this year’s flood of SPAC offerings — so-called “special purpose acquisition companies” or “blank check” companies which come public simply to raise cash, and then find a merger target. One that caught our attention recently was Longview Acquisition Company [LGVW], which has announced its intention to merge with Butterfly Network, a medical diagnostics company which is producing a new medical imaging tool with many potential applications. We are attentive to opportunities to invest in new and promising technologies in the healthcare sector and invest in them when appropriate.

Other themes that interest us in 2021 include some recovering sectors and industries that will experience powerful bounce-backs as the “pandemic pause” potentially yields to a new cyclical upswing. Here we are thinking of physical infrastructure, climate-change and carbon mitigation, transportation, and travel, leisure, and (non-electronic) entertainment in particular. We like green themes, including batteries and new battery technologies, decarbonization, EVs, advanced biopolymers and biodegradable plastics, and new recycling technologies. At the nexus of tech and electrification sit rare earths, which will be significant especially as conflict with China continues, and could offer opportunities as non-Chinese sources come back online.

Some pandemic-recovery themes will be overshadowed by the acceleration given to tech-related themes by the pandemic. Some of these tech themes will moderate, but they have likely inflected to a more rapid trajectory of adoption as a result of the events of the past nine months.

The second-order effects of the inflection in business digitization may provide the most interesting themes for 2021. These will include quantum computing and enterprise artificial intelligence, as applied especially in logistics, manufacturing, materials production, and drug discovery.

2020 has provided a remarkable slate of new IPOs, and with the potential imminent offering of Airbnb, the year seems set to come to a strong close. Airbnb provides a particularly interesting case study in the resilience of tech business models, the ethos that informs the architects of tech’s transformative companies, and the working out of real-world consequences of the founders’ idealistic initial visions, as those visions encounter both regulators and incumbent competitors. The prospectus is worth studying even for investors who are not planning to take a position in the stock in the near term.

Equity Themes: Beyond the U.S.

Though we are bullish on many American companies, we also see excellent opportunities beyond the U.S. stock market in 2021 and possibly 2022.

Japan

Japan is a particular focus of interest, as it typically benefits from a global industrial inflection, and due to its preeminence in precision manufacturing, autos, major machinery, heavy equipment, and industrial and consumer electronics, and it will benefit especially from continued global trade realignments. Another positive is a gradual change in the thinking of company managements in Japan — they are becoming more open to change and to the implementation of new strategies and operational flexibility. The Japanese market may be emerging from a generational malaise.

South Korea

South Korea is also a focus, for similar reasons. Many South Korean companies are poised to benefit from the same forces that would benefit Japan; attractive sectors include heavy and light machinery, software, electronic equipment, and autos.

India

Another favorite investment destination outside the U.S. is India. The long, slow progress of India towards a more business-friendly domestic regime continues. If Indian governance continues to move in the right direction, India will benefit from the realignment of global supply chains. India has an educated and entrepreneurial population, and is experiencing a rapid inflection in e-commerce and financial technology, to which many domestic Indian financials are exposed due to requirements that fintech companies use the payment rails established by Indian private banks. While the Indian stock market remains difficult to access for U.S. investors, we advise you to keep a careful eye on U.S.-available exchange-traded products (ETFs) targeting specific sectors of the Indian economy, since more will be created by Indian financial entrepreneurs. Within Indian financials, we recommending avoiding government-run banks; financial services are our areas of focus.

Hong Kong

Finally, we will mention Hong Kong. Although Hong Kong’s political future is somewhat clouded by heavy handed governance from the mainland, international reaction to that governance may drive some significant Chinese companies to move their listings to Hong Kong from the U.S. and the U.K. That, combined with rapid mainland Chinese growth, may provide a shot in the arm for the Hong Kong market. One stock of interest might be Hong Kong Exchanges and Clearing [HK: 388].

Emerging Markets

Of emerging markets broadly, we favor manufacturers and exporters, rather than commodity producers. Within emerging markets we would look where possible for sector and industry themes similar to those we described above for the U.S. and other developed markets. Emerging markets are emerging from a decade of underperformance, which is another attractive factor.

Gold and Bitcoin

Our views on gold and bitcoin are mentioned above. In our view, bitcoin will remain the king of digital assets, and its lack of serviceability as a medium of exchange is beside the point; investors and speculators will use it primarily as a store of value and potential source of appreciation, much as they do gold. Much of the recent rise in bitcoin has been driven, it is believed, by Silicon Valley whales who are comfortable with the concept of a digital asset, and by financial institutions and hedge funds who are awakening to the potential for a big move in bitcoin over the long term. Other digital assets with better characteristics for exchange will come and go, and there will be room for many of them.

Gold’s utility under current macroeconomic conditions needs no further comment.

Thanks for listening; we welcome your calls and questions.

Please note that principals of Guild Investment Management, Inc. (“Guild”) and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. In addition, for investment advisory clients of Guild, please check with Guild prior to taking positions in any of the companies mentioned in this article, since Guild may not believe that particular stock is right for the client, either because Guild has already taken a position in that stock for the client or for other reasons.