The bullish consensus for 2021 has reached near unanimity, which is an invitation to anyone with a contrarian itch to scratch it. We agree with much of the bullish thesis. Historic excess liquidity, the control of the pandemic, fiscal support, reopening economies, and energized digitization all seem to be near-unarguable themes.

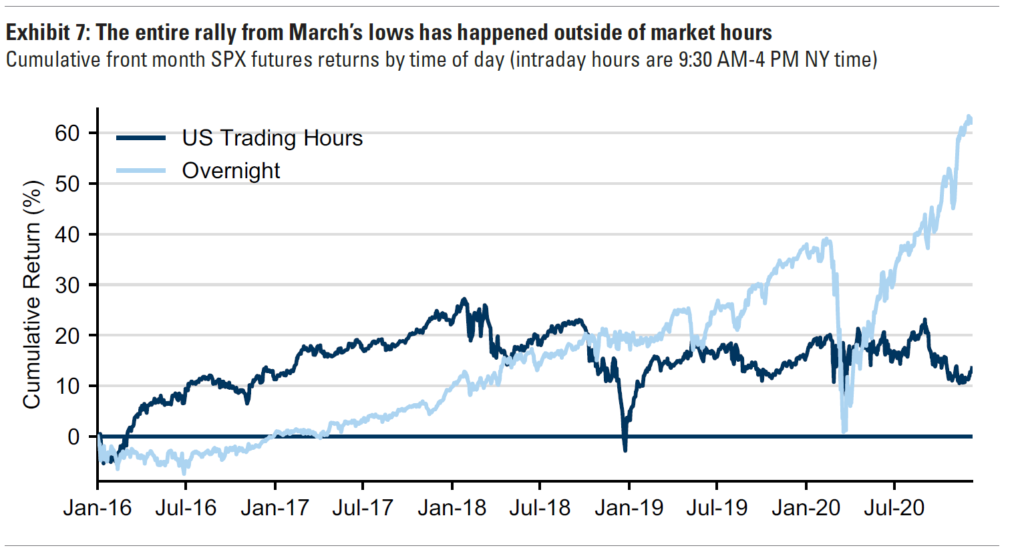

One fly that we note in the ointment is the significance of options trading in the market’s rise into year-end. Options volume in 2020 has been double its 20-year moving average, according to Bloomberg. Certainly this is related to the year’s unprecedented volatility and the maneuvering of hedge funds to blunt it. But the influence of speculators — including the numberless Robinhooders and the likes of Masayoshi Son’s Softbank tech options warriors — may be showing itself here. Goldman Sachs recently pointed out an interesting phenomenon: that most of the post-March gains have happened in after-hours futures trading.

This also suggests to us that the current tidal wave of bullishness is benefitting from and abetting some ferocious speculative activity under the surface. While this observation does not obviate the likelihood of a bullish landscape for equities in 2021, it does reinforce the sense one gains from the technicals that the current rally is reaching a point where a near-term correction would be warranted.

On such a dip, which could occur in concert with any number of political or pandemic disappointments, we would be buyers of the usual panoply of themes we have described in these pages for months — the cloud, the internet of things, software that enables and deepens business digitization, 5G, next-gen semis, telepresencing technologies and platforms, tech-focused healthcare, e-commerce, financial technology, electronic entertainment, cybersecurity, biotechnology, and specialty pharma. We’d include our favored international markets, which would likely also be caught in the downdraft (including Japan, South Korea, and India), as well as travel and in-person entertainment sometime in 2021.

Thanks for listening; we welcome your calls and questions.