Of the critical macro variables for investors to watch, inflation is one of the most important. Current inflation, as well as prospective changes in inflation levels and direction can result in very different outlooks for asset classes, sectors and industries, and entire economies.

In the post-2008 era, broad inflation has been AWOL. There has been inflation in a few spots — notably in financial assets. This has confused many investors and analysts who expected widespread inflation to emerge after the world’s most important central banks launched their programs of quantitative easing, mass purchases of government and other debt and occasionally even equities (the Bank of Japan has been buying Japanese stocks for years).

But inflation never arrived, confounding the experts. Many explanations have been offered for its absence. Some of these tell part of the story — for example demographics, or business digitization, automation, and artificial intelligence, and the rise of the massive technological giants such as Amazon [AMZN] who have been able to harvest technological gains to push costs down relentlessly. There is some truth here, but not the whole truth.

The disinflationary thesis is now close to being an iron-clad certitude. There is an old saying that market participants as a group tend to want to fight the last war — in this case, the war against deflation. Deflation is the specter that haunts the minds of many economists, central bankers, and Wall Street strategists.

We agree with the eminent strategist Russell Napier, who has reversed his longstanding deflationary call, and is now saying he believes inflation is coming — that this time is different. We think that the reasons offered for why this time is different, and the observable data, suggest that the thesis holds water.

If inflation and rising interest rates are coming, that will spell trouble for some of the income-generating assets that investors have been driven to in order to find yield, particularly firms in many industries that have used leverage to boost returns.

Here are the planks of the argument that we think are solid.

Other things being equal, inflation is created by more money chasing fewer goods, so the creation of money is of paramount importance. But contrary to the popular conception, most money is created by the lending activity of commercial banks. Central banks can influence this process with a variety of policy levers — short term interest rates, reserve ratios, and so on. Essentially, many of their efforts to spark lending activity by banks, and a consequent growth in the broad money supply, have failed over the last ten years.

Why? It was likely both a supply problem and a demand problem. Banks were scarred and cautious, and in addition, they had a slew of new regulatory requirements placed on them by Congress after the Great Financial Crisis. That was the supply side — reluctance to lend and stringent oversight. On the demand side, in the long, slow-growth recovery, companies were reluctant to borrow and expand — but those who did, borrowed outside the banking system, offering bonds and selling stocks, increasing debt and raising equity, but not the money supply. In spite of all the expansionary policies of central banks, they failed to generate inflation and failed to get GDP growth out of the doldrums in which it has languished since the 2008 crisis.

But the policy response to the 2020 pandemic was fundamentally different. Napier refers to the central banks’ outright asset purchases last year as “pyrotechnics” that obscured the very new, and more important, measures that were introduced by concerted cooperation between monetary and fiscal authorities: measures to backstop and guarantee loans made by commercial banks to businesses. That was the Paycheck Protection Program and the Main Street Lending program in the U.S., and the “Bounce Back Loans” in the U.K.

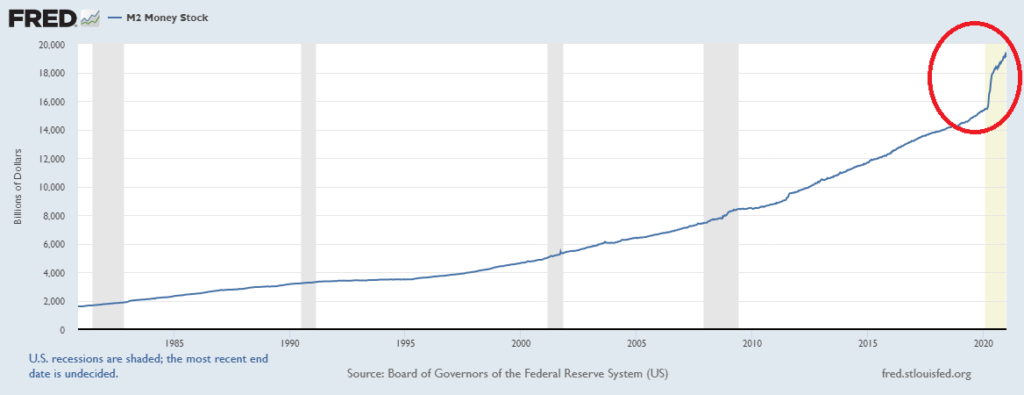

M2 — a broad measure of the money supply — expanded at an unprecedented rate in 2020.

In the U.K., banks expect 50% of the loans extended under the Bounce Back program to fail. These are precisely the kinds of loans that underwriters would not have made without a government guarantee. With that guarantee, banks will be content to collect their small interest rate, and avoid the risk of losses from loans that go bad. In essence, these programs are a way for governments to side-step the central banks and spark commercial bank lending directly.

Many suspect that the initial round of pandemic loans will not be the last — and given what we know about the small appetite governments have to reverse expansionary spending policies, we’d agree. We can look forward to reconstruction loans… environmental loans… and perhaps social justice loans, all conducted with the same explicit Treasury backstop.

The incoming administration will probably be enthusiastic about such measures, which they will be able to target at their preferred industries and social causes. Ultimately the effects of such picking and choosing of winners and losers will be deleterious to GDP growth, of course, as they always are. But investors should certainly not ignore the trend.

In the U.K., which has typically lacked U.S.-style 30-year mortgages, the government has stepped in with policies to backstop the introduction of such products. Once the monetary Rubicon has been crossed, many such programs become feasible — and they are inflationary. During the QE era, fiscal and monetary expansion were decoupled; they have now been connected.

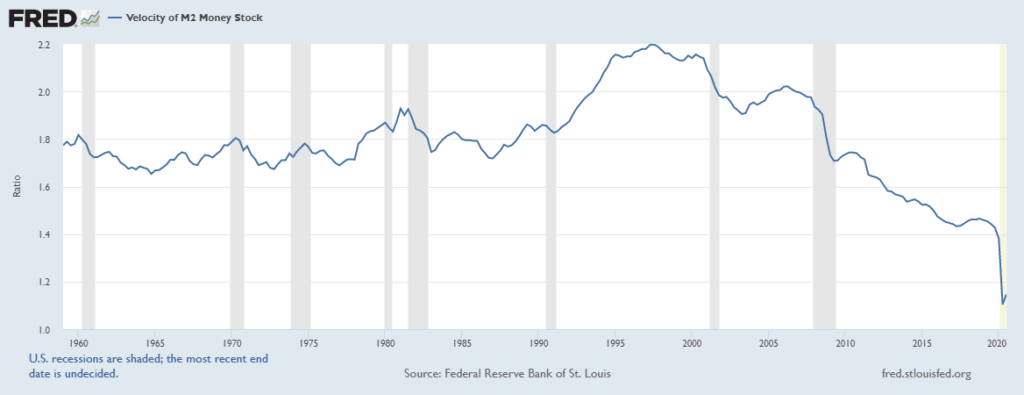

During this QE era, though, not only did M2 growth accelerate only slightly, the other major ingredient of inflation — the velocity of money, or how fast a dollar changes hands — dropped precipitously. This makes sense in an era during which large banks parked huge reserves at the Fed due to fear, a small return made available on Fed balances, and regulation. Recently velocity has begun to inflect, but off a very low base.

Inflation will begin to get underway in earnest when velocity ramps up, although there may be early signs showing:

Different “inflation heretics” who dissent from the ruling disinflation orthodoxy believe that widespread inflation will occur at different times; some believe it will begin in 2021, others think it will be a year or two. We tend towards the former view, although arguments can be made for both.

If the sea change we have identified does unfold, there will be significant long-term ramifications. For example, governments venturing into these “MMT-lite” waters will have to act to constrain longer-term interest rates, perhaps by mandating the levels of government bonds held by public pensions. By constraining long-term rates and enabling inflation, they will slowly transfer wealth from savers to debtors, from old to young, without resorting to nakedly confiscatory taxation. Even so, 10-year U.S. Treasury rates do not need to rise far from current levels to adversely affect a host of yield-focused investments, and income investors should be alert to this shift.

Investment implications: As we noted last week, the prospect of rising inflation is not one that should give investors fear. Inflation is a potential macro environment, one that brings particular assets into focus and suggests caution with regard to others. We continue to like emerging markets ETFs; we like India, and some developed Asian markets, particularly South Korea and Japan. Typically we prefer manufacturing exporters among emerging markets, but in a rising inflation environment, commodity exporters can also do well. We believe U.S. dollar weakness will continue, likely with some counter-trend rallies, and therefore we remain fundamentally bullish on gold and bitcoin, but we would buy dips and not chase peaks. We would not hedge most foreign currency exposure. We are cautious on highly indebted companies, and some REITs and BDCs who employ high leverage as part of their business models.