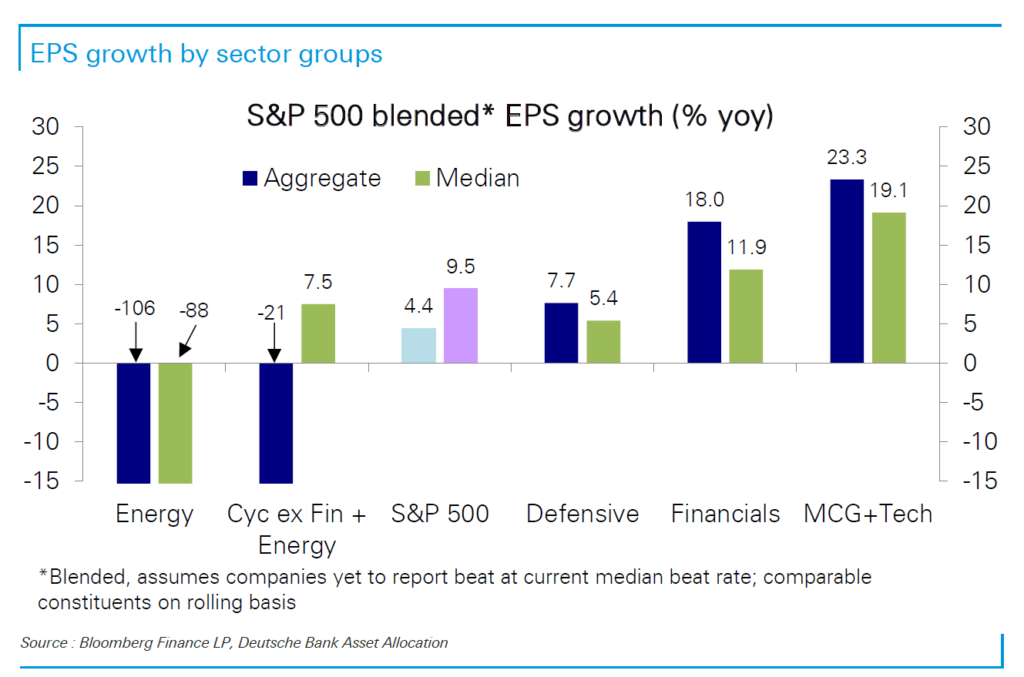

Earnings season is underway. Earnings growth has turned positive for the first time since the last quarter of 2019, before the pandemic:

Barring unforeseen developments on the vaccine front, which we can’t rule out but which seem unlikely, the 2021 playbook is going as expected so far: pandemic recovery, gradual easing of restrictions, and a significant bounceback in economic growth and in profit growth over the course of the year.

In spite of financials’ outperformance, we are not bullish on financials, especially in light of the unfolding big-picture scenario described above.

As we observed last week, markets are high, and a correction may already be underway. Given the massive liquidity present in the system, we don’t anticipate a crash. While we continue to like many of the tech-related themes we’ve favored since last year, and have mentioned every week for months, a healthy correction will afford investors a better entry point.

If the post-pandemic recovery unfolds as consensus expects, we will be interested in some cyclical stocks as well, including some materials and industrials. We continue to like emerging markets, including India particularly, and South Korea.

In the context of the possible emergence of an environment of financial repression, we like gold and bitcoin. Back in the heady days of bitcoin’s 2017 bull market, we commented on potential manipulation of the bitcoin market via fraudulent creation of the Tether stablecoin and unscrupulous activities by certain offshore bitcoin marketplaces. Rumors of ongoing problems related to Tether have emerged again. While the market has matured in the intervening years, this is still a potential concern for speculators — and is obviously one of the factors causing the SEC to be skpetical about the launch of crypto ETFs. Bitcoin speculators should monitor the situation.

Thanks for listening; we welcome your calls and questions.