In the blink of an eye last spring, half the American workforce found themselves doing their jobs remotely. In spite of the rollout of vaccines and the rollback of pandemic behavioral restrictions in many places, that shift is still largely intact. In the long term, perhaps a quarter of the U.S. labor force will be completely remote, with many more workers spending much of their time remote and visiting a central office occasionally. Whether this is going to be good or bad for productivity is anyone’s guess; and with “Zoom fatigue” entering the lexicon of remote workers, the workforce’s initial enthusiasm may wane. The think-tank cheerleaders of the brave new world believe that on net, the change will be a positive. It will vary by industry, but it will certainly be good for a lot of business’ bottom lines as legacy office-space expenses roll off. In 2020, 6% of potential startups wanted to begin their existence with an entirely remote workforce; in 2021, that figure is 42%. The pandemic has created what will likely be an enduring cultural and economic shift.

This shift will be extremely consequential for the demographic and economic geography of the U.S. The vice grip that the large coastal cities had on the middle and upper-middle class workforce has been broken. While workers were tethered to a geographic location, a few prime locations became focal points and much of the country languished. But it has transpired that people weren’t living there because they wanted to be there; they just had to be near their employer. On the merits of living expenses and quality of life, they would make different choices — and now they are doing so. Some of the old urban meccas will still draw businesses and workers for the glamor and public relations effect, but around the few hottest zip codes, there will be just a penumbra of faded glory.

Businesses and workers will go where living is cheaper, houses and offices are cheaper, and the quality of life is better, and smaller heartland cities will shift the policies they enact to compete for the new arrivals. Until now, policy was focused on amenities and breaks to attract mega-scale corporate relocation and investment — maybe the peak example was the competition to attract Amazon’s second headquarters, in which localities offered billions of dollars’ worth of incentives. But to attract the new mobile knowledge workers and their tax and spending dollars, localities will have to invest in entirely different things: broadband infrastructure, schools, public services, parks and green spaces, walkable neighborhoods and commercial districts, and cultural amenities.

The influx of remote workers will give a long-term boost to much of America beyond the former bicoastal “promised lands”; indeed, it will lead to booming real estate markets and vibrant economies, which we have already seen and heard about anecdotally. But they are getting a short term boost as well: stimulus.

For much of last year, terror reigned in statehouses around the country as the pandemic threatened to tank state and local finances. The allegedly parlous condition of state and local finances led to the allocation of $350 billion of the just-passed $1.9-trillion stimulus bill. Yet it turns out that states’ finances by and large weren’t in that much trouble. In 2020, state and local government revenue not only did not decline — it rose by almost 9%, according to some estimates. Federal stimulus to workers and businesses flowed through into state and local tax revenues of all kinds — sales, income, and property.

Under normal circumstances a sober assessment of state and local finances would probably have led to a more targeted round of stimulus in 2021, but these are not normal circumstances, so the bazooka came out. Consequently, there will be even more fuel added to the fire of the state and local economies that are booming thanks to the remote work revolution, as well as the greater presence of laissez faire policies in their governments, a more rapid rollback of pandemic restrictions, and more capital-friendly laws. Remember, capital will always go, if it is allowed, where it is treated best. For now, all these forces are converging on the formerly disparaged “flyoverland” areas of the west, Midwest, and particularly the south. Tennessee led in inbound moving traffic in 2020, and real estate investors with a nationwide remit will want to look closely at the south in particular.

Lastly, some observations about the fate of the stimulus in the hands of John Q. Public.

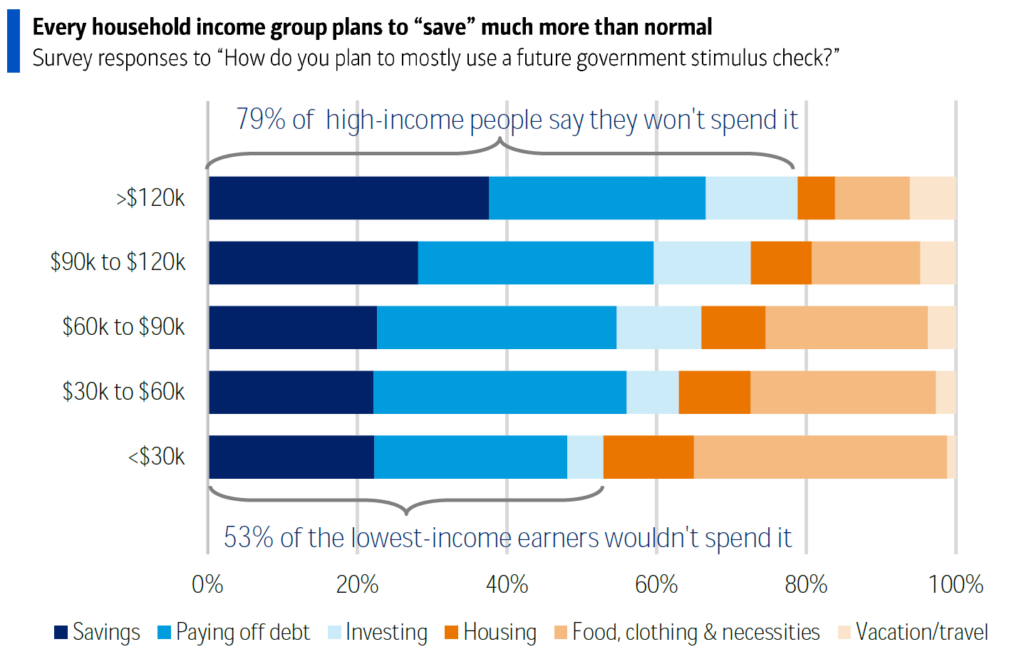

A poll conducted by Bank of America Global Research revealed that even in the bottom quintile of workers, 53% of them planned to use their “stimmy check” not on consumer goods, but to save, invest, or pay down debt. Usually, the figure for that quintile is 2%. And of course, for higher income quintiles, the predilection for saving and investment is even higher.

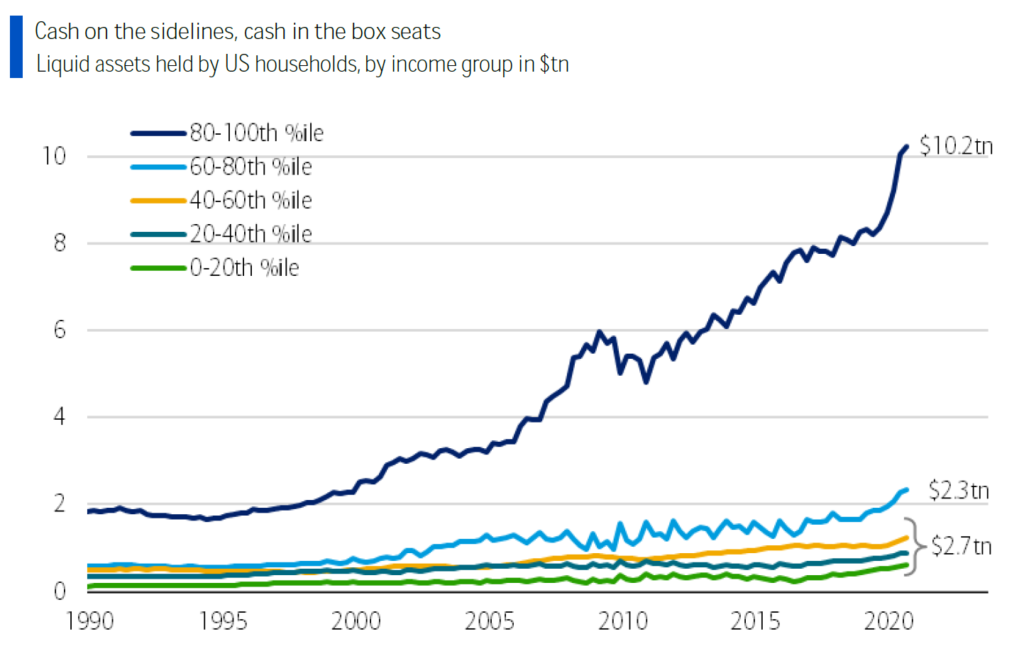

From the end 0f 2019 through September 2020, U.S. household liquid assets rose $2.2 trillion. So the $2.2 trillion question is, how will this liquidity be used as the economy reopens? We have some clue in the chart immediately above, which suggests a lot more savings, investment, and debt paydown than usual. But most of the rise in the value of households’ liquid assets during the pandemic period has been in the highest-income groups:

On balance, then, while some of the stimulus will doubtless flow through into immediate consumer spending, much more significant is the “wealth effect” that the pandemic has created for the income quintiles most likely to take any windfall and reinvest it where it will be treated best — and that, still, is simply the stock market.

Inflation is coming; inflation is already here. It will rise this year due to the base effect and due to pressures from the reopening global economy, and perhaps prolonged aftereffects of supply-chain disruption. The next few quarters’ real inflation numbers will unsettle some market participants. Real inflation will substantially exceed the massaged “core” inflation numbers presented by the government’s statistical authorities. How persistent consumer price inflation proves to be in coming years is a question, as some of the disinflationary forces existing well before the pandemic were sharply accelerated by it (including automation and a developed-world “baby bust”). This remains to be seen, but of one thing we are confident: asset price inflation is here to stay.

Investment implications: Real estate investors should remain attentive to the geographic, demographic, and economic trends inaugurated by the pandemic; the effects will be lasting, and will lead to a realignment of local economic growth and opportunity in the United States. Particularly as the current, and perhaps future, rounds of stimulus work their way into state and local economies, and as the outflow of remote workers to more livable small cities continues, certain states and localities will experience economic booms.