The Fed’s press conferences in the era of “money printer go brrrrrr” are often derided as “nothingburgers,” but of course they are still required listening and contain important information. Nothing in Fed Chair Powell’s Wednesday press conference was surprising to us, but it served to underscore our convictions about (1) the economic cycle environment in which we find ourselves, (2) how it is developing, (3) what is coming down the pike, and (4) when and how markets will begin to discount it. (Hint: they already are.)

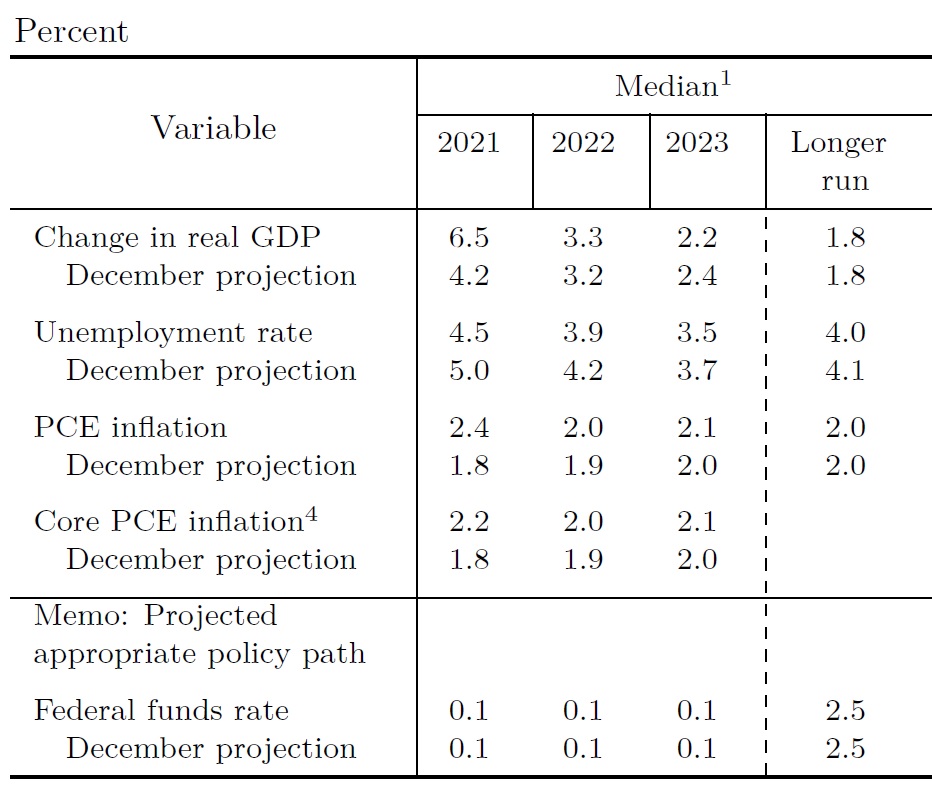

The Fed’s inflation and growth expectations were both revised up substantially in the current release:

We generally give more credence to the work of the Fed’s GDP analysts, since to put it mildly, they don’t have the same level of political pressure that is applied to Fed inflation projections.

Of course there are countless ways in which Federal government statisticians work to dampen inflation expectations. The stripping out of food and energy to produce “core” inflation readings is only the most obvious of those; they extend also into the arcana of things like “hedonic quality adjustments.”

Without getting into the weeds, we will simply say that there is “actual inflation” and “fake inflation.” The former is what you actually experience as you procure the goods and services you need to conduct your life, and the latter is what you read about in official inflation statistics from the Fed and the Bureau of Labor Statistics. At best, the latter offer hints about what to expect, and what the data shown above suggest is simply that inflation is here and it is going higher — quite a bit higher than the official numbers suggest.

Even the Fed sees overall (not core) inflation at 2.4% by the end of the year. We suspect it will be at least 3%, and possibly higher by the end of 2021, and much higher by early 2022.

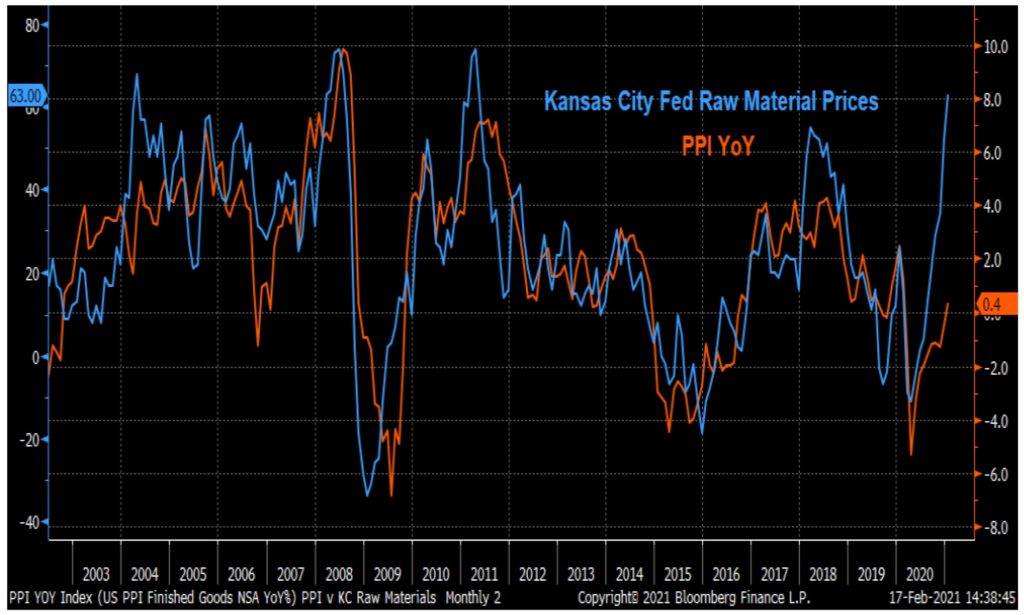

The prices of raw materials are already reflecting the powerful combined impetus of stimulus and recovery, as shown in the recent activity of the Kansas City Fed’s raw materials index:

These are the prices of the raw materials that will flow through to consumer goods. If we are correct, and real (not fake) inflation will be moving to the levels we indicated above in the time frame we think is likely, the market would already be pricing it in, looking for the assets that will be benefitted — and punished — by rising inflation.

Is it? Yes, we believe it is, as demonstrated by recent rotations and price action. By the time the Fed gets the data and reacts to the data, it is late, as has been proven through many cycles. And now, the Fed is explicitly communicating that they will be reactive and not anticipatory. Markets act faster and discount faster. This is why investors must be ready, and wise about official (low) projections of inflation.

We are sad to reiterate to all holders of intermediate and long-term bonds in particular that the rotation will continue to hurt bonds and benefit bond shorts.

The rotation has been brutal for tech stocks with extremely high or infinite multiples (i.e., profitless companies). We believe that this process will also continue.

We don’t think that technology as a theme is challenged. All of the strands of technology as a theme that we have been examining for months remain significant, and the theme is intact. Many of the mega-cap tech names that have been powerful engines of portfolio returns for years may continue to produce returns, albeit at a slower pace — with their earnings still rising, but their multiples contracting. We are not suggesting that such stocks should be shunned, but that investors should broaden their interest in tech beyond the mega-cap names, and beyond the market darlings with extremely high and infinite multiples, towards more value-oriented and smaller-capitalization companies. These include “picks and shovels” themes that we have been mentioning recently — companies building the nuts and bolts of tech infrastructure — as well as some old-line, low-PE, moderate growth tech companies.

However, beyond technology, investors should now be turning their attention generally towards inflation beneficiaries. This essentially means cyclicals — agricultural, construction, and industrial materials, equipment, and services; and raw materials — capital goods, construction materials and supplies, industrial metals, and technological materials such as lithium and rare earths.

Bitcoin has been driven both by inflation expectations and by extreme speculative fervor. Bitcoin has risen dramatically, and likely has further to run before a real cycle high. Gold has languished, with a generational shift perhaps contributing to a current shift of attention to digital assets. But we do expect gold to catch up. We also expect other precious metals that have industrial applications (silver, platinum, palladium, etc.) to benefit both from inflation and from the economic acceleration that will benefit base metals as noted above.

Investment implications: The unique characteristics of the Covid pandemic recession may lead to a shorter cycle — both because of the unprecedented and intense stimulus, and because of unresolved issues that characterized the late stage of the previous cycle. Certainly the inflation data, economic projections, and market rotation suggest that we are moving into the next stage of the cycle, which should benefit cyclicals. Investors should not neglect tech as a theme but they should look for more value-focused, smaller tech names, as well as some lower-multiple old-line tech leaders. Because the Fed is planning on being reactive, investors must be proactive. There is no evidence throughout history that policymakers can pivot policies to control inflation after purposefully creating it.