A trend has emerged: the research departments of the big brokerage houses are gradually increasing their estimates for U.S. GDP growth in 2021. Last week, Bank of America raised its full-year target from 6.5% to 7%. Although Goldman Sachs has kept its full-year target at 7.5%, this week it pulled some of that growth forward, raising estimates for the first quarter from 8.5% to 9.5% and the second quarter from 10% to 12.5%. The members of the Fed’s Open Committee, at their March meeting, raised their 2021 target to 6.5% — from the 4.2% they had forecast at their December meeting.

These are not small adjustments. With annual U.S. GDP running at $21.5 trillion, a half-percent adjustment to full-year GDP growth amounts to more than $100 billion in additional economic activity.

We believe that further upward revisions will continue to come out, and that both government and mainstream private-sector analysts will be forced to revisit their numbers again and again as the year progresses and the U.S. economy proves stronger than expected.

What is going on underneath the hood that the mainstream has missed, and has still not yet adequately taken into account?

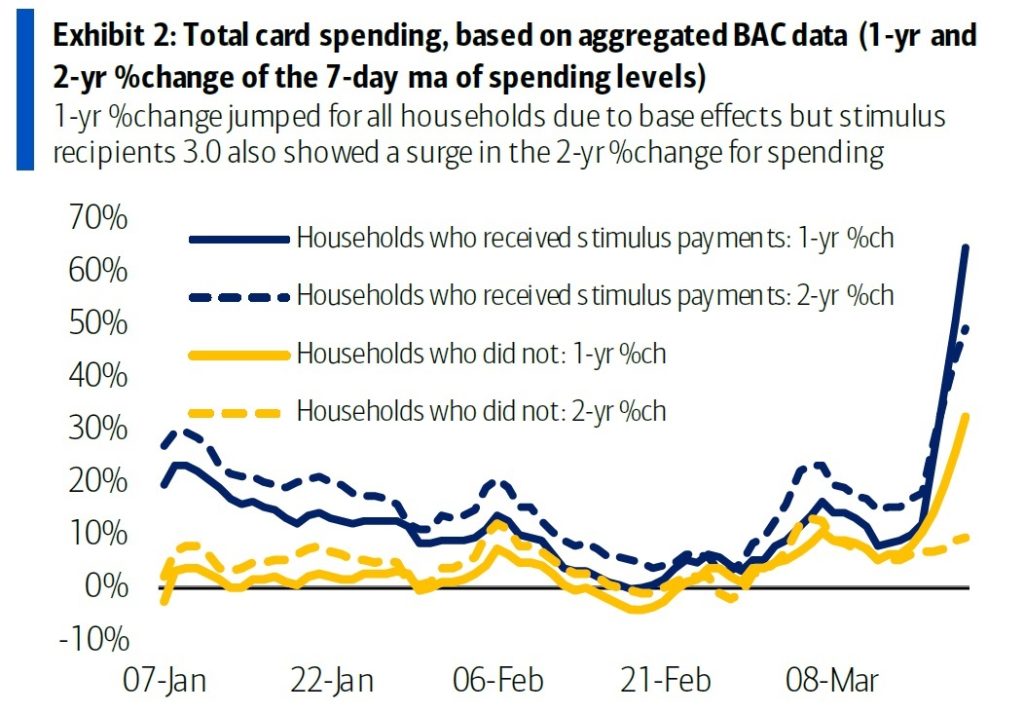

First on the list is stimulus and its effects. Another $1.9 trillion bolus of stimulus funds — including modern-monetary style “stimmy checks” hitting most Americans’ bank accounts — just went through. While some surveys report that more recipients are intending to use their check to save or pay down debt, real-time credit card data suggest something else:

As we’ve noted previously, although the pandemic stimuli have included the traditionally staggering servings of Congressional pork, they have also been radically different from the stimuli that have characterized emergency fiscal and monetary policy responses until now. Both in terms of helicopter money to individuals, and the Fed’s underwriting of commercial lending, the money-creation impulse of the covid stimulus programs is structured in a way that will send more money into the real economy. It will be spent, creating demand and sparking growth… and, we believe, inflation.

Of course, the Fed also remains on the job. That “job,” we are pretty sure, is no longer de facto quite the “dual mandate” it once was. The Fed’s projections are for merely “transient” inflation, while it sees ongoing profound risks to the economy that will keep it stimulating for the foreseeable future. We do not believe that the inflation people actually experience will be “transient.” The Fed has pledged to be “reactive” rather than “proactive,” and to us, that means the likelihood that the economy will run hot — hotter than most expect.

Yes, there will be negative consequences coming down the pike from these policies. Yes, there are plenty of risks of future policy mistakes as policymakers navigate those consequences. As we have observed, at some point, the Fed will need to act to cap rates on the long end by implementing some form of yield curve control, and that will represent a distortion of basic market pricing mechanisms with unforeseeable results.

But 2021, we believe, is not the year for that. 2021 will be a year for economic growth, stock market appreciation, and inflation.

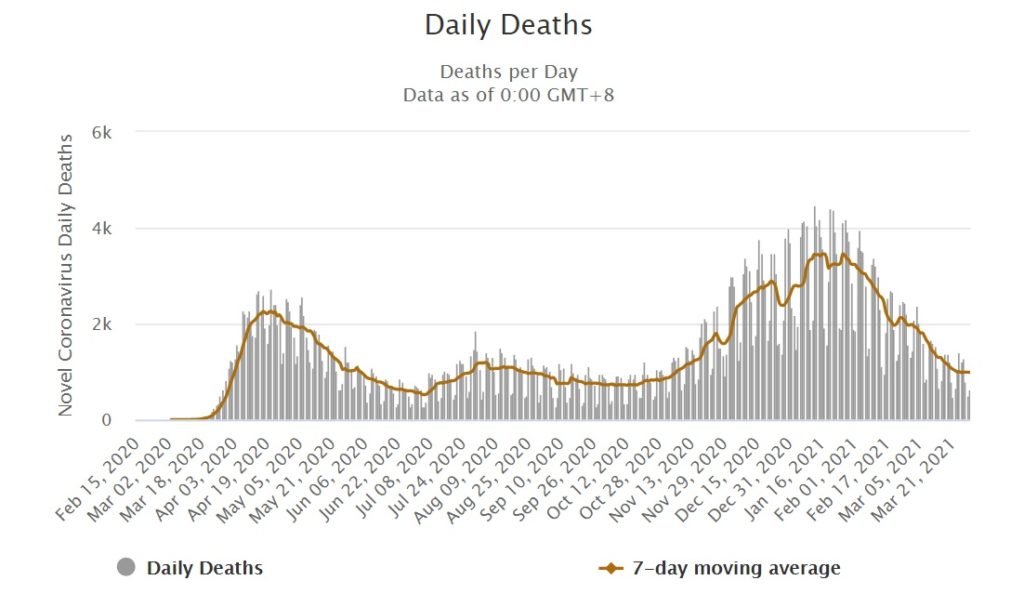

There will likely be feedback loops as employment gets stronger than anticipated. Last August, well before the vaccines currently being deployed were approved for emergency use, we argued that natural herd immunity, existing widespread T-cell immunity, and eventually, vaccines would soon bring the pandemic under control. Indeed, daily deaths peaked in January, well before the general rollout of vaccines started:

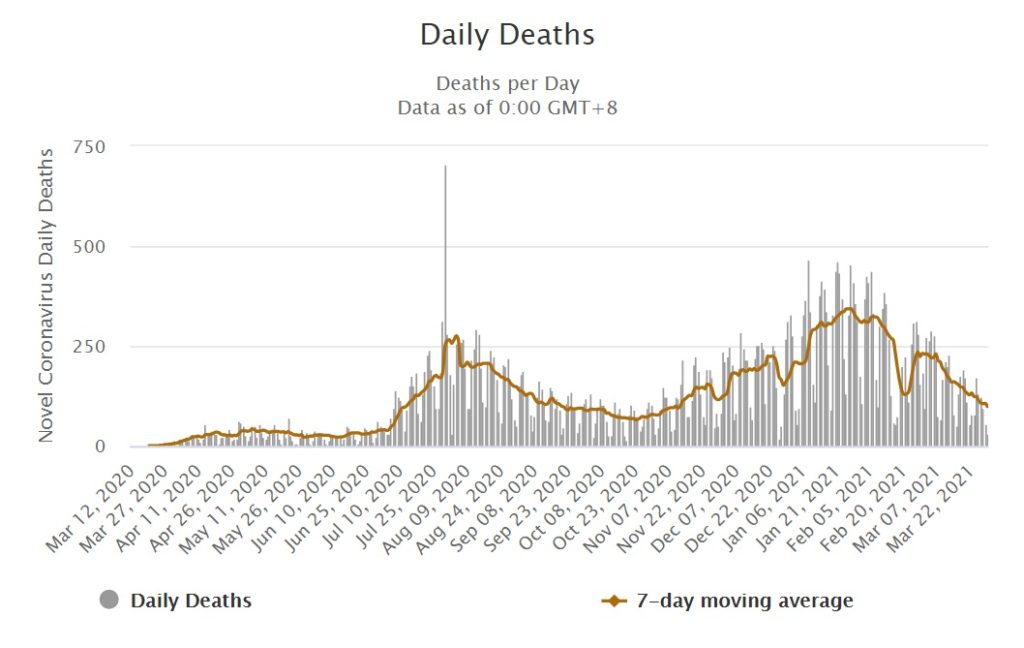

Add to this the experience of the states which have opened economic activity up completely. Here’s the same chart for Texas, which lifted all restrictions, and its mask mandate, almost a month ago:

The last plank of stimulus for growth is what Canaccord Genuity’s Tony Dwyer calls the “third level of stimulus” (after monetary and fiscal stimulus) — interest expense. Put simply, for government, corporates, and households, the ratio of debt service to cash flows remain at historically very low and manageable levels. As we noted above, the day will come when this picture will darken — but that day is not today, nor soon.

To us, the current picture is quite bright, hard as it may be to believe in a polarized political environment where it seems (as we have often observed) that media have an interest in stoking fear and division. U.S. growth will be better than expected… and that bodes well for U.S. stocks and the U.S. dollar. The major cloud on the horizon, we believe, is that the next big rounds of spending will need to be funded with tax increases that may be substantial, and too drastic a shift in tax policy will not be taken well by markets. The plan just floated by the Biden/Harris administration calls for the rollback of the key components of the previous administration’s corporate tax reform.

Investment implications: Analysts’ estimates for economic growth are lagging because it has not yet completely sunk in that as an emergency, the pandemic is over. Demand will rise, employment will rise, spending will rise, economic activity will rise, and inflation will rise… and it will probably take the analysts all year to catch up. Market participants who focus on the future problems that will be created by today’s policies will miss out on what may shape up to be a boom year. However, watch out for aggressive tax increases, which could cause the market to stumble badly.