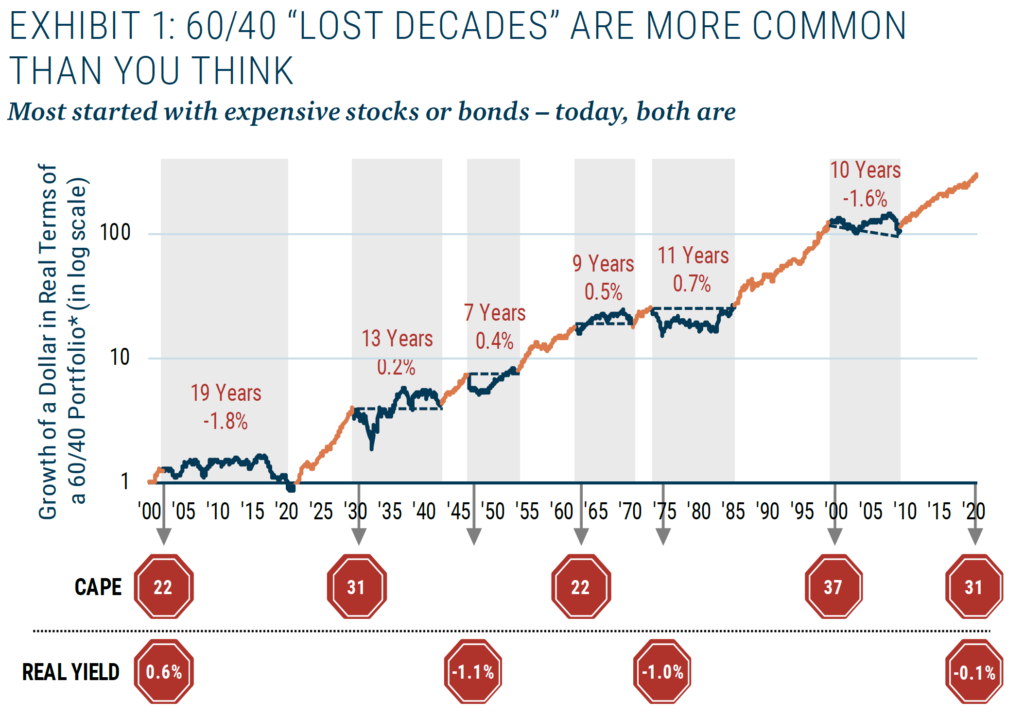

Last week, we noted that the typical 60/40 stock/bond portfolio allocation that has become an investing commonplace in the past several decades has historically produced many “lost decades” — periods of ten years or more that saw little to no advance in the portfolio’s real value.

Source: GMO Capital

Of course, this has everything to do with inflation. We noted last week:

“Once inflation expectations reach the point at which they trigger the fear of higher rates, they are not as good for equities — particularly for many equities which sell at elevated P/E ratios, and consequently see those P/E ratios contract as future rate increases are priced in. Note that this is the very scenario which can see both asset classes of a 60/40 portfolio falling in price — often, not a scenario foreseen by a conventionally minded investment advisor… This is especially true when rates are rising and the yield curve is steepening, i.e., when shorter-term rates are rising more slowly than longer-term rates. That looks very much like the environment that we are entering. As we have said before, the Fed has more control over short-term than long-term interest rates for many technical reasons.”

We are entering territory that most managers don’t remember, because they weren’t alive yet (or if they were, all the remember is Saturday morning cartoons).

In brief, when inflation is rising and has reached a psychological tipping point, rates are rising in response, the yield curve is steepening, and stocks are challenged, both stocks and bonds will suffer — and that spells trouble for the 60/40 asset allocation strategy that has become conventional wisdom. (Of course, any conventional wisdom endures only until it stops working.) Historical examples of this scenario can be seen in the “lost decades” illustrated above, although they are beyond the living memory of money managers educated since the 1980s. Could we be on the cusp of another period of prolonged underperformance for a static 60/40 allocation? We believe the evidence suggests that the answer is “yes.”

Cash Is No Solution

And of course, during such an episode, leaving your portfolio in cash is no solution either. Those investors who can remember the 1970s will understand why prospective Guild clients in those years often came to us with a simple plea to “just keep ahead of inflation.” A dollar you held on January 1, 1970 had lost 54.1% of its purchasing power by New Year’s Day in 1980.

Pro-Inflationary Forces Everywhere

We have reiterated that we do not believe the current environment will be like the 1970s. It will probably not repeat, but it may rhyme. When the distortion of COVID base effects is removed — for example, by looking two years back instead of one year, right into the pandemic lockdowns — inflation seems to be trending higher, but not at the level of the 70s. As we scan the horizon we continue to see pro-inflationary forces:

- Food prices are spiking in a way not seen since the spikes that helped precipitate the Arab Spring, and there is drought in Brazil.

- A global minimum tax is being mooted by G20 fiscal authorities, which if it were implemented, would certainly be passed on to consumers through higher prices, as will Biden administration corporate tax hikes in the U.S.

- Direct transfer payments to the unemployed are ongoing, in spite of an increasingly sharp disconnect between pandemic recovery, job openings, and those still drawing benefits.

- The U.S. seems to be experiencing a generational lurch towards greater fiscal expansionism, and while the political consensus to implement all the desired borrowing and spending (money creation) is lacking, a good deal has been enacted and more will be.

- Working out the supply-chain kinks created by the pandemic lockdowns may take longer than previously thought, with some analysts suggesting, for example, that shortages of some types of chips may persist into 2023.

All of these trends are undoubtedly inflationary, in spite of the continuing large-scale disinflationary factors of aging demographics, increasing savings, and technology.

Conclusion 1: Commodities

To reiterate our conclusion from last week, an important missing element in the conventional asset-allocation wisdom is commodities. We do not believe that a static commodity allocation is any more appropriate than a static 60/40 stock/bond allocation. Different times call for different measures; we believe that signs strongly suggest the current environment is one in which a commodity allocation is critical.

Conclusion 2: Tactical Allocations

Another piece of conventional wisdom we believe is likely to be challenged in a “lost decade” is the buy-and-hold approach to equities, and particularly to index funds. Historically stretched valuations for markets as a whole fairly reliably indicate depressed returns for the indexes looking out over the coming decade. This view obviously does not apply to securities held more tactically to take advantage of shorter-term price movements. Retirees in particular are facing an investment environment in which a “lost decade” could fundamentally challenge underlying assumptions about the adequacy of their savings to last through retirement. A more tactical approach, designed to minimize lengthy drawdowns and to take advantage of rallies, may prove critical to retirees in coming years.

Investment implications: We believe that most investors should allocate to commodities through the securities of commodity producers and commodity related companies (assuming that they are in politically stable locations), rather than attempting to use exchange-traded products (ETPs) created with underlying commodity futures contracts. Such products are often problematic because of technical characteristics that result in performance inferior to what the movement of the spot index would suggest (e.g., futures roll). Thus we prefer the stocks of gold and silver miners to “paper” gold and silver to hold in retirement accounts.

When investing in individual securities, it is important to select companies in jurisdictions where the rule of law prevails (either developed markets or developing markets with reliably law-abiding governments). Some Latin American jurisdictions are often problematic in this regard, and so with commodities where producers are primarily in these geographic areas, we prefer ETFs of commodity-producing stocks rather than individual securities where the risk posed by unpredictable adverse government actions may be elevated. This is particularly true for copper, which is the one commodity where we might make an exception and purchase a futures-based ETP.

For base metal producers — for example, zinc or nickel — we would prefer Canadian or U.S. companies. Lithium producers in China, Australia, or the U.S. are safest, while Latin American producers are riskier; with lithium, we would opt for an ETF of commodity producers. If you have exposure to politically unreliable countries, you must monitor political conditions in those countries carefully.

Likewise, we prefer agriculture-related stocks, such as fertilizers and equipment manufacturers, to futures-based ETPs. On the energy front, we believe oil is likely going to $100, and we suggest exposure through the stocks of major oil producers or call options on oil itself, unless you have fundamental knowledge about specific U.S. exploration and production companies.