Unexpectedly poor job numbers for April caused a moment of consternation that the economic recovery was stalling. May and June’s reports were also misses, coming in below analyst estimates, although less sharply than for April.

The concern served to highlight a topic of enduring interest for us — new business formation. This is one metric that shows that the pandemic recovery is more robust than the headline employment data may suggest. Another related metric is the flip side — business demise.

A recent study published by the National Bureau of Economic Research (NBER) highlights that on both of these metrics, the pandemic recession and recovery have been a completely different animal from the 2008/9 Great Financial Crisis. Of course, this is what we could have expected (we titled one of our newsletters last fall “The Best Recession Ever”). As we wrote in that report, the Great Financial Crisis was an endogenous event, internal to financial system. It did severe damage to the circulation of liquidity which allows the economy to function, with scarring that lasted for years, in spite of the eventual advent of quantitative easing policies in response.

The Covid Recession, in contrast, was an exogenous event. Its causes were external to the financial system, and did not presage some looming financial “cardiac arrest” of counterparty failures and cascading insolvencies. There are certainly proving to be somewhat enduring challenges caused by the lockdown stop/starts — notably in supply chains. There will also be long-lasting pandemic knock-on effects of various kinds — accelerated business digitization, regional economic shifts within the U.S., rethinking of “just-in-time” and potential reshoring in certain industries. But when it comes to deeper financial and economic damage obstructing recovery, we don’t see it.

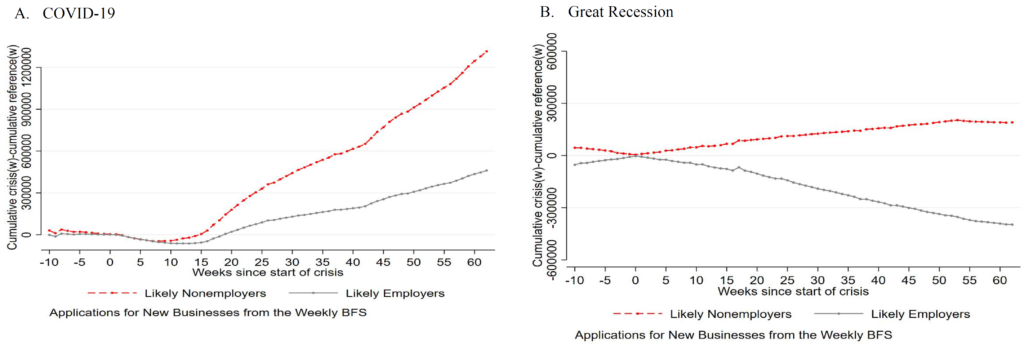

Our first evidence: a graph from the NBER study mentioned above, Entrepreneurship During the Covid-19 Pandemic: Evidence From the Business Formation Statistics.

The red line shows new business that are likely to be sole proprietorships (which can be assessed by the EIN applications filed); the black line shows businesses which are likely to hire employees. Although both are significant, the black line is the more important; this kind of business creation is, as we have pointed out many times, the most important single engine of employment, productivity, and economic growth. That line shows behavior during the Covid Recession the mirror opposite of what was seen during the Great Recession.

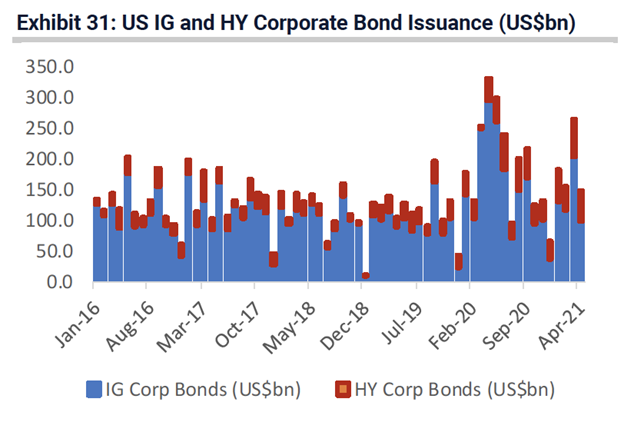

At least part of the huge liquidity created by fiscal and monetary stimulus during the covid recession (which has sparked record corporate bond issuance, see below) has found its way into funding for new businesses.

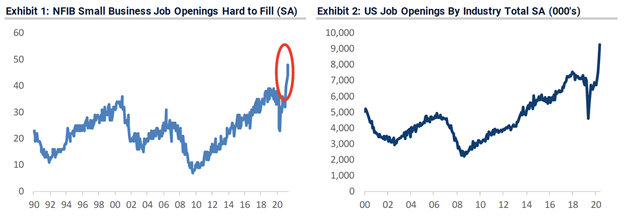

Given the robustness of these data and the extraordinary level of new employing businesses being created, we suspect that many analysts will underestimate the strength of employment growth. Job openings — and small business “job openings hard to fill” — further corroborate these data.

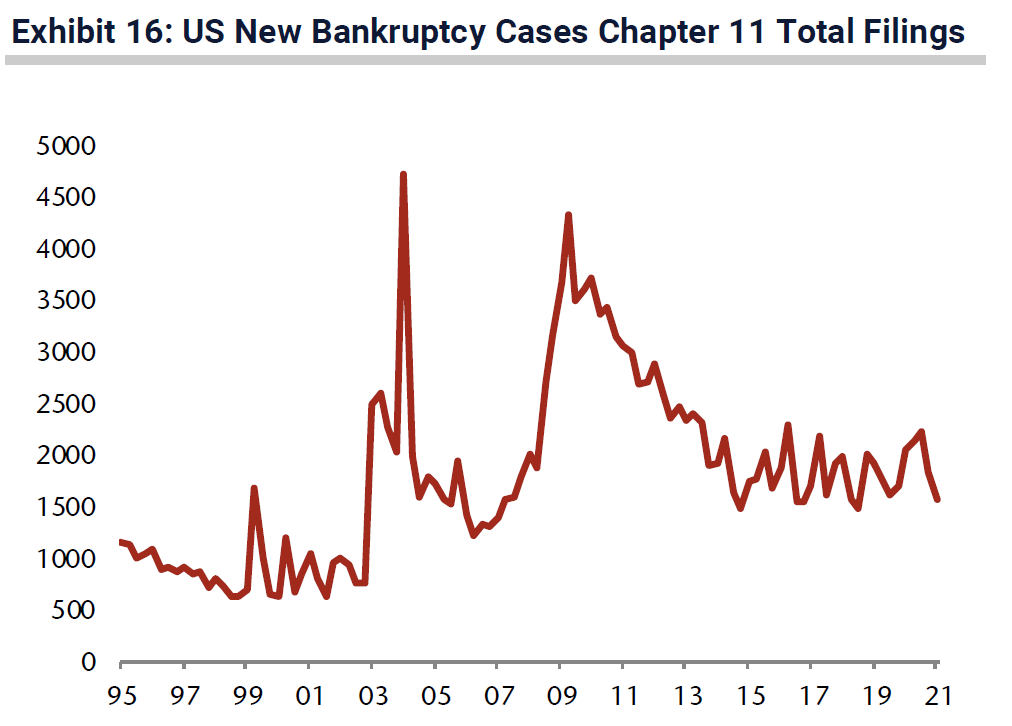

Further, in spite of consternation last year about business demise, bankruptcies have remained relatively contained and in line with recent history — totally unlike the pattern in 2008 and 2009:

Investment implications: The strength in new business formation since the pandemic, and the relative lack of business failures compared to previous recessions, suggest that whatever fluctuations are seen in monthly employment survey data, the employment picture in the U.S. will remain strong throughout 2021 and 2022. We believe that this will remain the case even as supplemental crisis unemployment benefits roll off and more workers return to seek the many jobs that are open.

All this bodes well for the strength of the U.S. economy. However, it is important to note another effect: the Fed is looking very closely at employment data, and come the Fed’s Jackson Hole economic summit in late August, stellar employment data may provide the occasion for Fed officials to speak more openly about the inevitable eventual tapering of crisis-era policy. If markets begin to anticipate such talk, that, combined with the stimulus deceleration that’s already underway, could result in market volatility as we continue into the back half of the year. Given the positive economic backdrop, we would be buyers of that dip.