Is there something strange in the water in Washington — or perhaps are we approaching the “haunted house” season where strange and scary things come out to spook us? We may not be alone; the market may be feeling the same way, gauged by its recent behavior. An electric vehicle summit without Tesla? Senator Elizabeth Warren proclaiming Fed Chair Jerome Powell to be a “dangerous man”? The IRS angling to surveil all bank accounts over $600? Regional Fed presidents stepping down after the “impropriety” of personal trading activity front-running pandemic policy? Another prospective debt-limit showdown…and threat of default? And although to some extent the market has become inured to the zeroes, a $3.5 trillion “infrastructure” budget proposal containing a wealth of social engineering programs — to go along with the much-needed investment in bridges, roads, clean water, and broadband?

All of these are providing ample justification for concern to a market that is asking itself tough questions. Earnings season is approaching once again, and investors are wondering if analysts’ estimates, which have been climbing steadily out of the pandemic trough, are not too high — with rising costs and challenged inventory and supply for many inputs, including labor, raw materials, finished goods, and energy.

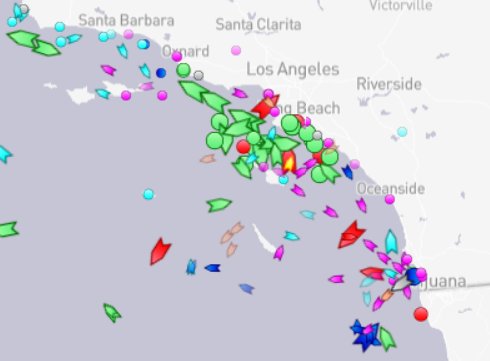

The current traffic jam at the Port of Los Angeles, the nation’s largest, illustrates the problem.

Source: MarineTraffic.com

The rotation underway from growth and back towards cyclicals may not be a run-of-the-mill rotation, if, as noted above, materials and energy are moving into a period of greater pricing power. Investor dollars that have been indiscriminately thrown at fast growth stories on that basis alone may begin to find their way more selectively both to better growth stories, and to selected cyclicals.

We think that energy is interesting at this juncture and may present a tactical opportunity for traders, particularly if the northern hemisphere winter is colder than usual. Energy prices may ease again in 2022; longer-term trends are difficult to divine, but we think the energy trend for fossil fuels, renewables, and nuclear is “higher.” When it comes to stocks, we still prefer to approach this theme through green tech, decarbonization facilitators, uranium, and lithium and other critical battery components.

For traders, there are probably trading opportunities in oil and gas producers, which in recent years were purged from many institutional portfolios for ESG reasons. It would not surprise us to see some stocks like Exxon [XOM], Chevron [CVX], Diamondback Energy [FANG], EOG Resources [EOG], and/or energy exchange-traded funds like XOP or XLE show up in more institutional portfolios in the fourth quarter, after a few years of relentless liquidations. Longer-term, fossil fuel companies look challenged as technology is helping to drive down the costs of cleaner sources of energy, but in the near term, a more bullish situation has developed for carbon.

Thanks for listening; we welcome your calls and questions.