Whatever else they can’t agree on — and it’s a lot — the fans of fossil fuels and the promoters of green energy solutions can agree on one thing: they all think an oil price north of $100 is a good thing. It seems that many forces are afoot in the world that could conspire to drive energy costs higher. In the short term this could provide an opportunity for more tactically oriented investors and traders. In the longer term it could affect a wide swath of economic sectors and industries — and through inflation, contribute to the globe’s fiscal and monetary trajectory.

The story with energy is similar to a broader theme of the post-pandemic recovery: challenged supply chains, depleted inventory, and producers scrambling to keep up with ramping demand — after fearing for their survival during the worst of the pandemic lockdowns in 2020.

In the energy world, these problems are showing up in many global markets for natural gas, oil, and coal, as well as for electricity — which is still predominantly generated by the combustion of fossil fuels. To worsen matters, even some fossil fuel alternatives have experienced coincident snags — with European wind generation, for example, suffering from a period of unusually calm weather; European nuclear generation continuing to decline as environmental policy leads to the shuttering of capacity; and Brazilian hydro power slashed from once-in-a-century low flows to a critical river basin. All of these have raised natural gas demand, since it has become the primary fuel for electricity generation. While burning coal used to be the primary low cost source of electricity, it suffers from too much disapproval in the developed world.

The winter of 2020–2021 was colder than usual in the northern hemisphere, resulting in a greater-than-average drawdown in fossil fuel stocks, just as the pandemic was challenging production through lockdowns, and challenging making investments in future production. Then the summer of 2021 saw higher-than-normal temperatures and high power demand, drawing more heavily than usual from depleted inventories. Natural gas inventories are 5% below pre-pandemic average seasonal levels in the U.S., and 15% below normal in Europe. Gas futures have risen sharply in the U.S., Europe, and North Asia. Crude oil inventories throughout the OECD are also about 5% below seasonal average. Even Chinese coal stocks are low, leading the government to press its coal-producing regions to increase production. Just as this note went to press, a Bloomberg headline came across our desk, indicating that Beijing’s energy-sector supervisor had “ordered the country’s top state-owned energy companies — from coal to electricity and oil — to secure supplies for this winter at all costs” and that “blackouts won’t be tolerated.”

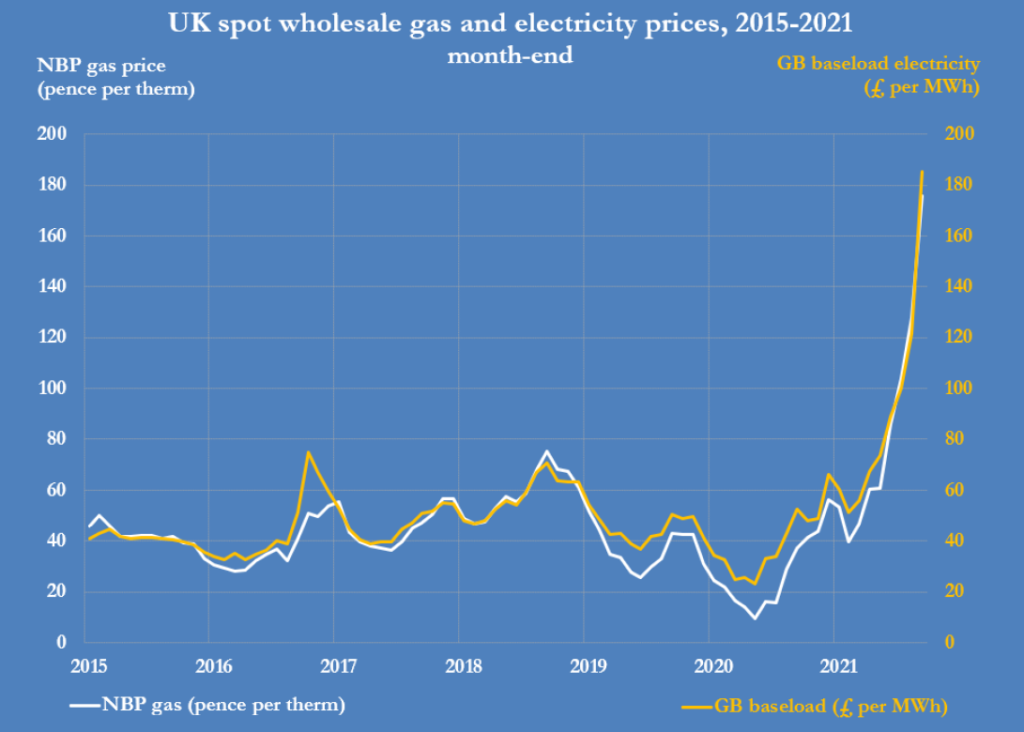

The UK Is A Poster Child For the Post-Pandemic Energy Spike

Source: John Kemp

While production was hit by the pandemic, the economic recovery, as readers know, has been extraordinarily rapid. As we approach winter, and higher energy demand in the northern hemisphere, that rapid recovery and inadequate restocking has left energy commodities — particularly gas, used for both heating and electricity generation — vulnerable to any deviation of the coming winter from normal.

Analysts believe it is unlikely that fuel inventories will be restored by year-end.

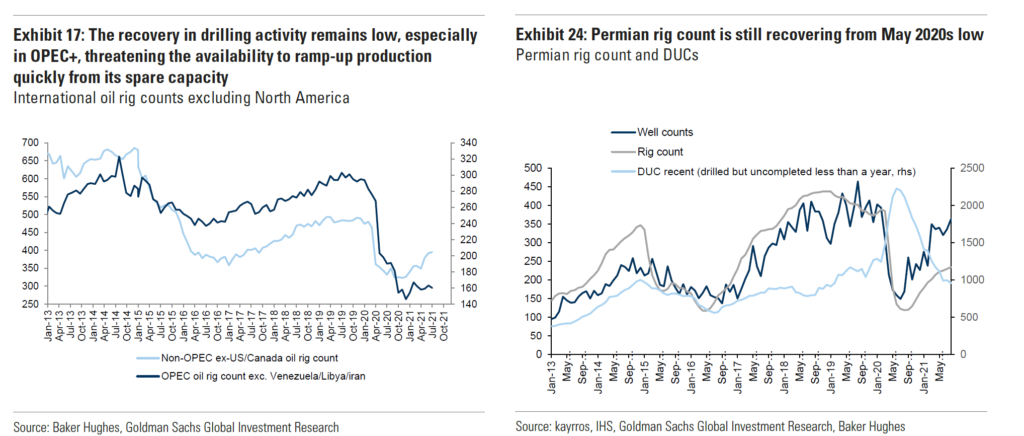

Oil Rig Counts Suggest That Deficits Will Continue Near-Term

Source: Goldman Sachs Commodities Research

One analyst from a major investment bank went so far as to suggest that consumers could protect themselves from “violent price upside” in natural gas using deep out-of-the-money options. We are not sure that opening a Robinhood account to trade energy contracts would be advisable for most, but the suggestion does underline the extent to which gas prices in particular are “unanchored” relative to the upside risks of a winter that is much colder than average.

Of course, it is also worth bearing in mind that rising energy costs could occur across the energy spectrum, and not merely in fossil fuels. Battery-grade lithium remains a subject of interest to us, with analysts predicting supply challenges for the coming decade.

Investment implications: Near-term conditions suggest a tactical opportunity may be emerging for energy, particularly for natural gas, and particularly in the event that the northern hemisphere 2021–2022 winter is any colder than average. Longer-term, the future of fossil fuels and fossil-fuel producing companies remain murky, since they abide under a regulatory and policy cloud nearly universal in the developed world. If higher fossil fuel prices become structurally persistent, that may struggle to translate to stock price for fossil fuel companies. However, such companies can have periods of relative outperformance. We noted recently that some major cloud service providers are competitively cutting prices; whereas inflation may mean that cyclical companies are entering a period where they will have greater pricing power. Investors should also bear in mind the significance of energy costs for company margins.