Yesterday, the Bureau of Labor Statistics released monthly inflation data, showing the consumer price index (CPI) for all urban consumers rising at a 5.4% year-on-year pace. In the world of official CPI reporting in recent decades, that is hot. At the same time, retirees got a reminder of their vulnerability to inflation, as the Department of Labor announced that Social Security’s cost-of-living bump would be 5.9% for 2022 — the highest since the early 80s. You can be sure that retirees’ expenses, skewed as they are towards goods and services whose prices are rising at a faster clip, will sharply outstrip that increase.

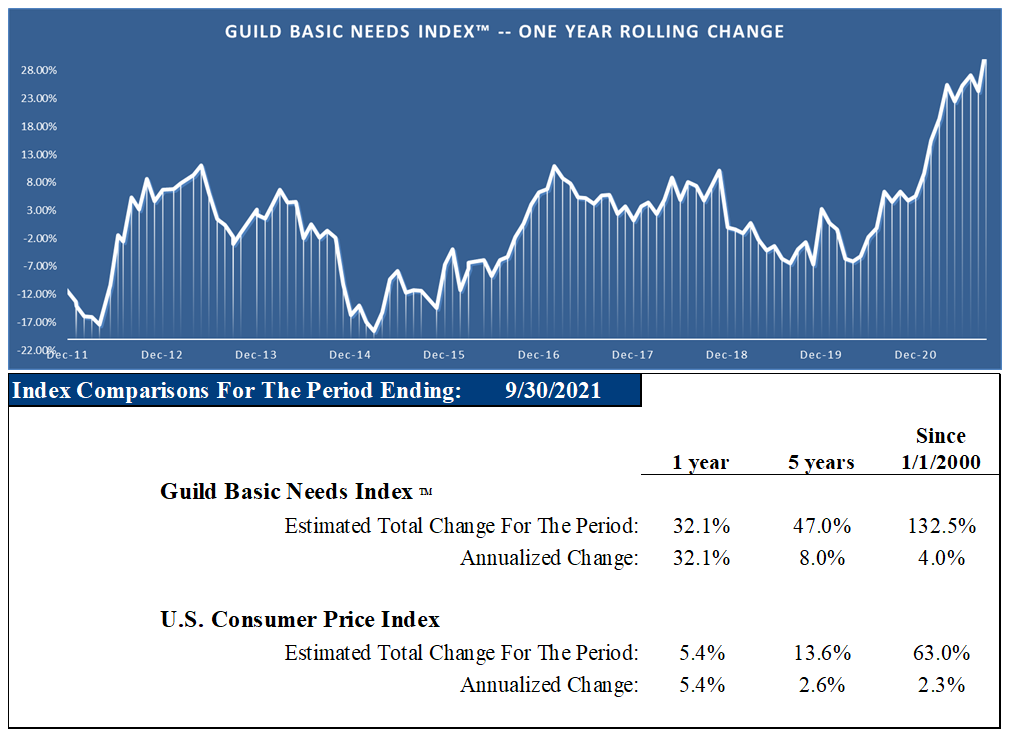

As our regular readers know, we have long been dissatisfied with the official presentations of inflation data, which we believe are manipulated for political reasons. Therefore we constructed our own gauge, the Guild Basic Needs index, whose constituents and weightings reflect expenses faced by consumers to meet their basic, essential needs: food, clothing, energy, and shelter. Since we developed the index in 2009, we have kept these constituents and weightings the same, to avoid the frequent modifications and distortions that we believe undermine the integrity of the government’s “official” statistics and which make the data prone to political gamesmanship.

(For a further discussion of this index’ rationale and construction, please see the end of this article.)

Where the GBNI Stands

We don’t have September data for all the GBNI’s components, but preliminary results show it rising more than 32% year-on-year.

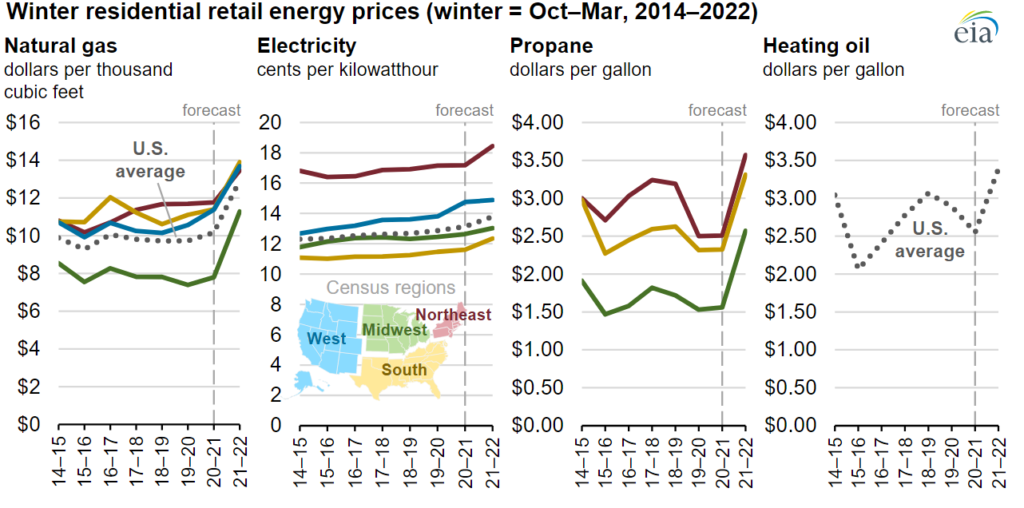

Heating bills are front and center in many consumer’s minds; the U.S. Energy Information Agency (EIA) announced in their winter fuels outlook that households were likely to see their winter heating costs rise sharply.

Source: U.S. EIA

As we noted last week, this picture will get worse in the event of a northern hemisphere winter that is much colder than normal.

So About That “Transitory” Inflation

Of course, these more volatile items do comprise a more existentially significant basket for the typical consumer. But they are primarily in the more volatile category excluded from official calculations of “core” inflation; they tend to rise and fall quickly. What are the signs that emergent inflation is not going to simply fall again once disruptive factors, such as supply chain issues, are resolved?

First, bond markets. In the face of central bank actions around the globe, bond “markets” are far from the neutral price-discovery mechanism that they would need to be to give us unclouded intelligence about the market’s inflation expectations. Even so, breakevens — the spread between the yields of ten-year Treasury bonds and inflation-protected Treasury bonds — are near 2021 highs.

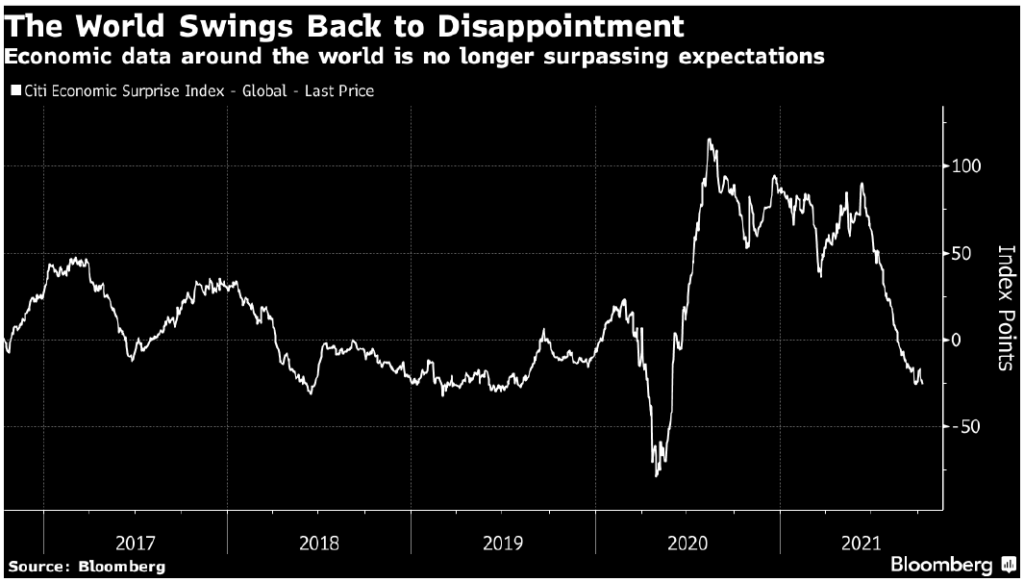

Is that just due to an overheating economy? Unlikely. Economic data globally have been trending negative, with negative “surprises” now outstripping positive “surprises” after more than a year of positive performance.

Second, inflation’s deeper sources. The sources of inflation are broadening into “stickier” and more problematic areas. Many commodities beyond energy and mainstream basic materials are rising rapidly, and many of these seem to reflect a common source: supply chain chaos, deeply exacerbated by labor issues.

It turns out that idling production and transportation networks and workers worldwide, and then attempting to restart the system after a sharp drawdown in inventories of all kinds and a months-long bolus of demand from transfer payments, is tougher to restore to equilibrium than you might think.

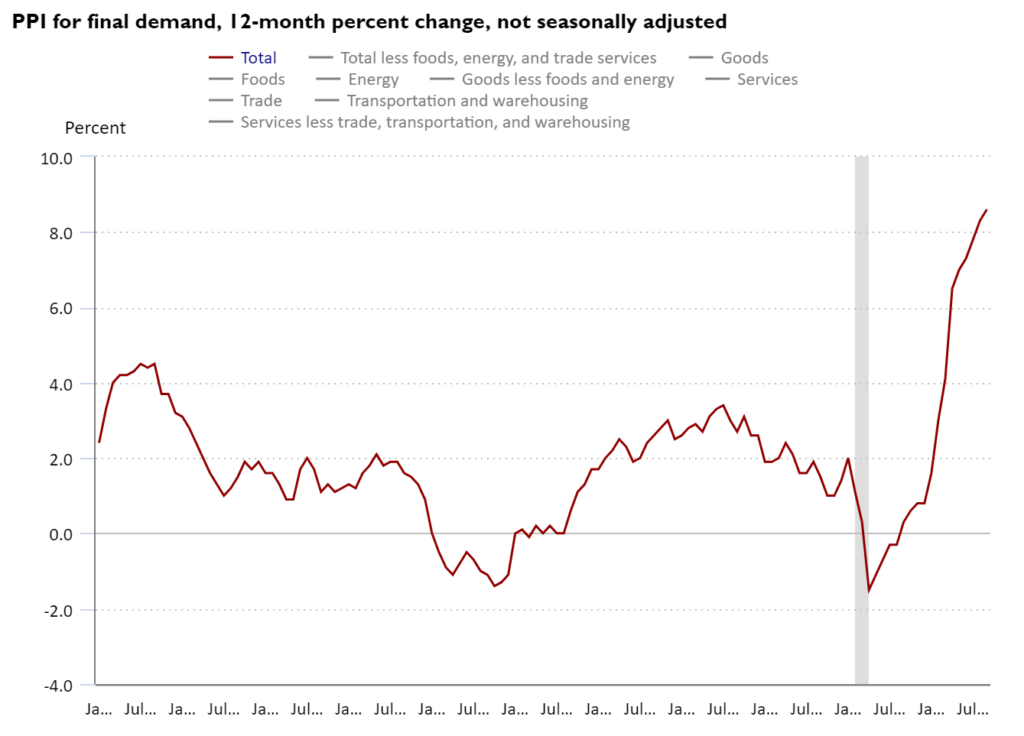

The producer price index (PPI) figures released this morning show the PPI decelerating month-on-month, but year-on-year, continuing to rise at a rapid rate (8.6%):

Source: Bureau of Labor Statistics

Simple math suggests that for many companies, rising input costs will spell reduced margins.

That brings us to the labor market. The most recentU.S. jobs report was a disappointment, but under the hood, earnings — particularly for nonsupervisory, hourly paid workers — are rising quickly. The last 24 months have seen weekly earnings rising at the fastest pace since 1983. If the inflation we are beginning to experience is significantly wage-driven, it will prove stickier than the “transitory” crowd wanted us to believe.

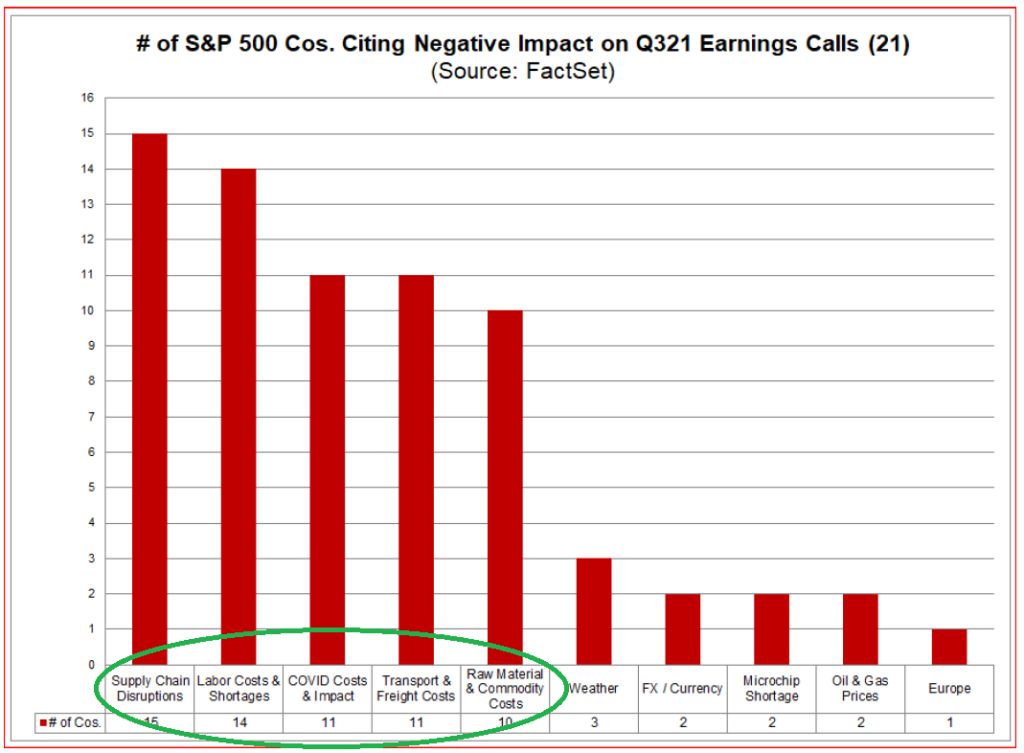

Third, earnings season is upon us. Company managements will be providing a lot of commentary on their experience of rising costs and about supply chain issues and their persistence. Sure enough, in this small sample of 21 early-reporting companies, those issues have been mentioned frequently.

Source: John Authers

To be sure, many companies will be using these cost issues to justify earnings that miss expectations. Which brings us to another topic of discussion: what all this means for earnings.

Investment implications: Gradually, consensus is shifting to accept the view that inflation will prove to be more significant and less transitory than initial projections of analysts and officials suggested — lasting at least well into 2022. This shift will likely prove challenging for markets to digest, particularly as it will alter investors’ calculus around the Fed’s aggressiveness in tapering pandemic-era policy, and ultimately in raising rates. In turn, higher inflation and higher rates will challenge higher-multiple stocks and likely precipitate a re-rating for longer-duration assets, including growth stocks. Indeed, that re-rating has been underway for some time. While we continue to see long-term value in the technological themes we have favored, we see tactical reasons during this period of digestion to turn towards commodities — particularly tech-related, such as rare earths, copper, and lithium — energy, precious metals, and cryptocurrencies. Bitcoin seems finally on the cusp of behaving consistently more like a defensive anti-inflationary asset, and not a risk-on speculative asset.

About the Guild Basic Needs Index

The widely quoted inflation index, the Consumer Price Index, is currently based on data collected from spending surveys given by the U.S. Bureau of Labor Statistics from approximately 14,500 urban families. In addition to basic needs, the CPI includes other expenditures, such as insurance and taxes. However, it also includes discretionary spending items such as personal care services and entertainment purchases such as the latest flat screen televisions and consumer electronics.

Another point about the CPI is that the Bureau of Labor Statistics periodically alters its content, making adjustments to the weighting of the components, and smoothing seasonal patterns. Such tinkering with data, as we have mentioned over the years, usually results in an understatement of the inflation rate and creates an unreliable, misleading cost-of-living index.

We believe a simpler index is necessary for tracking the price changes of basic needs. No such index existed, so we created one: the Guild Basic Needs Index (GBNI). The GBNI will not reflect spending patterns of one segment of the population. Rather, it will measure the changing prices of essential living expenditures. Another key differentiator between the GBNI and the government’s measures is that the components of the GBNI do not change. They are not adjusted, statistically smoothed or manipulated.

The GBNI concentrates on four fixed categories of primary and essential living needs. Each category is assigned a specific percentage of the overall index:

Food 30%

Clothing 10%

Shelter 30%

Energy 30%

Food, clothing, and shelter are self-explanatory, and energy is needed for basic heating, electricity, cooking, and transportation. The categories and their values within the GBNI are fixed, unlike the government indices. There is no tampering — no seasonal adjusting, smoothing, or replacing of components.