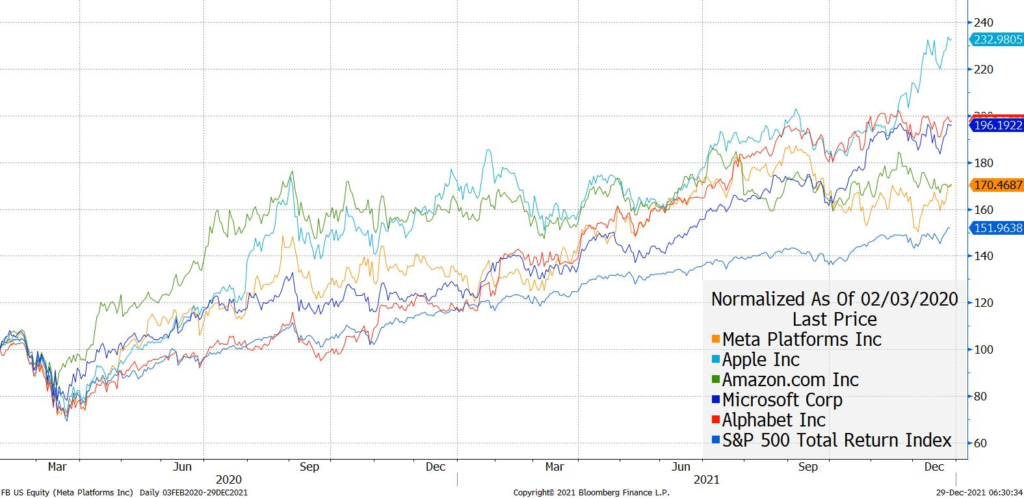

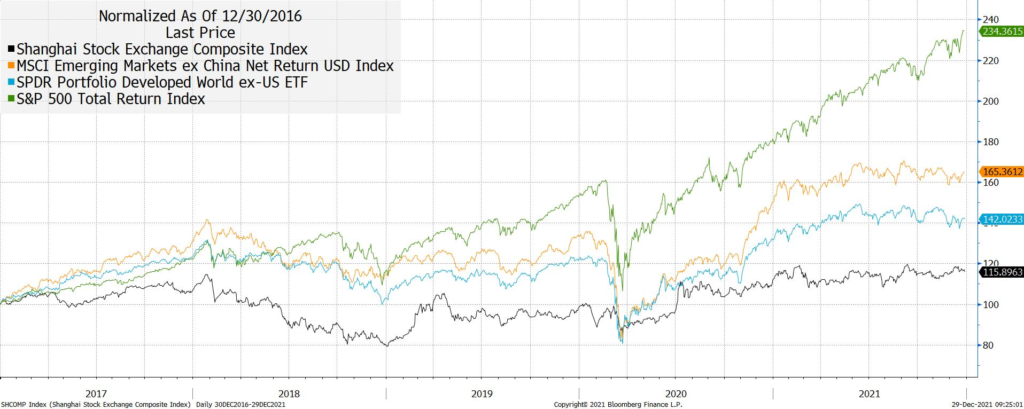

With all the ups and downs that have accompanied the pandemic — stay-at-home stocks duking it out with reopening stocks in rounds that have tracked the virus anxiety cycles — mega-cap technology stocks have continued to outperform the broad market. This is a trend visible since early 2020 (top graph), but also over a longer period (bottom graph, showing the past five years). It contains a lesson about the power of disruption, and offers some useful insight particularly as we begin to move into what looks increasingly like a new inflation regime, following years of disinflation.

Source: Bloomberg, LLP

Perhaps even more germane is the relative outperformance of the S&P 500 index itself, of which the mega-cap tech stocks (comprising nearly a quarter of the market capitalization of the whole index) are “merely” the long-term leaders.

Source: Bloomberg, LLP

What Differentiates the S&P 500

Obviously, there are many characteristics of the S&P 500 index that make it the preeminent global equity destination. Unlike China and most developing markets, there is relatively little political risk in the U.S. For all the worsening political polarization, the U.S. remains a place where investment capital is assured of the rule of law. However, this distinction does not hold vis-à-vis the rest of the developed world; here too, in spite of whatever political differences there may be with the U.S., there is respect for the rule of law, and a relatively high level of political transparency and policy predictability. (Not as high as we might wish, but after all, we’re Americans.)

It is the long-term leadership of mega-cap tech that really underscores why the world wants to own American stocks.

Where Do Investment Profits Come From?

In the long run, what always offers investors the most robust returns is disruptive technological innovation. Today, that looks like the mega-cap tech stocks that headline the S&P 500. In the past, it looked like railroads, or oil companies. In the future, it may include (for example) innovators that rise to prominence through digital currencies and decentralized finance. In each economic epoch, though, the story is the same: investors who identify genuinely transformative trends early can reap the rewards.

The U.S. has been and remains the foremost global home for this kind of innovation, because of its dependable legal and economic structure and relatively light regulatory hand. As we have noted over the years, for example, Chinese tech entrepreneurs have been extraordinarily innovative — but unfortunately, the regime under which they operate is more guided by self-interested, politically forced stability … than it is by achieving stability through rule of law and respecting the rights of its citizens.

Sadly, the same is true for much of the developing world beyond China, where local entrepreneurs are hamstrung by cultures of political and economic corruption and lack of leadership accountability.

While there can be tactical opportunities in these markets under certain conditions, in the long run, they will not nurture the kind of capital depth and technological innovation that really drive long-term returns for investors. (The main difference is when such a government can make strides towards better transparency, reliability, and capital friendliness — as may be slowly unfolding in India.)

On the other hand, the U.S. is also set apart from the rest of the developed world by its dynamic population, openness to ambitious immigrants, entrepreneurial culture, and relatively low tax and regulatory burdens. While again, there are always exceptional individual companies, the wider demographic, fiscal, and regulatory environments in Japan and Europe, for example, make those regions unlikely to nurture the world-transforming companies that have been born in the United States.

All of these are the broad reasons why the flagship U.S. stock indices have long drawn, and will likely continue to draw, outsize demand from global investment dollars, euros, and yen.

Benefitting From Inflation

But there is a further reason, particularly relevant to a moment in which inflation may be lifting off after decades in the doldrums: the same business models that have driven U.S. technological innovation have also produced market leaders better positioned than many … to not only to survive inflation, but to benefit from it.

Inflation is not a simple negative. As old-school analysts are aware, companies’ cost structures differ widely — and some components of the cost structure do not move with inflation. Business models emphasizing these fixed-cost elements (and especially those with robust pricing power) will see accelerated earnings as inflation rises, and can see profits that rise at the same pace.

Which companies are best-positioned in this regard? Of course, the answer is, tech and tech-adjacent innovators, particularly software-related.

We have said often that corporate profits are the mother’s milk of higher stock prices. We have certainly seen this in the post-pandemic environment. While there were many valid reasons for concern about U.S. markets in 2021 — the waning of pandemic aid, the looming curtailment of pandemic monetary policy, worries about inflation, political turmoil, geopolitical events — the decisive element proved to be perennial — profits rose and carried the S&P 500 with them. Quite possibly, this “step function” will prove enduring.

Investment implications: In the long run, U.S. stocks — and particularly the tech-led big caps of the S&P 500 — remain the best positioned to reap the benefits of tech innovation, perhaps especially in an inflationary environment. The inflation defense stalwarts — both old (such as gold) and new (such as digital assets) — deserve to retain their place as portfolio hedges, but not at the cost of a fundamentally and incorrectly bearish attitude towards U.S. equities.

Uncomfortably high inflation is an example of an important factor that investors have not had to contend with for a few decades, and this can make for volatility and market anxiety. Volatility will come and go, from many quarters of the economy/market. Within the S&P 500, there are going to be winners and losers. The indexes can mask much of the bifurcation and disparate results, and index investing can be simple way to participate. That being said, we will watch for shifts and changes in global markets, and we will keep looking for new trends and areas that can offer large potential rewards.